The chart of accounts refers to the directory of every account made in the general ledger in an accounting system.

It’s a simple list of accounts with titles of accounts and numbers. Unlike a trial balance, the chart does not incorporate any other information like debit and credit balances.

Types of Accounts

In a chart of accounts, there are primarily 2 accounts which are further divided into sub-accounts, in groups.

Balance Sheet Accounts

The balance sheet accounts are responsible for storing 3 accounts:

Income Statement Accounts

The income statement accounts are used to store and store transactions involving:

- Operating revenue

- Operating expenses

- Non-operating revenues and gains

- Non-operating expenses and losses

The larger the company’s size, the more complex will be its chart of accounts. For example, if a company has more than 15 departments in its structure, each department will take into account its own expense and revenue account, etc.

Format and Number System

Each account in an accounting chart is assigned a number based on how it is displayed on the financial statements. The accounts which are usually presented first are the balance sheet accounts, which are followed by the income statement accounts.

Most companies today use a numbering system to group accounts into financial categories. The numbering system may look like this:

- Assets. Identification number: 10000-19999

- Liabilities. Identification number: 20000-29999

- Equity. Identification number: 30000-39999

- Income. Identification number: 40000-49999

- Expenses. Identification number: 50000-59999

The main reason why these number systems are used is that it enables accountants to keep track of the accounts and identify what group do they belong to. For example, if the information available to the accountants is unclear regarding these accounts, they can easily fix the error by looking at the prefix of the numbering system.

How to Make a Chart of Accounts

Before you construct a chart of accounts, you must keep in mind a few things that will help you create an accurate chart without any problems.

Size

Firstly, identify the structure of your business, whether it is a sole trading business, partnership, or corporation. After going through the structure, set up your chart in a way where you have enough records, to document financial transactions. Also, ensure that you don’t have extra accounts, as this will cost a lot of time when preparing financial statements and can also reduce the accuracy of the accounts.

Numbering

Secondly, it is essential to carry out the numbering, as it can help us pick any account based on its number. For example, a cash account is usually numbered as 1001, so this method may help an accountant in identifying the cash account details and save plenty of time.

Further, it is also recommended to leave gaps between accounts when assigning numbers, because subsequently, a few accounts are created later. For example, if you want to add a petty cashbook account that did not exist previously in your accounting books, it has to line up after the cash account as the charts of account have to be listed according to the most liquid enough assets.

Changes

The consistency principle states once you endorse an accounting method, continue to follow it consistently, even in the future accounting periods. This concept teaches us not to change the structure of our charts of accounts, as it will be more complicated to monitor or compare our previous accounting records with each other.

However, it is imminent, that you will need to expand your accounts in the future, so it is recommended not to add accounts drastically.

Example of a Chart of Accounts

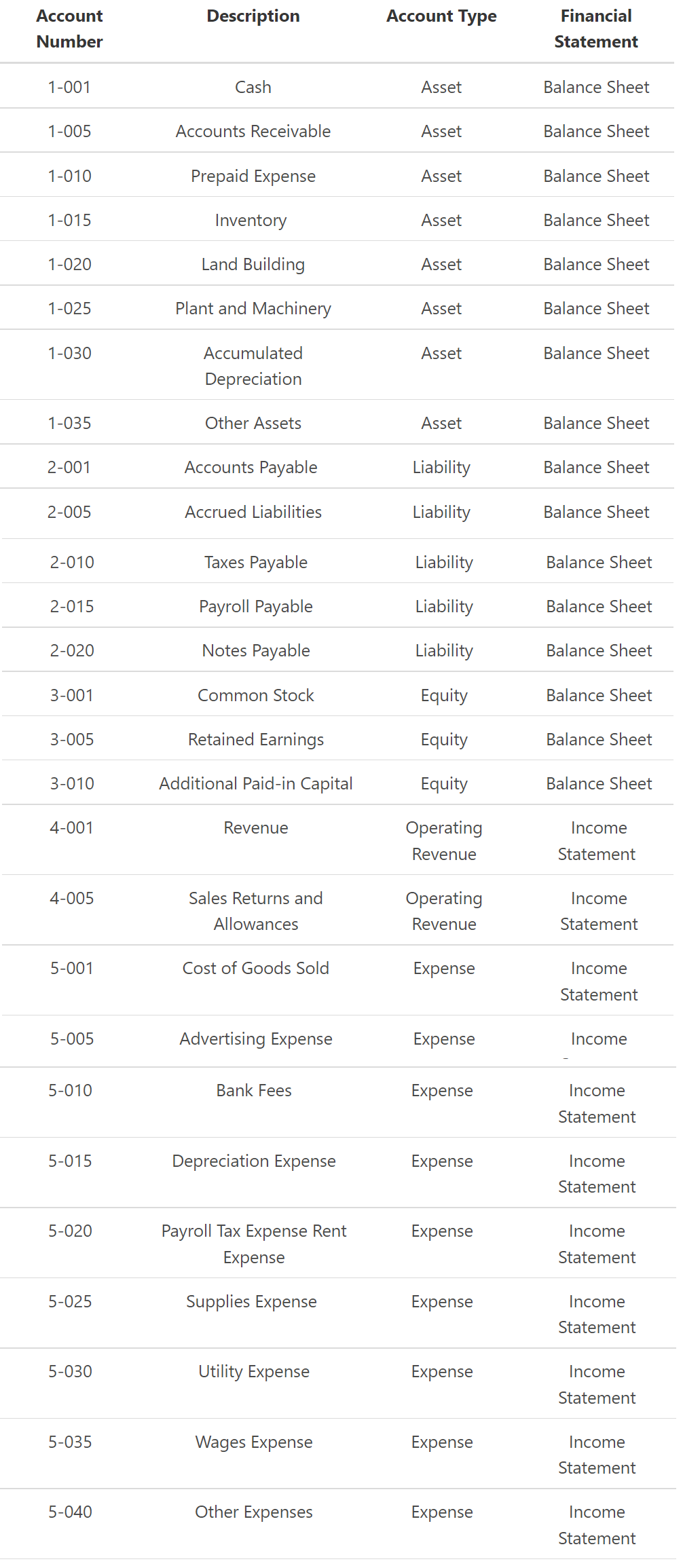

This is a graphical representation of a standard sample of chart of accounts. As you can see in this example, all accounts are listed according to their numbers. Also, the chart of accounts shows the title, account type and the financial statements of each account recorded in the chart.

Advantages of Chart of Accounts

As the identification process of the accounts is simple, it is easier to analyze and control the costs of a company. The chart of accounts encourages the use of the consistency principle which helps a company with the assistance of comparing financial reports of previous years. One other advantage of the chart of accounts is that as it is easier to manage the accounts, there are fewer chances of errors and more accuracy. Lastly, this chart also helps companies when making their financial statements, by categorizing all accounts into their specific statements.

Disadvantages of Chart of Accounts

However, there are many benefits of using the chart of accounts, there are also a few problems with this chart. Firstly, it is expensive as it requires specialized employees to record financial transactions daily. Secondly, as the chart requires the formation of extra general ledger accounts, this process can be very time-consuming.

Conclusion

Even though there are a few drawbacks to the chart of accounts, it is still recommended to use it, because it reduces the risk of error and arranges the assets, liabilities, and equity into a group, which makes it easier to record these accounts. The chart of accounts is best for businesses that need simple and easier ways to manage documents.

FAQs

1. What is the chart of accounts?

The chart of accounts is a graphical representation of all the general ledger accounts in a company. This chart arranges all the accounts into their respective titles, account types, and financial statement.

2. What are the 5 basic charts of accounts?

The 5 basic charts of accounts are: cash, accounts receivable, prepaid expenses, inventory, and land building.

3. Why is the chart of accounts important?

The chart of accounts is important as it provides a simple and easy way to identify, analyze and control the costs of a company.

Additionally, the chart encourages consistency which is beneficial for companies when comparing their financial reports from different years.

Lastly, the chart helps businesses with the creation of their financial statements by categorizing all accounts into their specific statements.

4. What does charts of accounts show you?

The chart of accounts shows you the title, account type, and the financial statement of each account recorded in the chart. This information is beneficial for businesses as it provides a snapshot of all the general ledger accounts in a company and their respective financial statements.

5. How do you adjust your chart of accounts?

You can adjust your chart of accounts by adding or deleting general ledger accounts. Additionally, you can also rearrange the order of the accounts to suit your company's needs.