Contributing to a Roth IRA

A Roth Individual Retirement Arrangement (IRA) is a great way to save for retirement. It is funded by after-tax dollars and offers tax-free growth potential.

If you can contribute to your Roth IRA and other retirement savings, you should consider how each account works before making a decision between them.

For example, traditional IRAs offer tax-deferred growth, but withdrawals are taxed as ordinary income. Roth IRAs offer tax-free growth potential, but contributions are made with after-tax dollars.

You should also consider your overall retirement strategy before making a decision.

Can I Stop Contributing to My Roth IRA?

You may be able to stop contributing to your Roth IRA if you have other retirement savings, but there are a few things to consider before doing so.

If you have other retirement savings, such as a 401(k) or traditional IRA, you may not need to contribute to your Roth IRA. However, you may want to continue contributing to your Roth IRA if you can do so.

The main benefit of contributing to a Roth IRA is the tax-free growth potential. If you stop contributing to your Roth IRA, you may miss out on this benefit.

Another thing to consider is whether or not you will need the money in your Roth IRA to cover living expenses in retirement. If you plan on using the money in your Roth IRA to cover living expenses, you may want to continue contributing to the account.

You should also consider your overall retirement strategy before making a decision.

Roth IRA Rules and Regulations

Before deciding whether to contribute to your Roth IRA, you should familiarize yourself with the rules and regulations.

You can contribute to your Roth IRA if you have earned income and your modified adjusted gross income is below a certain amount.

The amount you can contribute may be limited if your modified adjusted gross income is above a certain amount.

You can withdraw your contributions from your Roth IRA at any time without penalty. However, you may be subject to taxes and penalties if you withdraw earnings from your Roth IRA before you reach age 59 1/2.

If you are unsure whether or not you should contribute to your Roth IRA, you should speak with a financial advisor. A financial advisor can help you assess your retirement savings and decide if contributing to a Roth IRA is right for you.

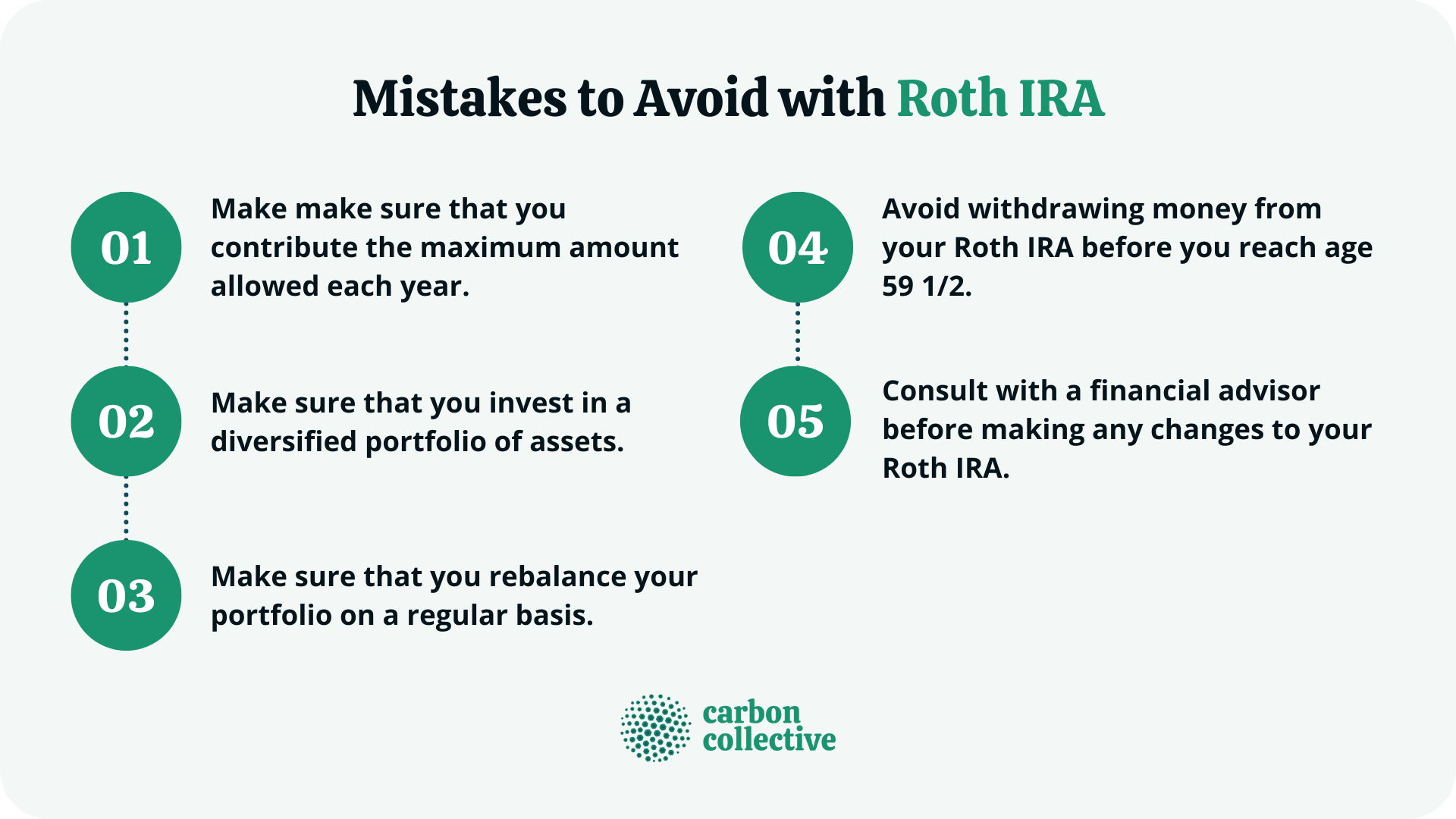

Mistakes to Avoid With Roth IRA

There are a few mistakes that you should avoid when contributing to your Roth IRA.

First, you should make sure you contribute the maximum amount allowed annually. If you don't contribute the maximum amount, you may miss out on tax-free growth potential.

Second, you should ensure that you invest in a diversified portfolio of assets. A diversified portfolio will help you minimize risk and maximize returns.

Third, you should make sure that you rebalance your portfolio regularly. Rebalancing helps ensure your portfolio stays diversified and aligned with your investment goals.

Fourth, you should avoid withdrawing money from your Roth IRA before you reach age 59 1/2. Withdrawals made before age 59 1/2 may be subject to taxes and penalties.

Fifth, you should consult a financial advisor before making any changes to your Roth IRA. A financial advisor can help you assess your retirement savings and make the best decisions for your future.

The Bottom Line

You may be able to stop contributing to your Roth IRA if you have other retirement savings, but there are a few things to consider before doing so.

If you can contribute to your Roth IRA, you may want to continue doing so to take advantage of the tax-free growth potential.

You should also consider whether or not you will need the money in your Roth IRA to cover living expenses in retirement.

Consult with a financial advisor before making any changes to your Roth IRA. A financial advisor can help you assess your retirement savings and make the best decisions for your future.

FAQs

1. What is a Roth IRA?

A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement.

2. Can I stop contributing to my Roth IRA?

You may be able to stop contributing to your Roth IRA if you have other retirement savings. Still, there are a few things to consider before doing so, like the tax-free growth potential, your retirement income needs, and whether or not you will need the money in your Roth IRA to cover living expenses in retirement.

3. How much can I contribute to my Roth IRA?

The amount you can contribute to your Roth IRA may be limited if your modified adjusted gross income is above a certain amount.

4. Can I withdraw money from my Roth IRA?

You can withdraw your contributions from your Roth IRA at any time without penalty. However, you may be subject to taxes and penalties if you withdraw earnings from your Roth IRA before you reach age 59 1/2.

5. When do I have to take distributions from my Roth IRA?

You are not required to take minimum distributions from your Roth IRA during your lifetime because this type of retirement account is funded by after-tax dollars.