Full-Time Equivalent (FTE) provides the basis for understanding the individual’s contribution towards organizational success. It serves as a useful scale to calculate a variety of performance metrics in business and can act as a resourceful tool to enable an optimum staffing model.

Performance or productivity defines the profit structure of an organization and employee strength is its pillar. To evaluate the value or profit, it’s important to first understand the requirement margin and establish the bare minimum criteria and benchmarks.

Many times, FTE is confused with “full-time employee”, so before we move on to the details and procedure to calculate metrics lets look at what is the difference between the two concepts.

Full-Time Equivalent Explained

Full-time Employees are workers who typically work for 30-40 hours a week and are employed on a permanent basis. Along with regular wage, they get benefits such as health care, vacation pay, pension, and other requirements as per the prevailing law.

Whereas, Full-time Equivalent (FTE) is a financial metric that evaluates the work performance of all employees irrespective they are full-time or part-time. It adds the total hours worked by part-time employees to the number of equivalent full-time workers. This metric is utilized by employers and companies to monitor workloads for their employees and to plan for future budgeting, and staffing. It acts as a compliance monitor and control mechanism which in turn bridges the company statistics with study them in line with various laws or benefits from applicable programs offered by the government.

What are the benefits of FTE?

- It helps to determine the size of the company and the extent of involvement of every employee in the business.

- It can act as an important metric for evaluation and feedback.

- Employers receive timely data to stay compliant with the rules. For example, once you reach 50 FTE, it’s mandated to provide for health insurance for the employees as per the ‘Affordable Care Act’ (ACA)

- This can be a major factor when determining bonus and annual appraisal cycle.

How to calculate FTEs?

The important two factors in determining the FTE value for an organization are:

- Number of employees (including part-time employee)

- Numbers of working hours

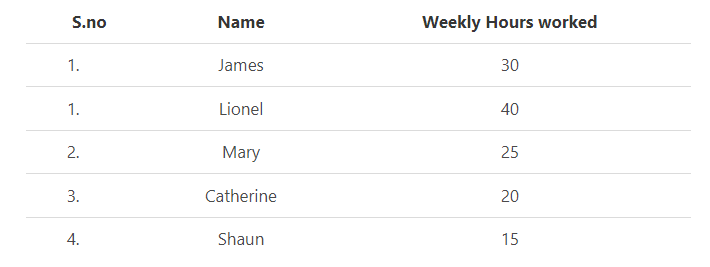

Step 1: Compile a list of the employees and calculate their working hours:

These include workers paid with a year-end W-2 form. For example, a pizza shop employs 5 workers who work the following average working hours excluding employees who are on leave, paid time off and sick leave.

Note: The FTE model does not include independent contractors, the owner, family members of the owner including their spouses and shareholders owning more than 5% of a C corporation and 2% of an S corporation.

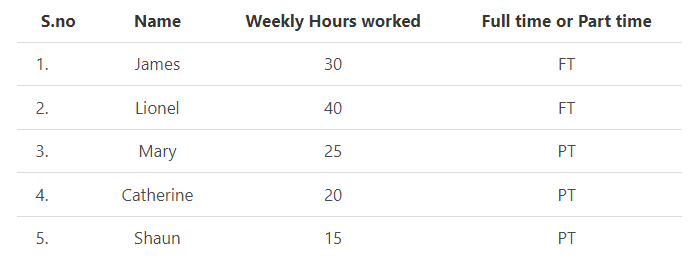

Step 2: Determine which employees are part-time or full-time:

This is dependent on the company policies as few employers might recognize 40 hours/week and above as full-time. Generally, employers consider a full-time employee to work between 30-40 hours a week. As per the IRS and the ACA, part-time employees work less than 30 hours a week on average.

As per the below table, as assumed there are two full-time employees working with the pizza shop

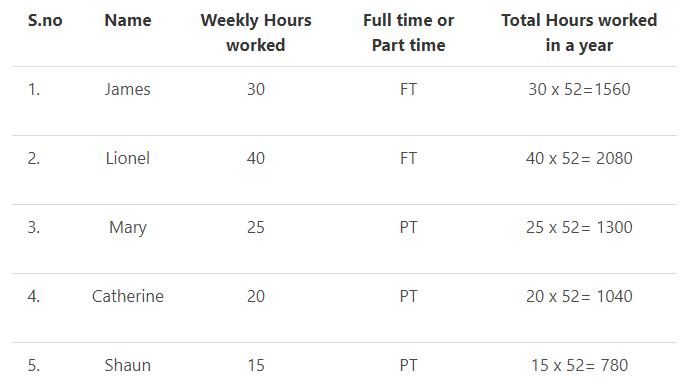

Step 3: Calculate the hours worked per year:

Next, we multiply the weekly hours with the number of weeks in a year which is 52 weeks

Step 4: Add up all full-time and part-time employee hours separately:

- Addition of James and Lionel’s hours gives us the total full-time hours

1560+2080= 3640 hours

- Addition of Mary, Catherine and Shaun’s hours gives us the total part-time hours

1300040 +780= 3120 hours

Step 5: Determine the part-time FTE by using the simple equation:

Total hours worked by part-time employees = 3120 = 0.85

Total hours worked by full-time employees 3640

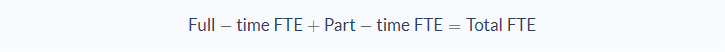

Step 6: Calculate the total FTE:

We add the full-time FTE, which as per point 2 is calculated to two, with the part-time FTE.

2+ 0.85 = 2.85 FTE

Thus, the FTE for the pizza shop is 2.85

How to calculate FTEs for different laws or programs?

A business is required to follow employment laws that depend on the number of employees and respectively FTE. In this section, we will explore how to calculate FTE for different laws or programs.

A. Consolidated Omnibus Budget Reconciliation Act (COBRA)

This law was passed in 1985 as a benefit to employees who have lost their jobs. Under this scheme, employees and their families can temporarily continue to avail of their group health insurance coverage even after the loss of a job or other permitted reason as per the law. It is meant to provide an aspect of economic security for employees who would otherwise be susceptible to losing their insurance.

Please note: It does apply to churches, the federal government, or other related organizations.

Example: An organization employs 15 full-time employees and 12 part-time employees who work 25 hours per week. The employer considers 40 hours per week as full-time.

Step 1: Use the following equation to calculate the total part-time employee work hours

Total number of part-time employees (12 no’s) X Average number of hours per week (25 hours) = 300 hours

Step 2: Use the below equation to calculate the part-time employee FTE

Total part-time employee work hours = 300 hours = 7.5

Total hours a full-time employee works 40 hours

Step 3: Add the number of a full-time employees (15) with the part-time employee FTE calculated above to get the full-time equivalent employees

FTE= (15+7.5) = 22.5

Step 4: Add the total FTEs per week and divide it by 52 weeks (a year) to find the full-time equivalent for the calendar year

As per the law, if the organization employs 20 or more FTE employees on more than 50% of the business days in the past calendar year, the company must offer a private-sector group health plan to be allowed to be covered under the COBRA act.

B. FTE calculation under Paycheck Protection Program (PPP)

In the light of the current socio-economical situation, this scheme was established with the aim to support businesses to retain employees on the payroll. It is a loan program that originated from the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The program allows for more time to spend the funds and makes it easier to receive loan forgiveness for small businesses based on the average FTE employee reduction and other requirements. It is backed by the Small Business Administration (SBA). The program is also extended to qualified sole proprietorships, independent contractors, and self-employed individuals.

Example: An organization employs 9 workers, out of which 4 are full-time and 5 are part-time. The part-time employees work 25 hours on average while the full-time employee record 40 hours per week. So, the total average hours they work in a week is 285 hours

The organization will calculate the reduction quotient to determine the PPP loan forgiveness amount

Step 1: Divide this total hour by 40 to get the number of FTE employees for the week

285/40 = 7.1

The average FTE during the week was 7

Step 2: To calculate the FTE reduction quotient, use the below formula. Let us assume the business did not reduce any FTE employees

Average number of FTEs during the covered period

Average FTEs during the reference period

Therefore, the FTE reduction quotient will stand at 1 (7 FTEs/7FTEs)

C. Employee Retention Credit (ERC)

Another relief measure is provided under the CARES act, the Employment Retention Credit is a refundable tax credit against certain employment taxes which can equal to 50 % of the qualified wages which an eligible employer has paid to their respective employees between March 13, 2020 and before January 1, 2021. Eligible employers can get immediate access to the credit by reducing employment tax deposits which they are otherwise required to make and also get an advance payment from the IRS, incase the tax deposits are not sufficient to cover the credit.

For businesses, which average fewer than 100 FTEs in 2019, the ERC is calculated on wages paid to every employee, however, if they averaged more than 100 FTEs, the tax credit is calculated on wages paid to employees who did not work during the period.

Example: A bakery’s FTE for the year 2019 looked as below

January- May: 90 FTEs per month

June- August: 80 FTEs per month

September- December: 100 FTEs per month

Step 1: Add together the FTEs per month to find the average number of FTEs for 2019

And divide by the 12 months

(90+ 90+ 90+ 90+ 90+ 80+ 80+ 80+ 100+ 100+ 100+ 100) = 1090

1090/12 = 90.8

Step 2: As per the calculations, the average number of FTEs for 2019 is below 100 FTEs and thus the bakery stands to benefit from the employee retention credit, based on wages paid to all the employees.

D. Affordable Care Act (ACA)

The comprehensive healthcare reform law was enacted in March 2010. The law has 3 primary goals which are to make affordable insurance available to more people, expand the Medicaid program to cover all adults with income below 138% of the federal poverty level and support innovative medical care delivery methods to lower health care costs.

Under this act, eligible employers with at least 50 FTEs on average during the previous calendar year would be subjected to the IRS’s employer-shared responsibility. Under these provisions, applicable large employers (ALEs) are required to offer minimum essential medical coverage to their employee which is ‘affordable’ and provides’ minimum value’ to full-time workers and their dependents.

Example: A business consists of 50 full-time employees and 16 part-time employees. Part-time employees work 60 hours per month.

The act considers full-time employees are those who work 30 hours/week or 130 per calendar month

Step 1: Multiply the number of part-time employees with the number of hours they work per month

16 X 60 = 960 hours

Step 2: Divide the total hours worked by part-time workers (900 hours) by total hours for full-time workers in a month (30 X 4 weeks)

900 hours/120 hours = 8

This tells us that the part-time workers make up for 8 full-time workers

Step 3: Add the FTEs for full-time and part-time workers to find the total full-time equivalent employees for the month

50 full-time workers + 8 FTE part-time workers = 58 FTE’s

Step 4: Add the FTEs per month and divide the total by 12 to conclude if the business has an average of 50 full-time equivalents for the calendar year.

To summarize, FTE is a very important metric that can be used in many employment situations and can be one of the determining factors for many business decisions. Apart from being a performance indicator, under the paycheck protection program for small businesses, FTE is used to determine the amount of loan forgiveness for borrowers affected (For example, in our current situation wherein companies are impacted by the coronavirus pandemic). For large employers, it is used in determining whether an employer comes under the purview of an applicable large employer (ALE), which mandates them to extend healthcare benefits to their employees or would be subjected to penalties and prosecution. While for small employers, it can be used to apply for a tax credit of 50% of paid health care premiums. From performance to loan and ultimately tax-saving mechanism, it’s important for a company to understand and deploy the FTE calculation while major making decisions.

FAQs

1. What is a Full-time Equivalent (FTE)?

An FTE is a measure of how many employees are equivalent to a full-time worker. To calculate it, take the total hours worked by all part-time employees and divide it by the hours worked by full-time employees. This will give you the number of FTEs for that month.

2. How do I calculate the Full-time Equivalent (FTEs)?

To calculate FTEs, add together the number of hours worked by all part-time employees and divide that total by the number of hours worked by full-time employees. Multiply the result by 100 to find the FTE percentage.

3. Why is it important to calculate the FTEs?

FTEs are an important metric for businesses of all sizes.

For large employers, calculating FTEs is necessary in order to determine if they are subject to the employer shared responsibility provisions of the Affordable Care Act (ACA).

For small employers, calculating FTEs can help them determine if they are eligible for a tax credit worth 50% of their paid health care premiums.

4. What does 100% full-time equivalent mean?

A company with 100% FTE has the same number of employees working full-time as there are hours in a week (40). This would be equivalent to a company with 50 full-time employees and no part-time workers.

5. What are the advantages of having 100% FTE?

There are several advantages of having 100% FTE.

First, a company with 100% FTE is not subject to the employer shared responsibility provisions of the ACA.

Second, a company with 100% FTE is not subject to fines for not providing health insurance to its employees.

Third, a company with 100% FTE may be eligible for the 50% tax credit for health care premiums.