Whether you are a college student planning out your career track or a seasoned professional seeking to elevate their position, a CPA or MBA may be a good option for your future. Both are highly-recognized accomplishments that can improve your job prospects and earning potential. If you are wondering what the difference is between a CPA and an MBA or which may best boost your career prospects, keep reading!

What is a CPA?

A Certified Public Accountant, or a CPA, is a credential that you obtain after satisfying the education, experience, and testing requirements. What you need to do to get your CPA credential depends entirely on the state that you plan to be licensed in.

To be eligible to sit for the CPA exam, you must have completed your Bachelor’s Degree in an eligible discipline. An additional 30 hours beyond this degree are necessary, although states may vary as to which courses are required.

In order to sit for the exam, some states require that you complete your Bachelor’s Degree, as well as the additional 30 hours prior to taking the test. Other states, however, may allow you to take the exam prior to finishing your schoolwork.

The CPA exam is made up of four sections;

- Financial Accounting and Reporting (FAR)

- Auditing and Attestation

- Business Environment and Concepts

- Regulation

Each test is four hours long and can be taken at Prometric testing sites across the United States. Once you pass the first section of the exam, you will have 18 months to pass the remaining three sections. Any exam section that you’ve passed over 18 months ago will need to be retaken.

To complete the licensing requirements, you will need to take an ethics exam provided by the American Institute of Certified Public Accountants. Most states require work experience. You can check out your state’s licensing requirements at the National Association of State Boards of Accountancy, or NASBA.

What is an MBA?

Commonly referred to as an MBA, a Masters of Business Administration is a graduate-level degree that you can pursue an MBA after you’ve completed your Bachelor’s Degree. Some universities may offer a blended program where you can get both a Bachelor’s and a Master’s degree at the same time.

An MBA covers a wide range of business disciplines including management, operations, marketing, and accounting. An MBA degree teaches effective management, communication, and analytical skills which equip future business leaders with the tools that they need to make complex decisions and lead teams with confidence.

Depending upon the school you attend, you can pursue a general or specialized MBA track. A general track will give you a broad overview of business disciplines. Common specialized tracks include finance, operations, marketing, and entrepreneurship.

To enter into an MBA program, your school may require you to take and pass the GMAT or GRE exam with a specified score. In addition to test scores, your school may require that you provide personal letters of reference, transcripts, an essay, and a resume.

An MBA typically takes 2 years of schooling to complete the 30 credit hours. If you are working and strapped for time, you can complete your MBA online. Some schools offer an executive MBA program that is tailored around those who work.

CPA vs MBA: How Much Does it Cost?

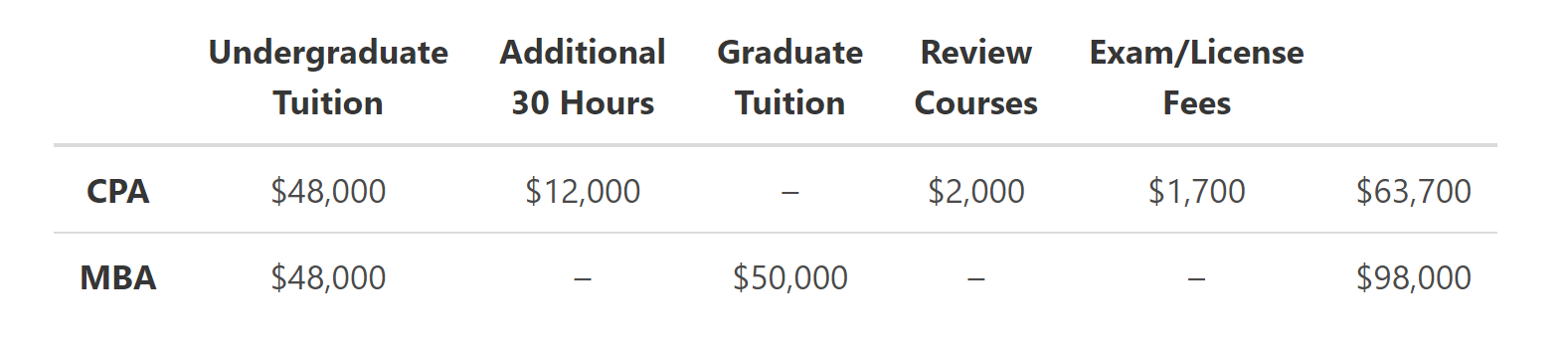

Where you choose to go to school impacts how much it will cost you to get an MBA or CPA. Below are the typical costs that you can expect when you pursue an MBA or CPA;

The average cost for getting your MBA can range from $50,000 to $80,000, depending on the program.

In addition to the above, CPAs are required to take continuing education courses to maintain their license. Some states require that a CPA takes 80 hours of CPE every two years, although other locations may have different rules. CPE can cost an average of $2,000 per year, however that can vary based on how many hours your state requires.

CPA vs MBA: Salary

Where you work can impact your salary. Large cities and metropolitan areas traditionally have higher costs of living and, therefore, will pay higher salaries.

The average starting salary for an MBA graduate is $73,417. Starting salaries often range between $40,000 and $98,500 depending on the state that you work in.

For an entry-level CPA, the average starting salary is $60,697. A majority of base starting salaries for new CPAs ranges between $43,000 and $72,500.

Keep in mind that an MBA requires a greater financial investment. While the starting salary for an MBA is about $13,000 higher, it can cost you over $35,000 to get it over a CPA credential.

CPA vs MBA: What Jobs Can I Do?

A CPA credential is geared toward the accounting profession. With a CPA license, you can work in public accounting as a tax, audit, or accounting professional. If you decide to work for a company, you may take a position as an analyst, controller, of a Chief Financial Officer.

An MBA can work in a variety of positions in such industries as healthcare, technology, sales, and finance. They are often employed as executives, managers, administrators, and analysts. An MBA can also set you up to go into business for yourself.

Which is Better for Me – a CPA or MBA?

Deciding which is better for you comes down to personal preference. Those leaning toward accounting or finance may find a CPA credential a valuable asset for their career. If your plan is to move into an executive or leadership position, an MBA may be a good choice. One strategy you may also consider is expanding the courses that you take to complete your MBA to include ones that will qualify you to sit for the CPA exam.

Becoming a CPA or getting your MBA are great ways to elevate your position, increase your earning potential, and improve your career outlook.

FAQs

1. What is the difference between a CPA and an MBA?

The biggest difference between a CPA and an MBA is that a CPA is geared specifically for the accounting profession while an MBA can work in a variety of positions in industries such as healthcare, technology, sales, and finance.

2. Who earns more, MBA or CPA?

There is no definitive answer, as it depends on a variety of factors. However, the average starting salary for an MBA graduate is $73,417 while the average starting salary for a CPA is $60,697.

3. Is CPA higher than MBA?

No, you don't need a masters to be a CPA. A CPA is a designation earned by passing an exam, while a masters is an academic degree. However, many MBA programs offer courses that can help you prepare to sit for the CPA exam.

4. Is a CPA better than an MBA?

An MBA will be a better choice if you are interested in working in business or industry. A CPA is better suited for those interested specifically in accounting and finance. However, there are many areas where the two overlap, and many professionals have both a CPA and an MBA credentials.

5. What is harder CPA or MBA?

CPA is harder. It requires passing an exam that covers a range of topics in accounting and finance. An MBA can be harder depending on the program, but usually entails completing coursework in areas such as marketing, management, and financial analysis.

Moreover, it takes approximately 1,000 hours to become a CPA, while an MBA usually takes two years to complete.