The cash turnover ratio (CTR) is a profitability and efficiency ratio that measures how many times a company uses its cash to generate revenues. It measures the efficiency of a company to turn over its cash balance into sales revenue in an accounting period.

A high cash turnover ratio means that the company is turning over its cash quickly, resulting in very efficient cash management. A low cash turnover ratio means that the company is not efficient, and it takes too long before it makes a complete cycle of cash flow in the economy.

A high cash turnover ratio is a justification that there is an efficient cash flow through the business, turning a stronger profit. So obviously this would be preferred over a low cash turnover ratio. This ratio is especially useful when the sales are not made on credit. Companies that make most of their sales on credit will always have a high cash turnover ratio compared with those dealing in cash, so before you draw a general conclusion, it is necessary to find out if the sales are on credit or cash.

Comparisons using this ratio are only valid for companies in the same industry with an almost similar capital requirement. Consider the variation in cash balances and mode of sales to avoid a skewed cash turnover ratio.

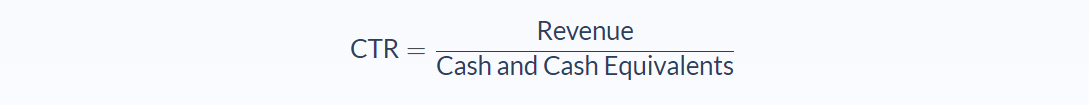

Cash Turnover Ratio Formula

The revenue is the company sales and can be found on the company’s income statement, while cash and cash equivalents will be listed at the top of a company’s balance sheet.

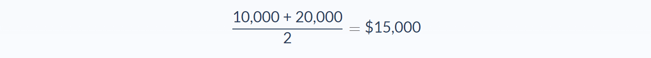

When calculating the cash turnover revenue, you would generally want to average the cash and cash equivalents over the current accounting period and the last accounting period by summing up the two and then dividing them by two.

Cash Turnover Ratio Example

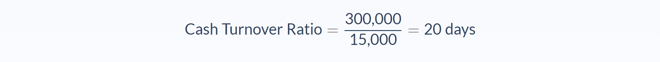

XYZ Company Limited generated $300,000 in sales in the fiscal year 2018. They had cash and cash equivalents of $10,000 and $20,000 at the beginning and the end of the accounting period, respectively.

Calculate the company’s cash turnover ratio.

First, we need to calculate the average cash and cash equivalent:

The cash turnover ratio for this example was 20. This means that XYZ Company Limited replenished its cash balance 20 times during the fiscal year 2018.

A higher cash turnover ratio is preferred because it indicates that you are turning your cash more frequently and are running a more efficient company.

However, a high cash turnover ratio could potentially mean that the company has limited cash available and subsequently might require short-term funding in the future. Also, this could be interpreted that the company selling more of its stock on credit, which may not give a clear picture of cash circulation in the business.

Cash Turnover Ratio Analysis

The cash turnover ratio is a profitability and efficiency measure. It tells more about how many times a company can replenish its cash and cash equivalents with its sales revenue. Company accountants use this ratio for budgeting purposes to estimate the cash amount that will be needed to expand projected future sales. For instance, if XYZ Company Limited is budgeting for a $2,000,000 increase in its sales and its cash turnover ratio is 20 times, then that means that the company will need an additional $100,000 to fund the sales increase.

Analyzing the cash turnover ratio is a crucial efficiency determination as it tells you how many times you can make a complete cycle of cash flow in a business. Anybody concluding this ratio should be careful if the sales were on a cash basis or credit. This ratio works best if almost all sales were on a cash basis. Transactions made on credit can be affected by the late collection of the cash, especially when the creditor is not creditworthy hence making this ratio not to be suitable for sales made on credit.

A variation in cash turnover ratio measures the number of days businesses take to refresh their cash balances, and this is called days of cash replenishment, which is equal to 365 divided by the cash turnover ratio. For the case of XYZ Company Limited, the day’s cash replenishment is 365/20 = 18.25 days, which means that the company replenishes its cash balance after every 19 days. The shorter the days of cash replenishment, the better.

Another thought might be that the business is too small in size. Similarly, a high cash turnover ratio can be a result of investing somewhere outside the business to eliminate excess balances hence reducing the denominator of the formula (average cash balance).

The above mentioned exceptional cases for a high cash turnover ratio need to be given serious consideration when analyzing a business using this ratio because they will not provide an appropriate picture of the business as it should be; hence we conclude that there is no ideal cash turnover ratio number.

Cash Turnover Ratio Conclusion

- Cash turnover ratio measures how many times the company can replenish its cash balance using its sales revenue.

- It can be used to gauge the company’s efficiency and profitability.

- This measurement is used for budgeting purposes by accountants when the estimate future capital requirement to fund sales expansion

- This formula uses two variables: Annual revenue and average cash balance.

- High Cash Turnover Ratio indicates that the company is taking the shortest time possible to refresh its cash accounts using its sales revenue.

- Low Cash Turnover Ratio suggests that the business is taking long before it makes a complete cash cycle in the business.

Cash Turnover Ratio Calculator

You can use the cash turnover ratio calculator below to quickly calculate the number of days a business takes to replenish its cash balance using its sales revenue by entering the required numbers.

FAQs

1. What is a cash turnover ratio?

A cash turnover ratio is a business ratio used in the process of finding out how many times a company can make a complete cycle of cash flow using its revenue.

In other words, it measures how many times a company can refill its cash balance using its sales revenue.

2. How do you calculate a cash turnover ratio?

The cash turnover ratio is calculated by the following formula:

CTR = Revenue / Cash and Cash Equivalents

3. What is a good cash turnover ratio?

Ideally, a good cash turnover ratio is one that gets smaller depending on the company. However, there are no ideal cash turnover ratios This is because different companies have different operating styles.

4. What does a cash turnover ratio show you?

The cash turnover ratio shows you how many times the company can make a complete cycle of cash flow. This is very important when analyzing a business as it gives an idea of how efficient the company is, and what you should expect of its future performance.

A high cash turnover ratio indicates that the business is taking the shortest possible time to the cycle of cash flow. A low cash turnover ratio shows that it might take too long for a company to cycle cash flow and this can cause some problems and may need immediate attention.

5. What are the drawbacks of the cash turnover ratio?

The cash turnover ratio does not take into consideration other factors that might influence the company's performance and efficiency such as a late collection of receivables and also it cannot be used to measure sales made on credit because there is no record of when the money was collected.

Also, it does not consider the company's working capital.