What is an Exchange Traded Fund (ETF)?

Exchange-traded funds (ETFs) are investment firms registered with the Securities and Exchange Commission (SEC) and give investors a method to pool their money in a fund that invests in stocks, bonds, or other assets.

Financial advisers professionally manage the majority of ETFs with SEC registration. Some ETFs are actively managed funds that purchase and sell securities following a defined investment strategy.

While others are passively managed funds that strive to match the return of a particular market index.

Mutual funds are not ETFs. However, they combine characteristics of mutual funds, which may only be bought or sold at their net asset value per share at the close of each trading day, with the capacity to trade all day on a national securities exchange at market rates.

How Do ETFs Work?

Extended-traded funds are designed to trace the value of an underlying asset they trade at market-determined prices that typically vary from that asset.

As such, ETFs work in this way:

- The fund provider possesses the underlying assets, designs a fund to trace its performance, and sells shares in that fund to investors afterward.

- Shareholders don't own the underlying assets in the fund despite owning a portion of an ETF.

- ETF investors that trace a stock index may earn lump dividend payments or reinvestments for the stocks that make up the index.

- Investors can buy a share of the basket of funds, just like buying shares of a company.

- Sellers and buyers trade the ETF daily on a return, much like a stock.

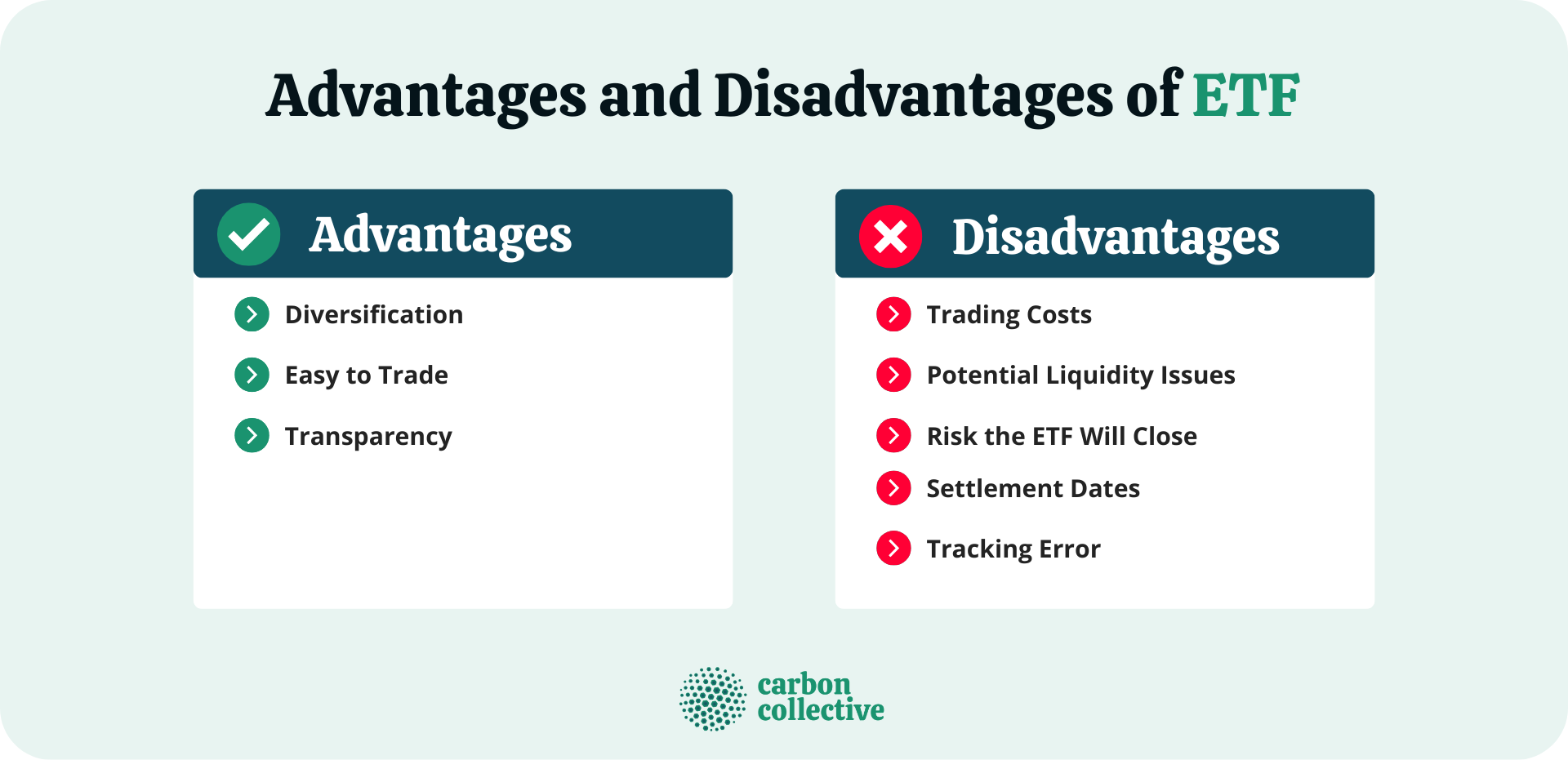

Advantages of ETF

There are some advantages and disadvantages to think about before investing in an ETF.

Diversification

ETFs allow investors to diversify across horizontals, such as industries, and deliver benefits to their portfolios.

Diversification can protect your portfolio against market volatility.

However, if you invested in just one industry, which had a terrible year, your portfolio might have performed poorly too.

Thus, you can provide more balance to your portfolio by investing across different industries, geographies, company sizes, and more.

Since ETFs are already well-diversified, you don't have to worry about making it within your portfolio.

Easy to Trade

Another pro of ETFs is that they are effortless to trade.

You can buy and sell them just like you would a stock, which makes them much more accessible than most mutual funds trade at the end of the day.

Transparency

You always know what you're buying with an ETF because the fund's holdings are public information.

So, you can always know the ETF's stocks or assets.

Disadvantages of ETF

Below are the disadvantages of ETFs:

Trading Costs

ETFs are exchange-traded, which may be subject to commission fees from brokers online. Thus, costs may not end with the expense ratio.

Potential Liquidity Issues

Some ETFs are thinly traded and may need help getting filled at the bid-ask spread.

It is essential to exercise caution when trading these types of securities.

Risk the ETF Will Close

The main reason that this happens is that a fund needs to bring in more assets to make up for the administrative costs.

Investors may be at a loss, for they are forced to sell the shuttered ETF sooner than they may have intended.

Settlement Dates

As a seller, your funds from the ETF sale aren't available to reinvest since ETFs are not settled for two days following a transaction.

Tracking Error

The ETF may not precisely track the underlying index for several reasons, most notably fees charged by the fund.

This tracking error is more significant for ETFs that follow less followed indexes and those with higher expense ratios.

Types of ETFs

Now that we know how ETFs work and some pros and cons, let's look at the different types.

Stock ETFs

Usually, stocks are composed and meant for long-term growth. Thus, they also bring slightly more risk than other types of ETFs.

Commodity ETFs

Commodities refer to raw goods that can be bought or sold, like crude oil, gold, and coffee.

Commodity ETFs allow you to bundle these securities into a single investment.

Bond ETFs

Bond ETFs don't have a maturity date, unlike individual bonds.

Hence, their most common use is to produce regular cash payments to investors.

International ETFs

An international ETF gives investors diversified access to stocks of companies located in a single country or region. They are easy and usually less risky.

Sector ETFs

A sector ETF contains a group of securities in the same industry.

Sector ETFs provide a technique to invest in specific companies within those sectors, including the healthcare, industrial, or financial sectors.

Often, sector ETFs carry a higher risk than broad-market ETFs.

How to Invest in ETFs

Investing in ETFs has become easy. Such steps you might follow are:

Step 1: Find an investing platform

Most ETFs are available on online investing platform that usually offers commission-free trading, which means that no fees are to be paid to the platform providers when buying and selling ETFs.

However, a commission-free purchase does not mean ETF providers will also give access to their product without associated costs.

Step 2: Research ETFs

The next and most important step in investing in ETFs involves researching them.

When investing in an ETF, during the process, remember that they are unlike individual securities like stocks or bonds, a whole picture is what you need to consider.

Hence, during the process of research, here are questions you might want to consider:

- What is your investing time frame?

- Are you investing for growth or income?

- Are there specific sectors or financial instruments that excite you?

Step 3: Consider a Trading Strategy

If you are a newbie investor in ETFs, a good trading strategy is dollar-cost averaging or spreading out your investment costs over time.

It smooths out returns over time and builds a disciplined approach to investing.

Thus, when investors become more comfortable with trading, they can advance to more sophisticated strategies like sector rotation or swing trading.

Final Thoughts

Exchange-traded funds have become a go-to investment for many investors.

Their low costs, broad selection, and ease of use make them an attractive option for both beginner and experienced investors.

However, as with any investment, there are risks to consider before investing in ETFs.

But overall, they can be a helpful tool to achieve your investment goals.

FAQs

1. What is an ETF?

An Exchange-traded fund (ETF) is a fund that owns a basket of securities, such as stocks, bonds, or commodities, and tracks an index. ETFs are traded on exchanges and can be bought and sold throughout the day like stocks.

2. How do ETFs work?

ETFs are passively managed, which means a fund manager does not actively manage them. Instead, the fund manager invests in all of the securities in the index that the ETF tracks.

3. How to buy ETFs?

To buy an ETF, you must open an account with a broker offering ETFs. Once you have opened an account, you can buy and sell ETFs like stocks.

4. What does an ETF cost?

The cost of an ETF includes the management fee, which the fund manager charges, and the expense ratio, which covers the costs of running the fund.

5. How to invest in ETFs?

You can invest in ETFs by buying them on an exchange or broker. You can also invest in ETFs through managed or retirement accounts.