Economic profit can be calculated by subtracting the opportunity cost from the accounting profit. The opportunity cost is the investment that the business will need to give up investing in the current opportunity. When we talk about profit in a company it is normally accounting profit. If we thus make the statement that our firm has made a profit, we are referring to an accounting profit.

Economic Profit Formula

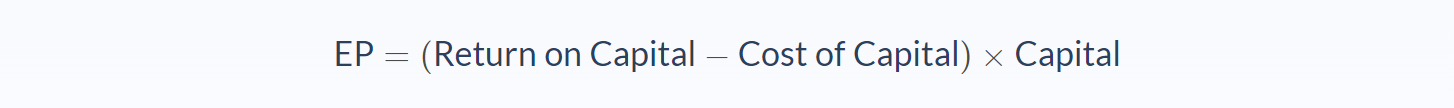

There are a few different formulas you can use to calculate economic profit:

In the first formula, the opportunity cost is the cost of not doing something. So, for example, if you didn’t take a job that paid $30k a year to continue your education, the opportunity cost of that decision is the $30k salary you gave up.

NOPAT is net operating profit after tax. It’s a profit measurement that indicates how much profit a company generates by looking at its operating income minus taxes.

The return on capital is often referred to as return on invested capital (ROIC) and it measures a company’s profitability using shareholders’ money.

Economic Profit Analysis

Economic profit is an important trade-off concept. A company needs to decide what they are going to invest in or what it will produce. The company invests at the same time in different things and that will determine their profit.

Let’s use the example of you deciding to study after school or to start working. It will cost you $40,000 to complete a degree but you could earn $20,000 per year if you start working after school. What would be the cost of completing your degree?

The total cost to complete your degree is actually $60,000. This is the $40,000 for the degree, plus the $20,000 opportunity cost you missed out on by not getting a job.

If you start a job after your qualification has been completed and you do not get more than the $60,000 per year that you could have if you started working, then you would have incurred a loss in choosing to study over the full-time employment.

Limitations of Economic Profit

The limitations of economic profit are:

- Economic profit is only valid for one year.

- Employees bring value to an organization; economic profit does not consider this value in the calculation.

- There are no profit ratios considered when calculating economic profit.

Economic Profit vs Accounting Profit

Economic profit and accounting profit differ based on:

- The fact that economic profit will measure the cash flow of a business and the accounting profit will measure the profit based on accrual.

- Accounting profit doesn’t consider opportunity costs, but economic profit does consider it.

Economic Profit Examples

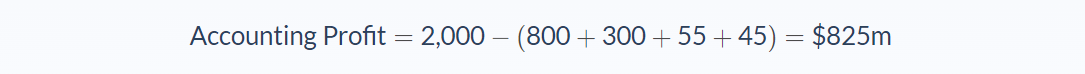

Example 1: ABC manufactures jackets, the annual turnover is $2,000,000. The direct expenses are:

- Raw materials: $800,000

- Labor cost: $300,000

- Production costs: $55,000

- Depreciation: $45,000

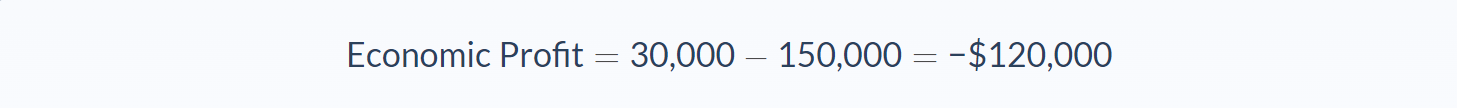

Example 2: Sandy decided to leave her job as a business analyst where she made $150,000 per year to start a coffee shop. In 2018 she made an accounting profit of $30,000.

Sandy’s economic profit will be the profit of the coffee shop less the opportunity cost of the job that she left.

Through rational thinking, Sandy would see that she is still making a profit and keeping her coffee shop open, but having such a big economic loss could lead to her deciding to rather go back to her previous job.

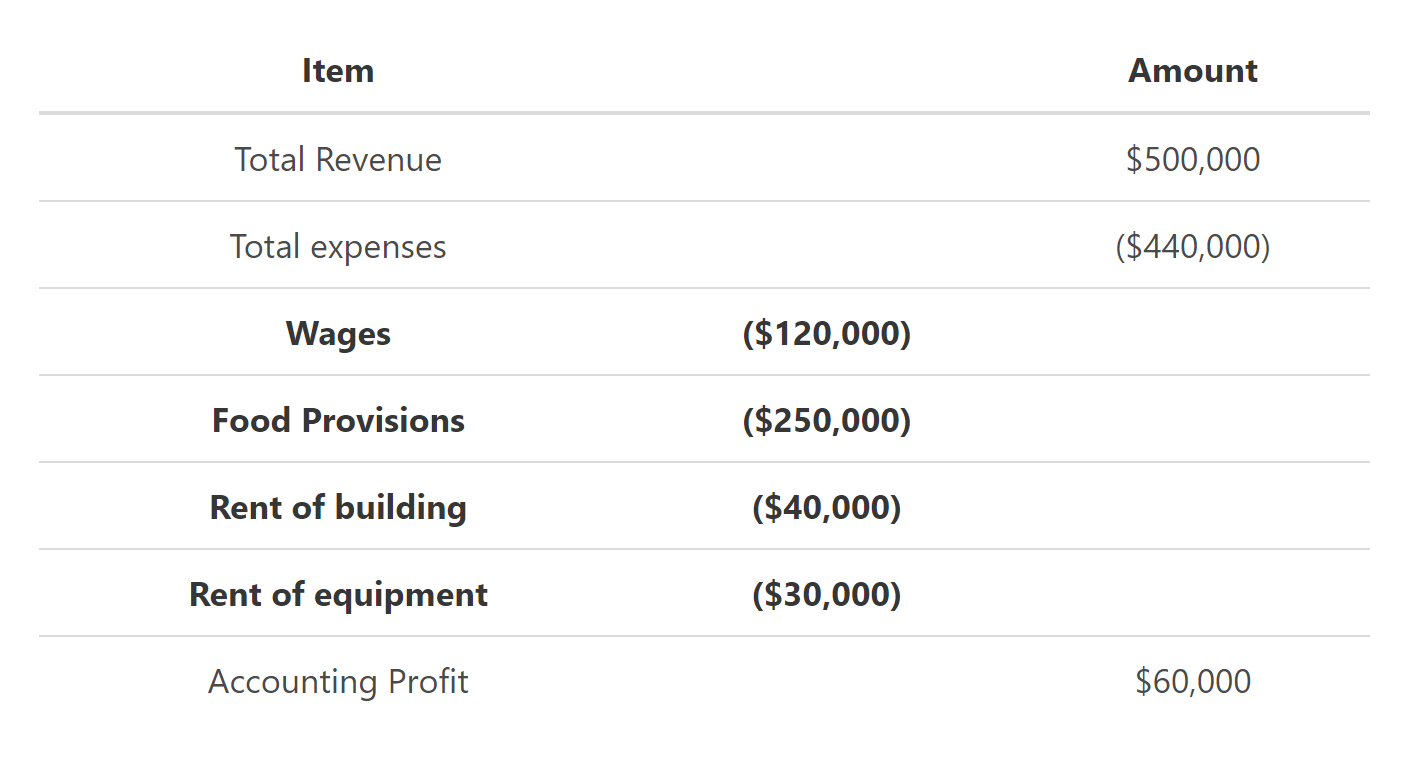

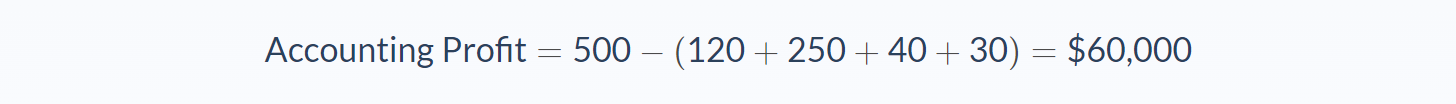

Example 3: Freddy decides to leave his work as a doctor to start a pub. He earned $220,000 per annum as a doctor. In 2018 his new pub made a revenue of $500,000.

Freddy has the following expenses:

- Wages– $120,000

- Food Provisions – $250,000

- Rent of building – $40,000

- Rent of Equipment – $30,000

What is the accounting profit for Freddy’s pub in 2018?

What is the economic profit for Freddy?

Freddy did earn a profit of $60,000 but he has an economic loss of $160,000. If he is rational, he will still see the accounting profit as a profit but having such a big difference in the economic profit might convince him to move back to being a doctor.

Economic Profit Conclusion

- Economic profit can be calculated by subtracting the opportunity cost from the accounting profit. The opportunity cost is the investment that the business will need to give up investing in the current opportunity.

- Economic profit and accounting profit differ based on:

- The fact that economic profit will measure the cash flow of a business and the accounting profit will measure the profit based on accrual.

- Accounting profit doesn’t consider opportunity costs, but economic profit does take them into consideration.

FAQs

1. What is an economic profit?

Economic profit is a calculation that measures the difference between the accounting profit and opportunity cost. The opportunity cost is the investment that the business will need to give up investing in the current opportunity. Economic profit takes into consideration both expenses and revenue when calculating the profit. This calculation is only valid for one year.

2. How do you calculate the economic profit?

To calculate the economic profit, you will need to subtract the opportunity cost from the accounting profit. The opportunity cost is the investment that the business will need to give up investing in the current opportunity. This calculation is only valid for one year.

3. What is the difference between an economic profit and a normal profit?

The difference between economic profit and normal profit is that economic profit takes into consideration both expenses and revenue when calculating the profit. Normal profit only takes into consideration the revenue and not the expenses. Economic profit is a more accurate calculation of the profits of a business.

4. What is the main role of economic profits?

The main role of economic profits is to help businesses make rational decisions. Economic profit measures the difference between the accounting profit and opportunity cost. The opportunity cost is the investment that the business will need to give up investing in the current opportunity. This calculation is only valid for one year.

5. What is a negative economic profit?

A negative economic profit means that the business is losing money. This can be caused by having more expenses than revenue or by having an opportunity cost that is higher than the accounting profit. A negative economic profit is not a good sign for a business and can lead to them shutting down.