The current ratio determines the ability of a company or business to clear its short-term debts using its current assets. This makes it an important liquidity measure because short-term liabilities are due within the next year. The current ratio will show how easily the company can change its quick assets to cash to pay current debts.

Why is this important? Well, a company only has a limited amount of time to pay current liabilities, and the more current assets a company has, the easier it would be able to convert them to cash. It’s an important measure of liquidity because using short-term assets is better than having to sell long-term and possibly revenue-generating assets.

The current ratio is also a good indicator for investors on whether or not it is wise to invest in a given company.

Current Ratio Formula

To calculate the current ratio for a company or business, divide the current assets by current liabilities.

The current ratio is expressed in numeric format rather than decimal because it provides a more meaningful comparison when using this to compare different companies in the same industry.

GAAP accounting principles mean that it is required for companies to separate current and long-term assets and liabilities on the company balance sheet. This makes it very easy to calculate the current ratio for management, investors, and creditors.

Current assets are assets that can be converted to cash easily within a one-year period or less. Examples of current assets include cash, cash equivalents, marketable securities, accounts receivable, and inventory, which are examples of current assets.

Current liabilities are business debts owed to suppliers and creditors. They include notes payable, account payable, accrued expenses, and deferred revenues.

Current Ratio Example

Sammy has a store selling novelty toys and needs a business loan to move to a larger property so that he can stock more items. The bank needs to see the last three year’s balance sheets so they can analyze the current and long-term assets and liabilities.

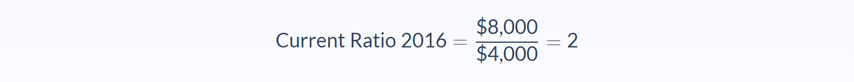

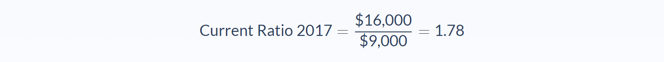

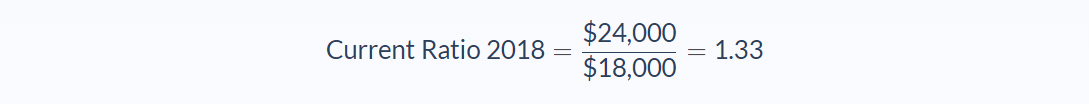

From Sammy’s balance sheets, the following data were deducted.

Current assets

- 2016: $8,000

- 2017: $16,000

- 2018: $24,000

Current liabilities

- 2016: $4,000

- 2017: $9,000

- 2018: $18,000

Banks tend to prefer a current ratio of at least 1 or 2, which Sammy’s store did have in 2016. However, the current ratio has declined over the three years and could be an indicator that the company is not doing well financially, and may struggle to convert current assets to cash to pay their short-term debts.

Since the company is becoming increasingly highly leveraged, it’s a risk for the bank to lend Sammy money to expand, and it’s unlikely he would be approved for the loan.

Current Ratio Analysis

When calculating the current ratio of a company, you will get a numeric value that could be too high or low depending on the available current assets as well as current liabilities of a firm.

It’s always important to measure companies against others in their industry because certain industries will more likely to have a high or low ratio depending on their short-term assets and liabilities.

Most companies with a current ratio ranging from 1.5 to 3 are considered to be financially healthy. Those that have a ratio below 1 may have trouble paying off their short-term debts.

Now, even though a higher current ratio could be favorable to investors and creditors, it’s important to note that an unusually high ratio is also an indicator that the company is underutilizing its current assets.

Current Ratio Conclusion

A current ratio figure expressed as a number simply tells analysts or investors the ability of a company to utilize its current assets to meet the current or short-term debts it has. The following is a recap of the vital points you need to know about the current ratio.

- Current ratio determines the ability of a company or business to clear its short-term debts using its quick assets

- To calculate the current ratio for a company or business divide the current assets by current liabilities

- This ratio is expressed in numeric form and not as a percentage like most other liquidity ratios

- To get meaningful results, you should compare the current ratios of companies in the same industry not across industries because the latter comes with different financial structures

- Most companies have current ratios ranging from one to three.

- An abnormally high current ratio could indicate a business is not using current assets efficiently

- Just as with many other financial ratios, this ratio has its limitations as using too much of your current assets reduces working capital

Current Ratio Calculator

You can use this calculator to calculate the current ratio for a company by entering the current assets and liabilities figures from the balance sheet.

FAQs

1. What is the current ratio?

The current ratio is a liquidity ratio that measures the ability of a company to pay off its short-term debts using its current assets.

This makes it an important liquidity measure because it looks at a company's ability to meet near-term obligations without resorting to selling long-term assets or taking on debt.

2. What is a good current ratio?

Most companies have a current ratio within the 1.5 to 3 range, which is generally considered healthy. This means that the company should be able to meet its short-term obligations without difficulty.

A ratio under 1 may indicate that the company could run short of cash to pay its short-term debts. Conversely, a current ratio over 3 may suggest that the company is holding too much inventory or other non-current assets.

3. How is the current ratio calculated?

To calculate the current ratio, divide the current assets by the current liabilities. This will give you a numeric value for the current ratio.

The formula is:

Current Ratio = Current Assets / Current Liabilities

4. What does a current ratio of 1.5 mean?

A current ratio of 1.5 means that the company has 1.5 times as many current assets as it does current liabilities. This suggests that the company has ample liquidity.

5. What is the importance of a current ratio?

The current ratio is an important liquidity measure because it looks at a company's ability to meet near-term obligations without resorting to selling long-term assets or taking on debt.

A high current ratio may suggest that the company is in good financial shape, while a low current ratio may indicate that the company is having difficulty meeting its short-term obligations.