Gross margin ratio is an economic term that refers to the ratio between a company’s gross profit to net sales. It is a ratio that gives insight into how much profit is made per unit product. The gross margin is mostly expressed as a percentage and is calculated by dividing the gross profit of a company by its net sales or revenue.

It is a ratio that expresses the percentage of each dollar (or any other currency that is used by the company) made that the company retains as profit. This means that if a company has a gross margin of 15%, it means that for each dollar made in sales, 15% of the dollar (15 cents) is the profit made by the company.

Company managers use the gross margin ratio to determine how efficient they are at turning raw materials into finished goods. It is used to determine the value of incremental sales, to guide pricing and promotional decision. Profit margin informs managers how much money is available to cover indirect costs of the business like rent, utilities, and other overheads. Business managers always know their gross margin ratio as it is fundamental in making financial decisions like budgets and forecasts.

The gross margin ratio varies across industries since the cost of production is different for different industries. This means that industries, where the cost of production is low, will have a higher gross margin ratio, while those where the cost of production is higher will have a lower gross margin ratio.

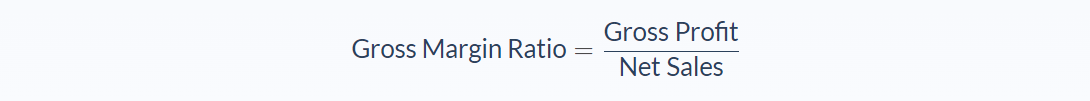

Gross Margin Formula

The formula compares the gross profit with the net sales or revenue of the company. The gross profit is the difference between the net sales and the cost of goods sold. Note that the cost of goods refers only to the fixed and variable costs directly linked to the production of the goods like the cost of materials, labour, transportation costs, etc.

Cost of goods does not include administrative costs or other overheads like rent and utilities. Net sales is total gross sales minus discounts, promos, and returns. The ratio GP/NS is multiplied by 100% to convert to a percentage.

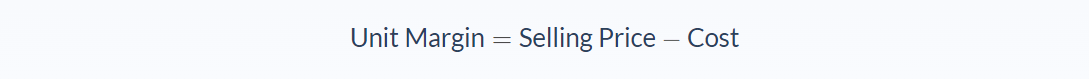

Another metric, similar to gross margin is the unit margin. Unit margins are used by some managers and they reflect the same thing. A unit may vary from one company to another, as different companies measure their production differently.

For a soap company, a unit may be a roll of soap, while for a bottled drink company, a unit might be a crate. The unit margin is defined as the difference between the selling price per unit and the cost per unit of production. Since these two metrics are vital in business, most managers are aware of them and can convert from one metric to the other.

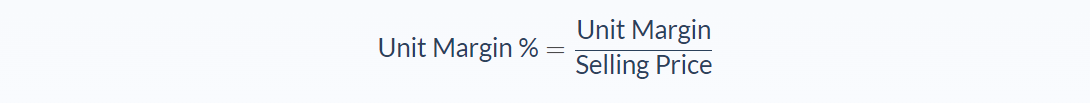

Unit margin is expressed in monetary terms while gross margin ratio is expressed in percentage. The above formula can convert one into the other.

Gross Margin Ratio Example

According to the income statement of a soap manufacturing company, Bright Skin, their net sales for February is $400,000. The total cost of production of the soaps that were sold in February is $120,000. The cost per roll of the soap is $3 and the selling price is $10. What are the gross margin ratio and the unit margin of the company?

First, let us break down the example into the variables that are required in our formula.

- The net sales = $400,000

- Cost of goods sold = $120,000

- Cost per unit of soap = $3

- Price per unit of soap = $10

From the explanation, the gross profit is calculated by subtracting the total cost of production of goods from the net sales.

The gross profit = $280,000

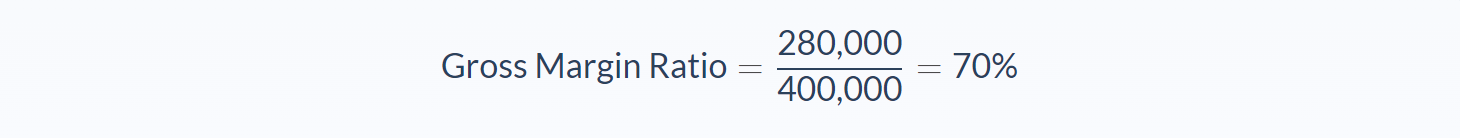

The gross margin ratio can be calculated by our formula:

Here, the gross margin ratio is 70%.

Let us also calculate the unit margin. This is not a percentage but is based on the per-unit calculations.

- Price per unit = $10

- Cost of production per unit = $3

Now, we can use our second formula:

We have calculated the gross margin ratio to be 70% while the unit margin is $7. Both calculations show the same thing. From the gross margin, it means that 70% of revenue is profit for the company. From the unit margin, it means that for each unit of soap the company sold at $10, the company made a profit of $7. Note also that $7 is 70% of $10. This clearly shows both refer to the same thing.

Gross Margin Ratio Analysis

The gross margin shows how efficiently a company is making a profit from its raw materials. A high gross margin ratio means that a company is efficiently changing raw materials to finished products for profit. Companies and businesses always target a higher gross margin ratio.

Companies might also use the gross margin ratio to compare their current and previous performances. Gross margin ratio is also not ideal for comparing companies from different industries, because the cost of production varies across industries.

Gross margin ratio can be improved by finding cheaper inventory. Cheaper suppliers will mean cheaper cost of goods. Marking up goods will also lead to higher gross margin since there will be higher net sales. However, increasing the price of goods should be done competitively otherwise, the cost of the goods will be too expensive.

Gross Margin Ratio Conclusion

- Gross margin ratio is an economic term that describes how much profit a business makes per revenue generated.

- This formula can be calculated by dividing the gross profit by the net sales.

- Gross margin ratio is fundamental for business managers in making decisions like budgets, pricing, and forecasts.

- The gross margin varies across industries hence it is best suited for comparing a company’s current performance to its previous performance.

- Gross margin can be improved by finding cheaper inventory, as this will translate to a cheaper cost of production.

Gross Margin Value Calculator

You can use the gross margin ratio calculator below to quickly calculate a company’s gross margin ratio by entering the required numbers.

FAQs

1. What is a gross margin ratio?

A gross margin ratio is an economic term that describes how much profit a business makes per revenue generated. It is a ratio that gives a snapshot of how efficiently a company is making a profit from its raw materials.

2. How do you calculate the gross margin ratio?

To calculate the gross margin ratio, divide the gross profit by the net sales. The formula looks like this:

Gross Margin Ratio = Gross Profit / Net Sales

3. What is a good ratio of gross margin?

Analysts generally consider a gross margin ratio of 50-70% to be good.

4. What does the gross margin ratio represent?

The gross margin ratio is a profitability ratio that compares the gross profit to the net sales. The ratio measures how profitable a company sells its products relative to the cost of goods sold.

5. How can a company improve its gross margin ratio?

A company can improve its gross margin ratio by finding cheaper inventory, as this will translate to a cheaper cost of production. The company can also mark up its goods, which will result in higher net sales and a higher gross margin ratio. However, increasing the price of goods should be done competitively so that it does not become too expensive.