Goodwill to assets ratio compares the value of a business’ goodwill to its total asset value. Goodwill is an unidentifiable and intangible asset. It’s also a part of a company’s total assets. Brand name, customer base, and good management are some examples of goodwill. In other words, the goodwill to assets ratio measures the proportion of assets that have an undefined useful life but no physical form.

The value of goodwill can only be determined when another business wishes to acquire the company. When a business wants to own another company, it will pay a fixed amount of money to gain all of the assets. If that happens, goodwill is the difference between the payment total and the market price of the assets.

Goodwill To Assets Ratio Formula

As mentioned before, goodwill is the value of the purchase price subtracted by the difference between the fair market value (FMV) of assets and liabilities. Fair market value is the price of an item when it’s available for sale in the open market. To better understand this, take a look at this formula:

As you can see, goodwill can also be thought of as the excess amount of money to buy all of the assets of another company, excluding liabilities. Why are we excluding them? Simple, because the old liabilities of the company now belong to the new owner. As a side note, you can also think of goodwill as the purchase price after the market value of any net assets is subtracted.

Note that we use the value of unamortized goodwill. Amortization is a technique sometimes used to lower the book value of intangible assets, including goodwill. It’s not dissimilar to depreciation, which is used for tangible/physical assets. So unamortized goodwill is the value of goodwill before amortization.

In the first place, however, goodwill does not have definite value on the balance sheet except when a merger happened. If the event happens, the value of goodwill recorded is automatically unamortized since the value is recorded for the new owner.

In general, goodwill is only a part of intangible assets. While other intangible assets have definite value, goodwill does not. Some people use the term “goodwill” and “intangible assets” interchangeably when there’s a big difference between them. A few examples of intangible assets that are not goodwill include software, copyrights, and patents. These assets have no physical form but still have identifiable value and useful life, unlike goodwill.

Goodwill To Assets Ratio Example

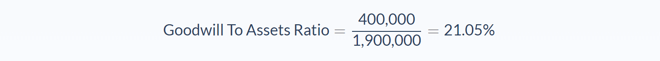

ABC Company wishes to acquire the XYZ Company to expand its operation. The total amount of the purchase price is $1,300,000. The assets’ fair market value of XYZ Company is analyzed to be $1,900,000. On the other hand, the fair market value of liabilities is $1,000,000. What is the goodwill to assets ratio of XYZ Company?

Let’s break it down to identify the meaning and value of the different variables in this problem.

First, we need to determine the value of goodwill. Goodwill takes the total of FMV of Assets (1,900,000) minus FMV of Liabilities (1,000,000), then it subtracts the purchase price (1,300,000). Thus, the value of goodwill—or unamortized goodwill—is $400,000.

- Goodwill = 400,000

- Total Assets = 1,900,000

We can now use the formula to calculate the goodwill to assets ratio:

The goodwill to assets ratio of company XYZ would be 21.05%.

From this result, we can see that from the total amount paid by ABC Company, 21% of them are addressed towards goodwill such as the brand name and customer base. In this case, the total assets’ worth of the company is bigger than the value of the purchase price.

But, keep in mind that some of them are in the form of liabilities that the new owner now needs to deal with. So, it’s not a problem even if the payment value is less than the assets.

Goodwill To Assets Ratio Analysis

Goodwill is an asset that can’t be sold individually or separately, while other intangible assets can. It will always stick with the company and can be written off entirely if the business stops operating. This is one of the reasons why goodwill to assets ratio is important. The ratio can help determine how much of the assets are sellable. By knowing goodwill to asset, companies can know the portion of assets that hold real monetary value.

Small goodwill to assets indicates that most of the assets of the company are items that way easier to sell compared to the goodwill—which can only be sold along with the company. Still, that does not mean all of these items are easily liquidated still. Some of them are fixed assets or copyright that are still hard to trade with cash but not as hard as goodwill.

On the contrary, companies with large goodwill to assets ratio are more likely to experience volatility in the value of their assets. For instance, if a company has total assets of $200 million but $100 million of them is in the form of goodwill, trouble may arise if the company is involved in a scandal at some point. It may lose the customer base as well as the reputation of the brand name which can significantly hurt the company's valuation.

Furthermore, like most metrics, there’s no perfect value for the goodwill to assets ratio. Analysts shall compare this indicator from multiple companies in the same industry as needed. That way, they can determine the standard for that particular field.

Goodwill To Assets Ratio Conclusion

- The goodwill to assets ratio is a metric measuring the proportion of goodwill among total assets.

- This formula requires two variables: goodwill and total assets.

- Goodwill is the difference between the purchase price and the fair market value of net assets.

- Goodwill is only a part of intangible assets and is unidentifiable.

- This ratio is essential to determine how much assets of the acquired company can be sold separately.

Goodwill To Assets Ratio Calculator

You can use the goodwill to assets ratio calculator below to quickly calculate the proportion of goodwill among total assets by entering the required numbers.

FAQs

1. What is goodwill to assets ratio?

The goodwill to assets ratio is a metric measuring the proportion of goodwill among total assets.

2. How is goodwill to assets ratio calculated?

The goodwill to assets ratio is calculated by dividing the goodwill by the total assets.

3. What is goodwill?

Goodwill is an intangible asset that can't be sold separately from the company. It's composed of the brand name, customer base, and other intangible assets.

4. How does the goodwill to assets ratio work?

The goodwill to assets ratio measures the proportion of goodwill among total assets. A higher ratio indicates that there is more goodwill compared to tangible assets, while a lower ratio suggests that there are more tangible assets. This information can be used by companies to assess how easily they could sell their assets if they needed to.

5. Why does the goodwill to assets ratio matter?

The goodwill to assets ratio is important because it provides insight into the liquidity of a company's assets. A higher ratio indicates that the company is more likely to experience volatility in the value of its assets, while a lower ratio suggests that they are less likely. This information can be used by companies when making decisions about whether to sell certain assets.