Controlling the flow of funds through a business is an important management activity. An analyst may judge the overall quality of management by interpreting the clues about how successfully the management team brings funds into the company and how successfully management allocates those funds once raised. There are several financial statements that may assist the analyst in gathering clues about funds flow.

]Funds Type Statements

Funds Type Statements are statements showing how funds flow through a business. Some examples include:

Examples of Funds Statements

- Statement of Changes in Financial Position

- Cash Flow Statement

- Funds Statement

Funds Flow

Statements showing the flow of funds throughout a business may provide clues about the quality of management.

Sample Statements

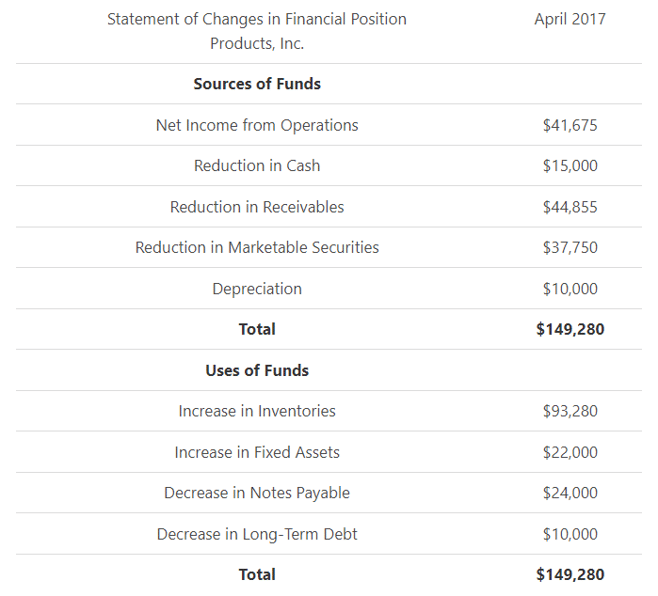

Statement of Changes in Financial Position

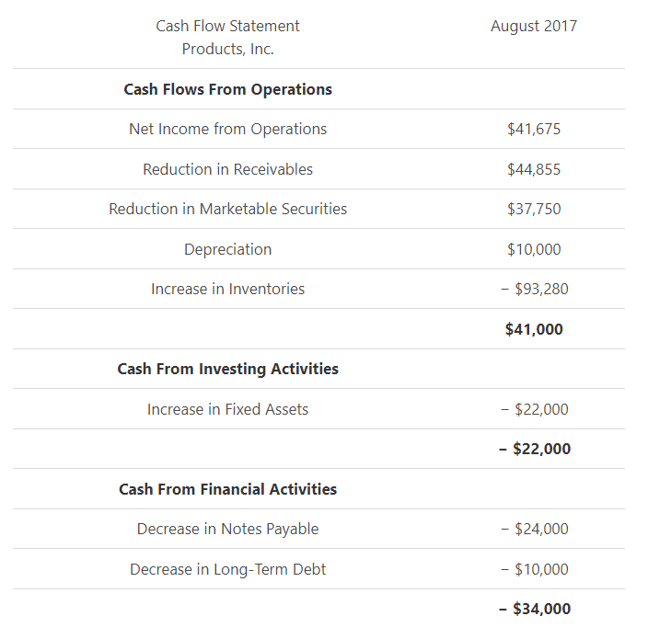

Cash Flow Statement

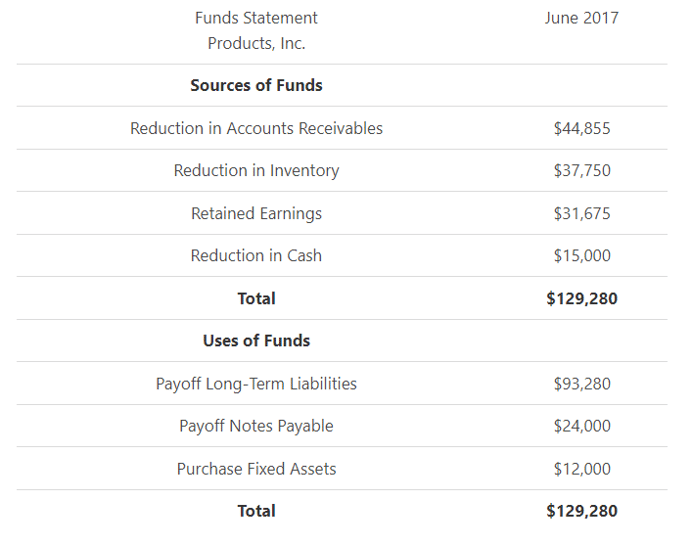

Funds Statement

Constructing a Funds Statement

Constructing a Funds Statement

- Compare Two Balance Sheets

- Identify Changes in Each Item

- Classify Those Changes as Sources or Uses of Funds

- Assemble Information in Desired Format

- Analyze the Information

Sources and Uses of Funds

Sources of Funds

- Increase in a Claims Item

- Decrease in an Asset Item

Uses of Funds

- Increase in an Asset Item

- Decrease in a Claims Item

Classifying Changes

Example of Classifying Changes

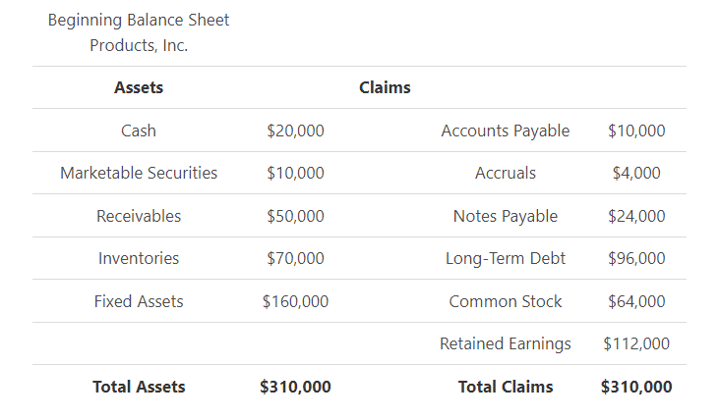

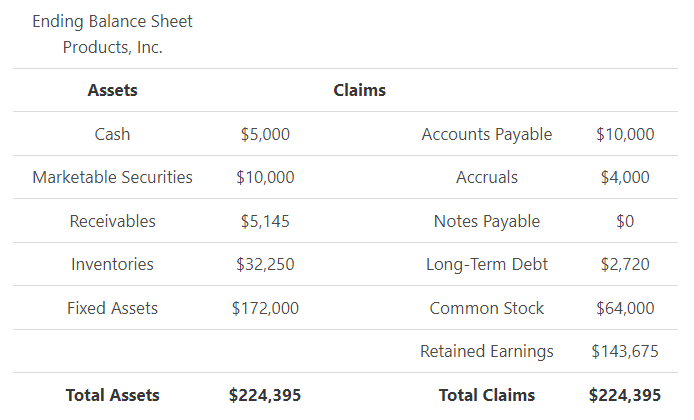

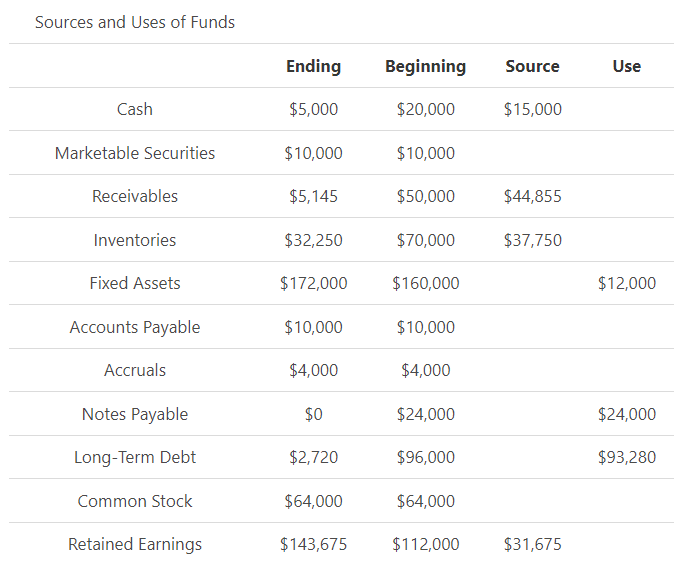

In the Funds Statement example below, the cash account goes from $20,000 on the first, Beginning Balance Sheet to $5,000 on the second, Ending Balance Sheet. That is a decrease of $15,000. A decrease in an asset item is a source of funds. Other changes would be classified accordingly.

Funds Statement – Step 1

Analyzing Information

When analyzing the information that goes into a funds statement, each item should be analyzed in detail and the overall impact of any change should be examined.

In the funds statement example below, the company appears to be profitable because retained earnings increased. Also, the company paid off a great deal of debt and purchased some fixed assets. To finance these moves, the company relied on reductions in inventory, receivables, and cash, as well as plowed earnings back into the firm.

Funds Statement – Step 2

This overview was developed by Dr. Sharon Garrison.

No adaptation of its content is permitted without permission.

FAQs

1. What are fund statements/financial statements?

Fund statements, also known as financial statements, are a compilation of a company's assets, liabilities, and owners' equity at a specific point in time. The purpose of fund statements is to provide insight into a company's overall financial position and performance over a period of time.

2. What are the types of financial statements?

There are three primary types of financial statements: the balance sheet, income statement, and cash flow statement. The balance sheet shows a company's assets, liabilities, and owners' equity at a specific point in time. The income statement shows a company's revenue and expenses over a period of time, while the cash flow statement provides information on how cash moves in and out of a company.

3. What is a source of funds statement?

A source of funds statement is a financial statement that shows the sources of a company's cash flow. It identifies the various items that contributed to a company's increase or decrease in cash, as well as how those changes impacted the company's overall financial position.

4. What are the 5 financial statements?

The 5 financial statements are the balance sheet, income statement, cash flow statement, statement of changes in owners' equity, and statement of cash flows. These statements provide a comprehensive view of a company's financial health and performance over time.

5. What are the benefits of a funds statement?

A funds statement can provide a company with a detailed overview of its financial position and performance. It can help identify areas where the company is generating cash, as well as areas where it is spending more cash than it is taking in. This information can be used to make informed decisions about how to best manage and grow the business.