Break-even point analysis examines how much a company can safely stand to lose before descending below its break-even point. At the “break-even point,” a company would not be making a profit, but it also wouldn’t be experiencing any losses. While they wouldn’t be making any money, all their costs would still be covered.

Below that point, the business would not even be generating enough to cover its expenses. However, results above the break-even point mean the company would be generating a profit in varying degrees. The break-even analysis examines what the safe distance is from that point that will allow the company to grow.

By comparing the amount of revenue or units that need to be sold to cover fixed and variable costs, the break-even point analysis calculates the margin of safety that a company has. It also allows managers to understand the required turnover and work needed to remain beyond that safety zone.

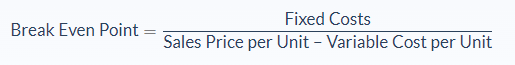

Break-Even Point Analysis Formula

The break-even point formula includes the company’s “fixed costs”. Fixed costs, like rent, are expenses that are constant despite the number of goods being produced. It doesn’t matter whether or not you’re producing goods, turning a profit or a loss, you need to pay those expenses.

For example, a manufacturer would need to be paying on their insurance, even when their production is low, or they weren’t producing a profit. Another term often used for the fixed cost is “overhead cost”.

Be aware that his formula assumes fixed costs are constant. While true in the short term, increased production will cause fixed costs to rise.

The formula also requires “variable” costs. In contrast to fixed costs, these expenses change all the time according to the situation. They will increase or decrease in direct relation to the volume of production for the business. These costs might include expenses like the cost of raw material, fuel, packaging, or anything else directly related to production.

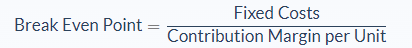

The sales price per unit minus the variable cost per unit is known as the contribution margin, and so we can simplify the formula to:

The “contribution per unit” is the profit you would make for the sale of one item. If you know the contribution per unit, you can easily plug it into the equation.

Calculating the break-even point tells us the threshold of losses a company can stand without harming the company even further.

Using this formula can give you a clearer picture of a business’s actual ability to generate a profit. As you calculate, you will see a direct correlation between the different costs and the revenue. The higher the fixed cost, the higher the break-even point. Likewise, the lower the fixed cost, the lower the break-even point.

Break-Even Analysis Example

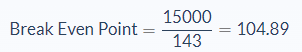

Erick is the CEO of a small business that manufactures sunglasses. His fixed costs are $15,000 per year. He does not know his contribution per unit. However, he knows his selling price per unit is $170. His variable cost per unit is $23. What would Erick’s break-even point be?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Sales price per unit = 170

- Variable cost per unit = 23

- Contribution margin per unit = 147

- Fixed costs = 15000

We can apply the values to our variables and calculate the break-even point:

In this case, the break-even point would be 104.89.

As an important note, in break-even analysis, you cannot have a partial sale. So any result with a decimal would need to be rounded up to the nearest whole number.

For Erick’s business, he would need to sell at least 105 pairs of sunglasses per year to break even. In his break-even analysis, Erick would want to determine the margin beyond that number where he would feel comfortable having his lowest total of products sold while still generating a profit.

Break-Even Point Analysis

Break-even point is an analytic tool that helps businesses to understand what their lowest margin of growth should be. In a worst-case scenario, a company would want to make sure that they could at least cover their expenses. Even if they are not bringing in a profit, they still want their rent to be taken care of and employee salaries to be paid.

If they can stay at or above the break-even point, they know that they still make changes to become more profitable in the future. If they drop below that point, they will have to make some serious changes to avoid being shut down. Essentially, a company’s break-even analysis is a major factor in its stability.

As a result, a company (or its investors) could use the formula to calculate how much funding it might need in order to produce growth and increase its profits.

In contrast, the analysis only focuses on predicting the return, based on costs and units. It does not take the actual sales into account. Still, break-even analysis can help you set revenue targets.

In fact, the analysis can help companies determine how sales price might affect their profits. Businesses can also use it in planning product launches or in updating the model and process for current products. By including this analysis in their portfolio, management can reduce losses and maximize the potential for return on their sales.

Break-Even Analysis Conclusion

- Break-even analysis measures how much a company can safely stand to lose before dropping below its break-even point.

- At the break-even point, the company would neither gain nor lose money.

- The break-even point formula requires two variables: fixed costs, and contribution margin per unit.

- The results of the formula must be in a whole number, so any decimals should be rounded up.

Break-Even Analysis Calculator

You can use the break-even point analysis calculator below to quickly calculate the break-even point by entering the required numbers.

FAQs

1. What is a break-even point analysis?

A break-even analysis is a forecasting tool that helps companies determine when they reach the point at which their business will begin to make a profit. It is a way to gauge the point when sales revenue matches expenses.2. How do you calculate a break-even point?

The formula for a break-even point analysis is:Break-Even Point = Fixed Costs / Contribution Margin per Unit