What Is a Crummey Trust?

A Crummey trust is designed to give beneficiaries financial gifts while minimizing gift tax.

Parents who want to create financial gifts for minor or adult children use this kind of trust.

A Crummey trust can offer another way to gift money instead of custodial accounts.

It can provide more flexibility and control when beneficiaries are approved to tap into assets, unlike a custodial account that automatically permits children ownership of assets once their legal age is reached.

How Does a Crummey Trust Work?

Crummey trusts differ from other types in taxation and transferring assets to trust beneficiaries.

After a trust is established, the beneficiary can withdraw assets within a specific period.

For instance, the beneficiary can withdraw within the first thirty days after the trust is created and funded.

This withdrawal power provides them a present interest in the financial gifts that are part of the trust.

When handing money to minor children or any other beneficiary, this feature lets you minimize gift taxes or entirely avoid them.

During the Crummey Timeline, the beneficiary is qualified to withdraw assets. However, in the case of minors, they are unlikely to make such withdrawals.

As a result, the financial gifts placed in the trust will remain there during this period and be within your specific timeframes.

Is a Crummey Trust Revocable?

A Crummey trust is revocable as the settlor can make changes to it, and they also have control over the trust.

The settlor is the person who creates and funds the trust. If you are the settlor, you will name a trustee to manage the trust on behalf of the beneficiaries.

Advantages of a Crummey Trust

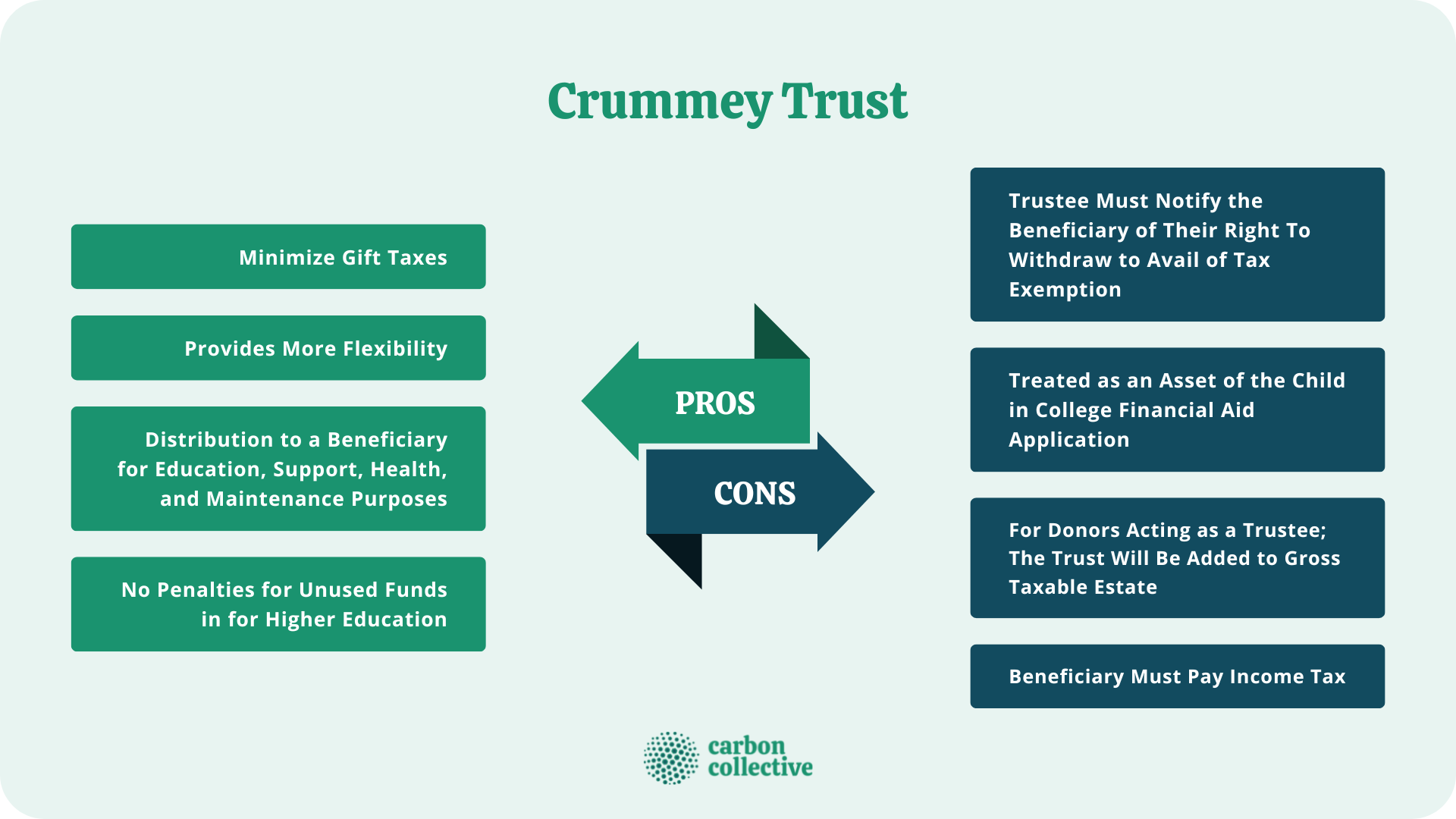

Crummey trust offers a few advantages, such as:

- It can help you minimize gift taxes or avoid them entirely.

- This type of trust also provides more flexibility than other types of trust, such as custodial accounts.

- It offers tax treatment favorable to financial gifts as part of your estate plan.

- On behalf of your beneficiary, when you add money to the trust, it qualifies for the annual gift tax exclusion.

The gifts can be invested and protected as in other types of trust if the beneficiary does not withdraw funds from the trust during the withdrawal period.

- It can be an outstanding way to transfer wealth and plan for your child's education. On the other hand, accessing the money until the child finishes college or turns 18 could be specified too.

- The trust lets for distribution to a beneficiary for their education, support, health, and maintenance. Thus, it can be done at any given time by a trustee.

- No penalties are added if you do not use your funds in Crummey trust for higher education.

- A Crummey trust is more flexible and advantageous than any other college saving account.

Disadvantages of the Crummey Trust

Crummey trust also has a few disadvantages, such as:

- A beneficiary may not cooperate for different reasons.

- Each time a gift is created to the trust, the beneficiary must be notified in writing of their right to withdraw, which is usually annually. The gift will only be exempt from taxation if the trustee remembers to inform the beneficiary.

- The trust can be treated as an asset of the child for financial aid application in college.

- The trust will be added to your gross taxable estate if you, being the donor, act as a trustee.

- In most cases, the beneficiary must pay income tax on the trust's income, like interest and dividends, even though the trust has a separate taxpayer identification number and files an annual tax return.

Final Thoughts

A Crummey trust is an irrevocable living trust often used in estate planning.

It can help you minimize gift taxes or avoid them entirely. This type of trust also provides more flexibility than other trusts, such as custodial accounts, when deciding how and when the beneficiary can access the funds.

A disadvantage to using a Crummey trust is that it is considered an asset during financial aid application in college.

You should speak with a financial advisor to see if a Crummey trust is right for you.

FAQs

1. What is a Crummey Trust?

A Crummey trust is an irrevocable living trust often used in estate planning. It can help you minimize gift taxes or avoid them entirely.

This type of trust also provides more flexibility than other trusts, such as custodial accounts, when deciding how and when the beneficiary can access the funds.

2. How does a Crummey Trust work?

A Crummey trust works by allowing the trustee to make gifts to the trust's beneficiaries. The gifts can be used for any purpose, but they must be made within a specified time frame.

3. Is a Crummey Trust Revocable?

No, a Crummey trust is irrevocable. This means that it cannot be changed or revoked once the trust is created.

4. What are the advantages of a Crummey Trust?

There are several advantages to using a Crummey trust, including the fact that it can help you minimize gift taxes or avoid them entirely.

This type of trust also provides more flexibility than other trusts, such as custodial accounts, when deciding how and when the beneficiary can access the funds.

5. Why would I create a Crummey trust?

There are several reasons you might create a Crummey trust, including minimizing gift taxes, avoiding them entirely, or providing more flexibility than other types of trusts when deciding how and when the beneficiary can access the funds.