Consumption flow and expenditure can be crucial to understand the fluctuations in the different business cycles. Consumption is a major concept in economics. It is the process in which markets and consumers exchange, use and destroys goods and services.

- Consumption can be termed as the satisfaction of an individual’s needs and wants by using goods or services. For example, a teenager using social media platforms to connect with friends and family online is a way of consumption.

- Consumption is also be defined as the destruction of utility i.e. an apple on its own has a utility, but when a man eats the apple, it changes its form and is no longer has its original utility intact, thus the man is said to have destroyed its utility in the act of eating it again termed as consumption.

- Consumption also involves expenditure of income. And it can be direct or indirect. It is direct when the product satisfies directly or immediately. For example, when a person drinks water the satisfaction is immediate. It is indirect when one good is meant for the production of other goods and not for final consumption. Use of a computer chip is to enhance the speed of the processor. The computer chip is a product but does not provide immediate satisfaction until paired a computer.

Consumption is an important component in the calculation of the gross domestic product (GDP). GDP is the financial value of all final goods and services produced within a country in a specific period.

Let me try and explain the concept with an example:

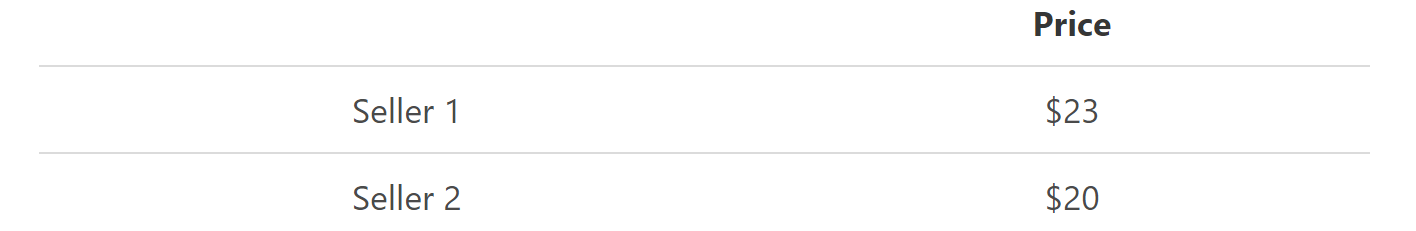

Lisa is an online shopper and decides to buy a dress for the upcoming dinner party at her aunt’s place. She understands to get the dress at a reasonable price, it’s important to do her research and look at all the products with varying prices. She finds a quality dress which she likes, but available with two different sellers on the platform.

With the same quality, she chooses the less expensive option, which is seller 2. The pattern repeats itself when she must buy accessories to go with her dress like a bracelet ($10 vs $12) and necklace ($25 vs $30). Lisa interacts with the market based on price, her needs, and the ability to purchase.

Determinants of Consumption

a. Income

- Income level is the most important factor of consumption as it directly affects the spending capacity of an individual or household.

- Income is derived from labor (in the form of salaries or wages), from capital (in the form of dividends or rent) or remittances from abroad.

- Disposable income is the average income minus taxes. Its what helps households to buy things.

- When disposable income increases the demand for goods and services also rises, that motivates manufacturing to ramp up to meet the demand, creating more employment and consumption in the economy.

- However, if the demand increases but manufacturers do not increase the supply of good or services, it leads to a rise in prices which creates inflation.

- Inflation refers to an environment of generally rising prices of good and services which results in a substantial drop in purchasing power in an economy.

- Another component of consumption is the income per capita, which is how much each person can spend. It reveals whether the standard of living is improving per individual.

b. Savings

- Savings ratio is a big factor in economic activity. When savings are low it could mean households are opting for short-term consumption over long-term investment.

- In the UK, a rise in savings lead to a fall in spending which ultimately became an important cause for the recession in 2008-2009.

- Recession is a phase when there is a general decline in economic activities like production, consumption.

c. Expectations

- Consumption could increase if there is an expectation of growth in income or household income. If individuals are confident, they are more likely to spend now.

- We can understand the general mood by looking at the consumer confidence index, which is a measurement of consumers attitudes about the present and future economic conditions.

- In case consumers are pessimistic about the future and expect inflation to be high, they will buy more goods or services now to avoid future price rises.

d. Changes in Fiscal Policy

- Changes Fiscal policy can also contribute to a change in consumption levels. As per the commerce department, the American consumers improved their spending during the coronavirus pandemic by a record 8.2% in May 2020, partly due to support from the government in the form of unemployment aid and a one-time stimulus checks of $1200.

- Even though there were many layoffs in April and in May there was a decline of 4.2% in personal income.

- The jump in consumption was distributed over to durable goods, purchases of autos and recreation vehicles and non-durable goods like clothing and food.

e. Debt

- It can be said that household debt boosts consumption growth in the short run as it assists to increase the purchasing ability of the household, through credit expansion. However, in the long run, it can prove to have a negative effect on growth.

- When consumers are in debt or pay bigger installments to repay their debt, it is unlikely their ability to consume will change or increase.

- Higher debt level could cause financial stress on households

f. Availability of good or services:

- Inclination to consume can also be affected by the availability of substantial-good or services.

- When goods or services are available in abundance, it could lead to more consumption, while a crunch in it can lead to a decline.

Importance of Consumption

The impact of consumption can be observed in every branch of economics. Consumption influences directs and guides production, consumer desires affect prices in the wider market and exerts influence on exchange as well.

1. Consumption Drives Production

- Good or services are produced with the purpose of consumption which makes production dependent on the level of consumption.

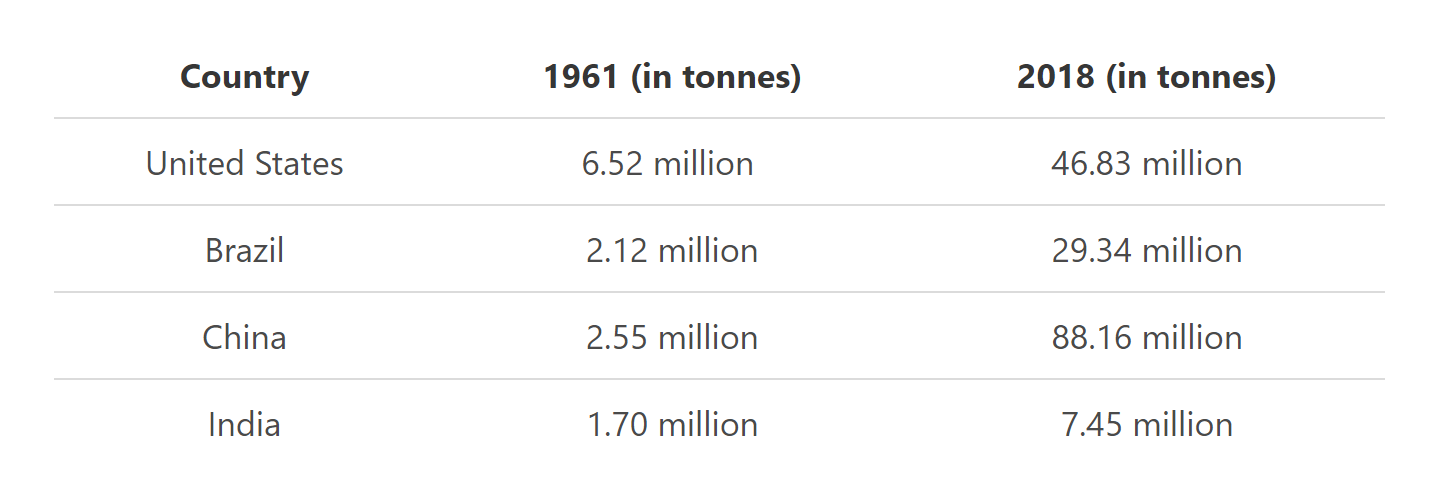

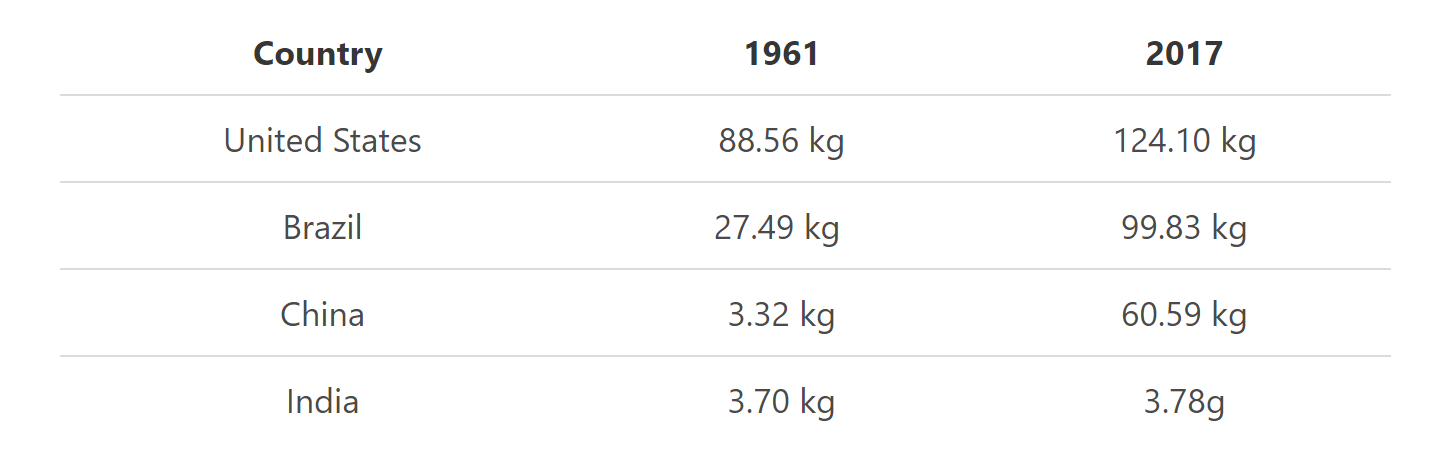

Example: According to a research on ‘Meat and Dairy Production’ by Hannah Ritchie and Max Roser, it was noted that as a global average, per capita meat consumption increased 20 kilograms since 1961.

- It means that the average person consumed 43 kilograms of meat in 2014. This increase in per capita meat consumption means the production of meat grew at a faster rate than the population growth.

Below is the global meat production 1961 to 2018

Below is the meat supply per person

2. Government Interventions

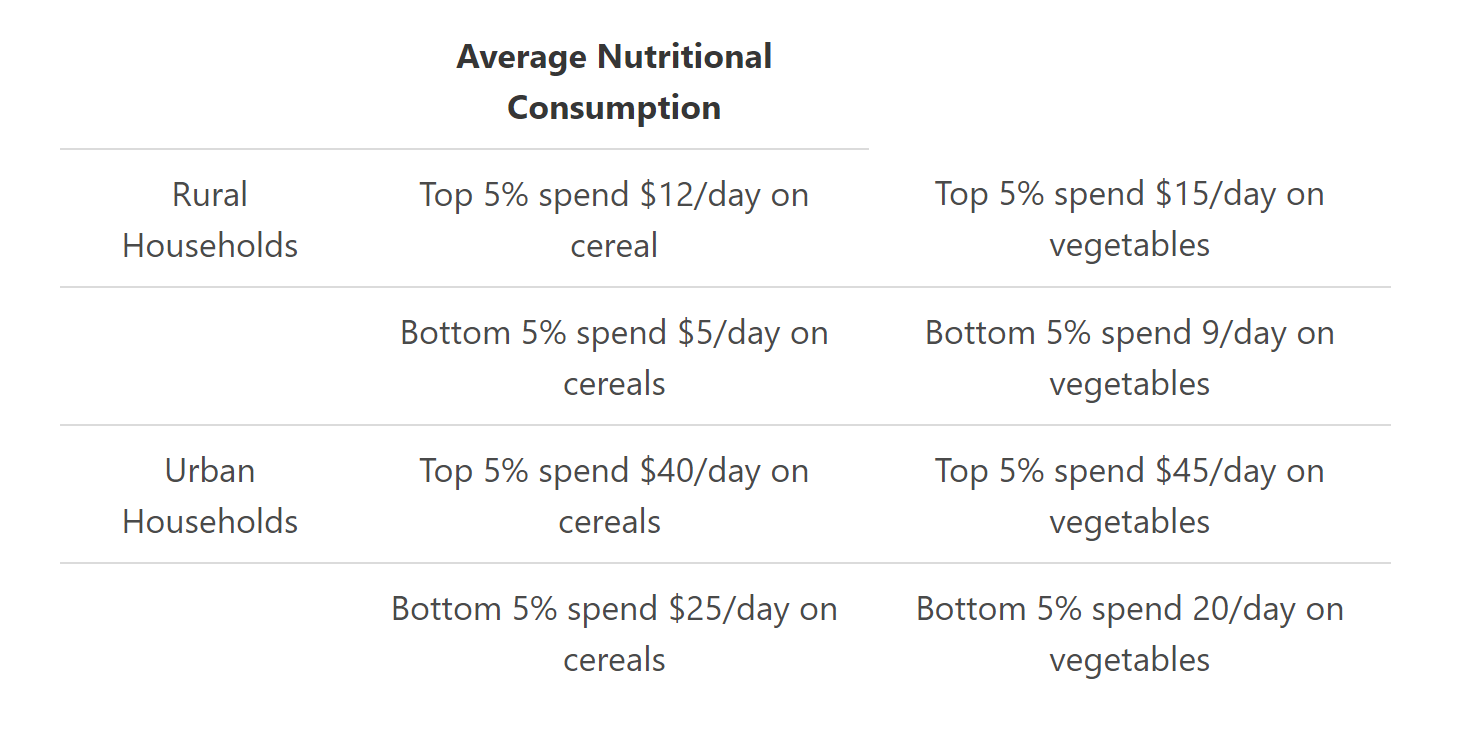

- Different surveys are conducted by the governments to collect information on the consumption patterns of households in urban and rural areas.

- The data helps to understand the average expenditure of goods or services and helps to estimate household monthly expenditure.

- Consumption data helps the government to formulate decisions related to minimum wage range and tax rates in their country.

- This data is helpful in assessing the demand dynamics of an economy and measuring living standards.

Example: A government conducts a survey on nutritional consumption

From the data, the government can deduce that there is quite a difference in the consumption patterns of urban and rural households and a similar disparity between the top 5% and the bottom 5 % relating to nutritional food products.

3. Consumption Pattern and Employment

- A fall in consumption of certain goods or services could lead to a decrease in production which further pushes businesses to lay-off workers, leading to unemployment.

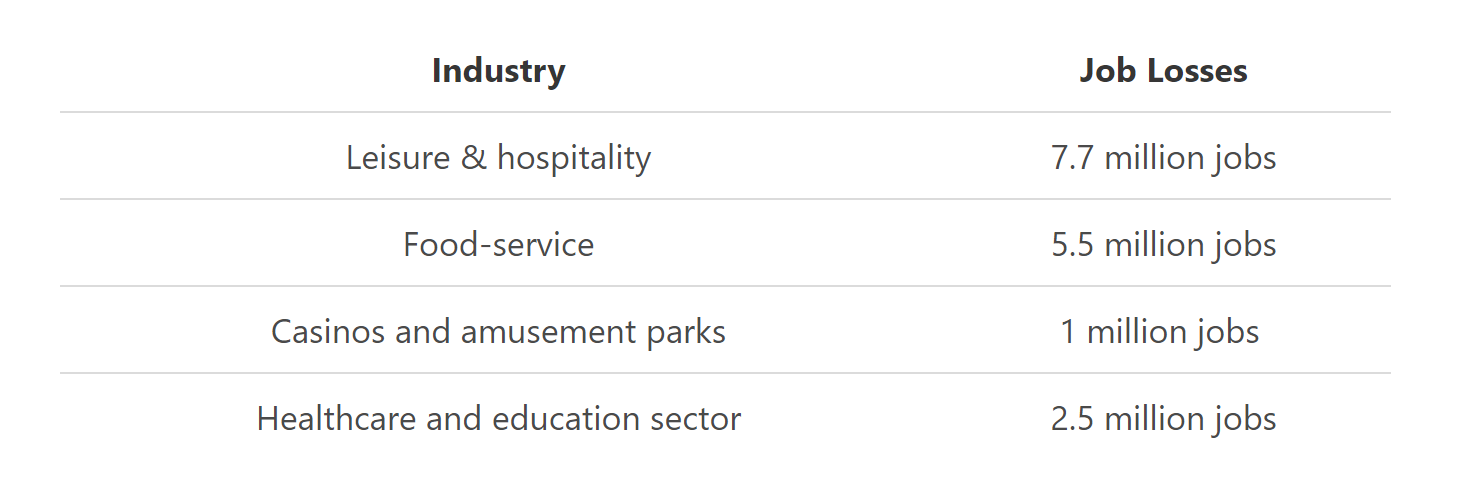

Example: Due to the coronavirus pandemic, the commerce department in United states reported that consumer spending plunged 13.6% in April 2020. This was because of an escalation of the pandemic which led to widespread business shutdowns. Fewer people shopped, ate outside, attended large events, or traveled.

April 2020

4. Consumption and Economics

- The economic system at large is dependent on the consumption and production of goods and services. Consumers decide what to consume as per price and availability.

- Economists have utilized the study of consumption to formulate several theories such as the consumption function, relative income theory of consumption, the law of demand, the consumer surplus and so on.

- These theories help us to understand the world of consumption around us, its functioning, and the consequences for the economy.

- Let us take the law of demand for example, which states other factors being constant, if the prices of goods or services increase there is a decrease in the demand. While the decrease in prices leads to an increase in demand.

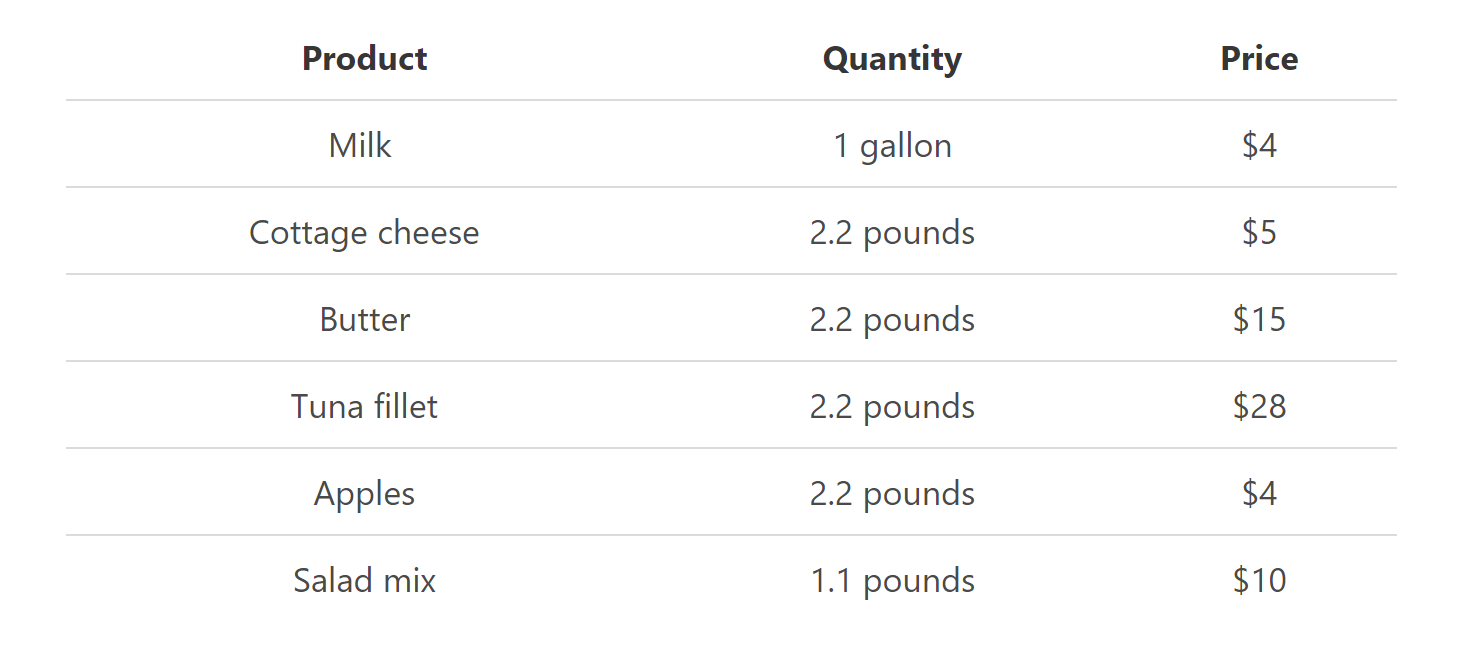

Examples: John on his weekend trip to the grocery picks up the following items

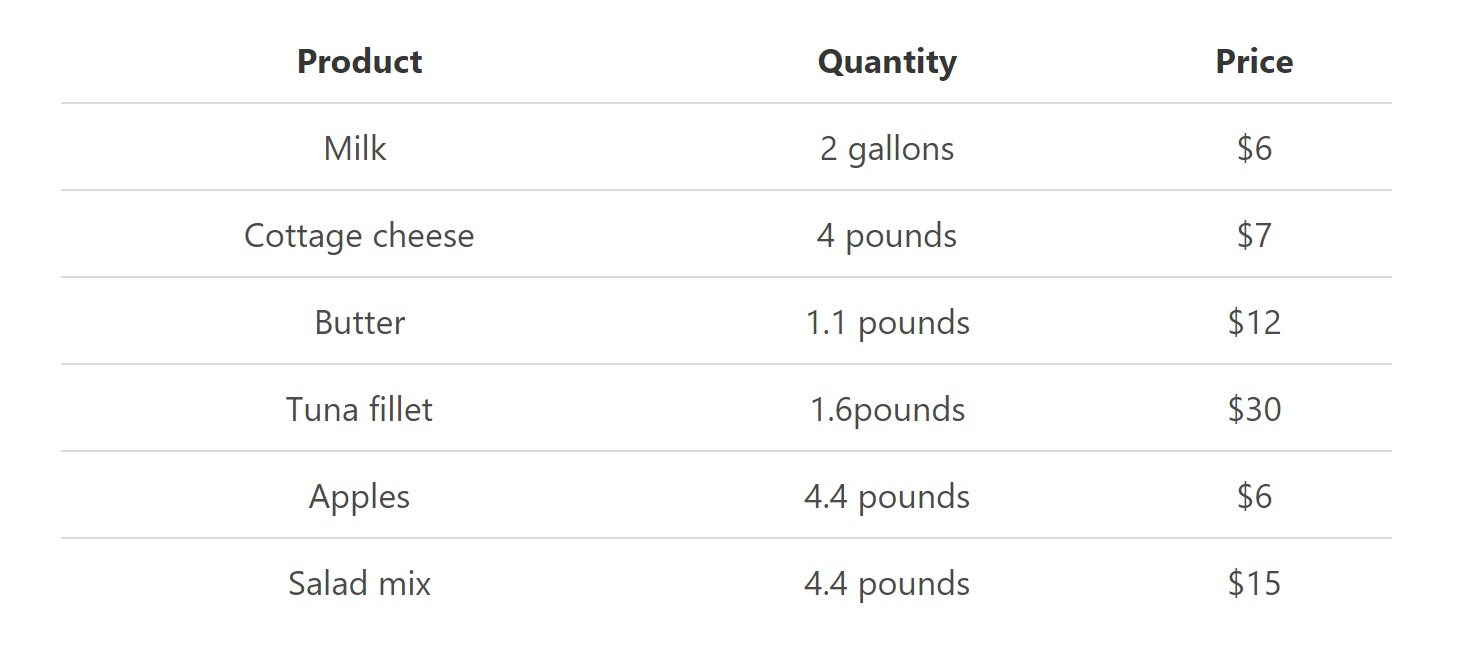

The next weekend, John comes to know that the store has discounted the prices for a few of the items while increased the prices for others. His grocery purchase is the following

We can deduce using the law of demand, that with discounted prices, the demand for items like milk, cottage cheese, apples, and salad mix went up. While there was a decrease in the quantity purchased for tuna fillet and butter, as prices increased.

Consumption and the Business Cycle:

Consumption flow and expenditure can be crucial to understand the fluctuations in the different business cycles. For example, during economic downturns, consumption of goods or services decline as the purchasing power of households is affected and consumers might put off non-essential purchases until the economy recovers.

Sustainability is not always taken into account in these conversations. Learn about

What is the business cycle?

- Business cycles are periodic but irregular ‘ups and downs’ in economic activity, due to fluctuations in different economic variables.

- During the ‘ups’ we can say the economy is expanding due to surge in jobs, sales, production. And during the ‘downs’ are the periods of recession when the economy is contracting.

- A business cycle is typically described by four phases namely recession, recovery, growth, and decline, which recur over time.

- The duration of these cycles can be from two to twelve years.

Stages of Business Cycle & Consumption

- Recession: It is a period of a reduced economic activity where factors like employment, buying, selling and production generally diminish, and businesses face hardships. Consumers prioritize buying essential products or durable goods like toiletries, food over-taking travel or buying the latest scooter.

- Recovery: Is the upturn in the events where the economy starts working its way up and there is an improvement in business activity and consumer confidence. It leads to an increase in non-durable products or services like cars travel compared to durable goods.

- Growth: A period of expansion where the consumer confidence is high which translates heightened business activity like production.

- Decline: The economy starts to contract characterized by fall in consumer purchases (especially durable goods) and consequently reduced production.

Summary:

- Consumption is the process that markets and consumers exchange, use and destroy goods and services.

- Consumption is direct when the products satisfy directly or immediately. The indirect when one good is meant for production of other goods and not for final consumption.

- Consumption is an important component used for calculation of the gross domestic product (GDP).

- Determinants of consumption includes Income, savings, expectations, changes in fiscal policies, debt, and availability of goods and services.

- The impact of consumption can be observed in every branch of economics.

- Consumption flow and expenditure can be crucial to understand the fluctuations in the different business cycles

FAQs

1. What does consumption mean?

In finance, consumption usually refers to the spending of money on goods or services. It's also used as a measure of economic output, as it's one of the components of gross domestic product (GDP).

2. Why do economists care about consumption?

Economists care about consumption because it's a key driver of economic growth. It also has a significant impact on things like employment, inflation, and debt levels. In addition, consumption can be used to measure the overall health of an economy.

3. How does debt affect consumption?

Debt can affect consumption in a few ways. First, it can increase the amount of money that consumers have to spend each month, which can reduce their discretionary income and lead to lower levels of consumption.

Second, debt can limit a consumer's ability to borrow money in the future, which could also lead to lower levels of consumption. And finally, debt can make it more difficult for businesses to borrow money, which could lead to a decrease in business investment and, ultimately, a decline in economic growth.

4. What are some of the key determinants of consumption?

The key determinants of consumption include income, savings, expectations, changes in fiscal policy, debt levels, and the availability of goods and services.

5. What's the difference between direct and indirect consumption?

Direct consumption refers to the purchase of goods and services that satisfy a person's needs or wants immediately. Indirect consumption, on the other hand, refers to the purchase of goods that are used to produce other goods and services, but are not necessarily consumed by the person who buys them.

Let's say, for example, you purchase a new car. The car is a direct consumer good, as it will be used to transport you from point A to point B. However, the steel and other materials used to make the car are indirect consumer goods, as they will not be immediately consumed by the person who buys them.