A general journal is where business transactions and events are first recorded and, for that reason, it is often called a “book of first entry”.

Records are entered in the general journal in chronological order and are available all in one place so that the management and accountants can easily analyze the data.

A journal can be of two types – a specialty journal and a general journal.

A specialty journal will only record the business transactions that are related to that particular journal itself. The four commonly used specialty journals are sales journal, purchases journal, cash receipts journal, and cash payments journal. The company can have more specialty journals, but these four will include the bulk of business transactions.

All other transactions that cannot be accounted for in the specialty journal can be entered in the general journal instead. These can include business transactions that may alter accounts such as accounts receivables, accounts payable, expenses, accumulated depreciation, etc.

The double-entry bookkeeping system is used to journalize business events in the general journal. These will follow the rules of debit and credit as given below:

- Increase in an asset account will be recorded via a debit entry.

- Increase in an expense account will be recorded via a debit entry.

- Increase in dividends or drawings account will be recorded via a debit entry.

- Increase in a loss account will be recorded via a debit entry.

- Increase in an income account will be recorded via a credit entry.

- Increase in a revenue account will be recorded via a credit entry.

- Increase in liability account will be recorded via a credit entry.

- Increase in shareholders equity account will be recorded via a credit entry.

Once the journal entries are successfully recorded in the general journal, they are posted to individual ledgers, after which the trial balance and financial statements are prepared.

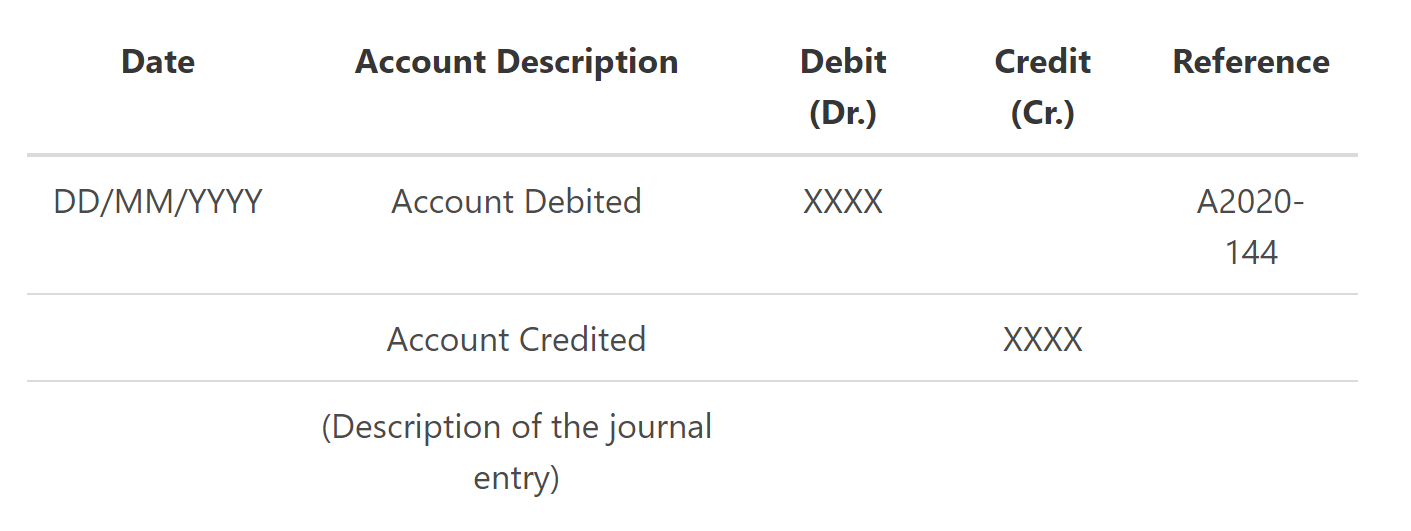

General Journal Format

The journal entries will need to be made based on the following format:

- The left column will contain the date of when the business transaction took place.

- The second column should contain the “account name” of the concerned accounts that are affected by that business transaction. The debited accounts should come first followed by the credited accounts. A short description of the nature of the transaction is also given below each journal entry. The rules of debit and credit bookkeeping systems are explained in the next section.

- The third and fourth columns will include the total debit and credit amounts related to the journal entries. Remember, the debit amounts should equal the credit amounts, otherwise, the accounting equation will not balance.

- The reference column will include a reference number that will be an easy indicator for which general ledger has the transaction been posted to.

Uses of the General Journal

Below are some of the uses of the general journal:

- To record the company’s transactions or business events

- Can also be used for investing activities. A trader can form a journal to record all the details of trades he has executed during the day. This can be later used for taxation and audit purposes.

- Specialty journals can be made for various purposes for instance a local grocery store will not know much about accounting, but he will have something that closely resembles a revenue or a cash receipt journal.

Bob Donut Shoppe, Inc. Example

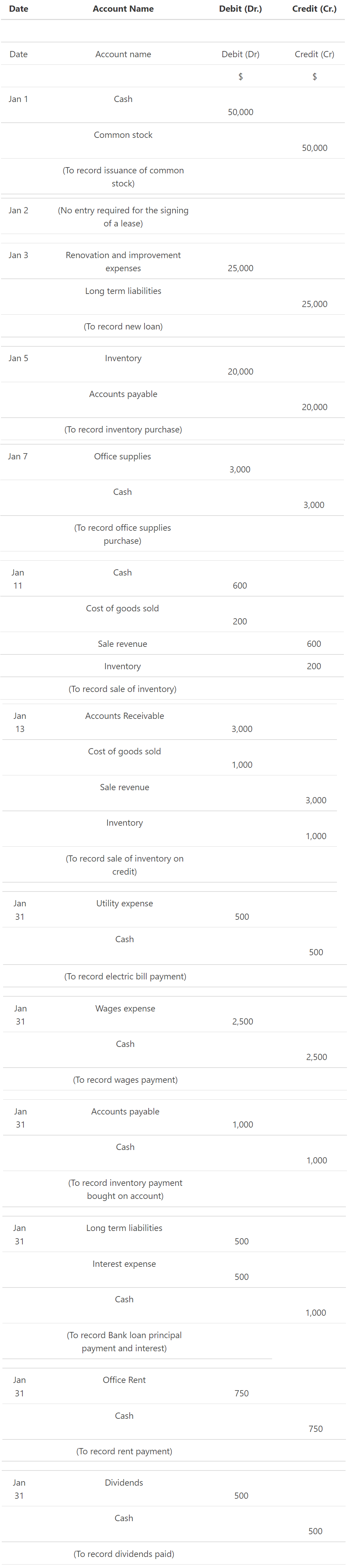

We have already studied the accounting cycle (from the preparation of journal entries to the final financial statements) for Bob and his company called Bob Donut Shoppe, Inc. Let’s go back to Bob and take a look at the business transactions that take place in the first year of business:

Transactions

Jan 1. Bob forms the Donut Shoppe, Inc by purchasing 50,000 shares at $1 per share.

Jan 2. Bob finds a good rental place on one of the busiest streets in his location and signs a lease for $750 per month.

Jan 3. Bob borrows $25,000 from the bank to pay for renovation and improvement expenses on the property. He agrees to pay $1000 per month for three years to repay off the loan.

Jan 5. Bob purchases $20,000 of inventory on credit from the vendors and agrees to pay $1000 per month.

Jan 7. Bob purchases supply to use around the store costing $3000.

Jan 11. Bob makes his first sale of 20 boxes of donuts for a neighborhood birthday party for $30 per box. They cost him $10 per box to make.

Jan 13. Bob sells another 100 boxes of donuts for an office party on account of $ 30 per box. Costing him to make is $ 10 per box

Jan 31. Bob pay his electric bill of $500.

Jan 31. Bob pays his staff salaries worth $2500.

Jan 31. Bob's first inventory payment is now due.

Jan 31. Bob's first payment for the bank loan is also now due. In addition to the $ 1000 loan repayment, Interest on the loan is $500.

Jan 31. Bob pays the first-month rental payment of $ 750 on the due date.

Jan 31. Bob makes a profit at the end of the month and decides to pay himself a dividend of $ 500.

Journalizing Entries

Conclusion

General journals are used for initial record keeping of all business transactions except for the ones that will be included in the specialty journal. These general journals during times when accounting still was largely a manual process. Nowadays, with the advent of software technology and automation, these general journals are slightly less visible as they are usually being prepared at the backend by the software you might be using.

FAQs

1. What is the general journal?

A general journal is a book of original entries in which all transactions are recorded for a business. This includes both debits and credits and allows for an accurate reflection of the company's financial position. The general journal is one of the oldest forms of accounting, and it still serves as the foundation for most businesses' financial reporting.

2. What is the general journal used for?

The general journal is used as a primary book of entry for recording all transactions for a business. This includes both debits and credits and allows for an accurate reflection of the company's financial position. The general journal is one of the oldest forms of accounting, and it still serves as the foundation for most businesses' financial reporting.

3. How do you record a general journal?

To record a general journal, you first need to know the account titles and numbers for the accounts that will be affected by the transaction. Next, you need to know the amount of the transaction in terms of debits and credits. Finally, you need to record the information in the journal in the appropriate columns.

4. What is the difference between a general journal and a special journal?

The main difference between a general journal and the special journal is that the general journal includes all transactions for a business, while the special journal includes only specific types of transactions. The general journal serves as the foundation for most businesses' financial reporting, while the special journal is used for more detailed reporting.

5. What is the difference between entries in a general journal versus a general ledger?

The main difference between entries in a general journal and a general ledger is that journal entries are not permanent. They are used to record the initial transaction, and then they are transferred to the general ledger. General ledger entries are permanent and represent the final financial position of the company.