What Are the Signs That You Need to Change Your Financial Advisor?

Many people stay with their financial advisor even when they're unhappy. They may fear making a change or think it's too much work. Others stay because they believe their advisor is providing good service, even though they're not getting the best returns.

But there are signs that indicate it's time for a change, including:

- Your financial goals have changed.

- You're not getting the level of service you want or need.

- You're not happy with the fees you're paying.

- Your account isn't performing as well as it should be.

- You and your advisor don't communicate well.

If you're experiencing any of these signs, it may be time to switch financial advisors.

How Should You Go About Changing Your Financial Advisor?

Once you've decided to make a change, there are a few steps you should take to ensure a smooth transition:

- Schedule a meeting with your current advisor.

- Gather your important financial documents.

- Choose a new advisor.

- Open new accounts and transfer assets.

- Close old accounts.

What Are the Risks of Firing Your Financial Advisor?

There are a few risks to consider before firing your financial advisor, including:

- You May Lose Access to Certain Investments. This is typically only an issue if you're invested in a proprietary product offered by your current advisor's firm.

- You May Have to Pay Fees to Exit Your Current Investments. This is usually only the case with certain types of investments, such as annuities.

- Your Taxes May Go Up. If you have a lot of taxable gains in your investment accounts, you may owe a significant amount of money in taxes if you sell everything at once.

- You May Have to Pay Fees to Close Old Accounts. This is typically only an issue with retirement accounts, such as IRAs.

- Your Portfolio May Be Disrupted During the Transition. This is usually only an issue if you're invested in a managed account or mutual fund with a high turnover rate.

How to Find a New Financial Advisor

Once you've decided to make a change, the next step is to find a new financial advisor. There are a few ways to do this:

- Ask family and friends for recommendations.

- Search online directories.

- Attend financial planning events in your area.

- Schedule consultations with multiple advisors to find the best fit.

What to Ask a Potential New Financial Advisor

When you're meeting with potential new advisors, there are a few important questions to ask, including:

- Are you fiducially obligated to act in my best interests? This is an important question to ask because not all financial advisors are required to put their client's interests first.

- What experience do you have with clients in my situation? This will help you gauge whether the advisor is a good fit for your needs.

- How do you charge for your services? This is important to know so that you can compare fees and determine if the advisor's services are worth the price.

- What is your investment philosophy? This will help you understand how the advisor approaches investing and whether their approach aligns with your own goals and risk tolerance.

- Do you have any conflicts of interest? This is important to know so that you can be sure the advisor is making recommendations that are in your best interests, not their own.

What Makes a Good Financial Advisor?

When you're choosing a financial advisor, there are a few qualities to look for, including:

- Fiduciary obligation. The best financial advisors are required by law to act in their client's best interests.

- Investment experience. Look for an advisor with experience managing the type of investments you're interested in.

- Financial planning experience. A good financial advisor can help you with more than just investing. They should also be able to help you with retirement planning, tax planning, and more.

- Comprehensive approach. A good financial advisor will take a comprehensive approach to your finances, looking at all aspects of your financial life, not just your investments.

- Fee-only compensation. The best financial advisors are compensated solely by their clients, not by commissions or fees from investment products.

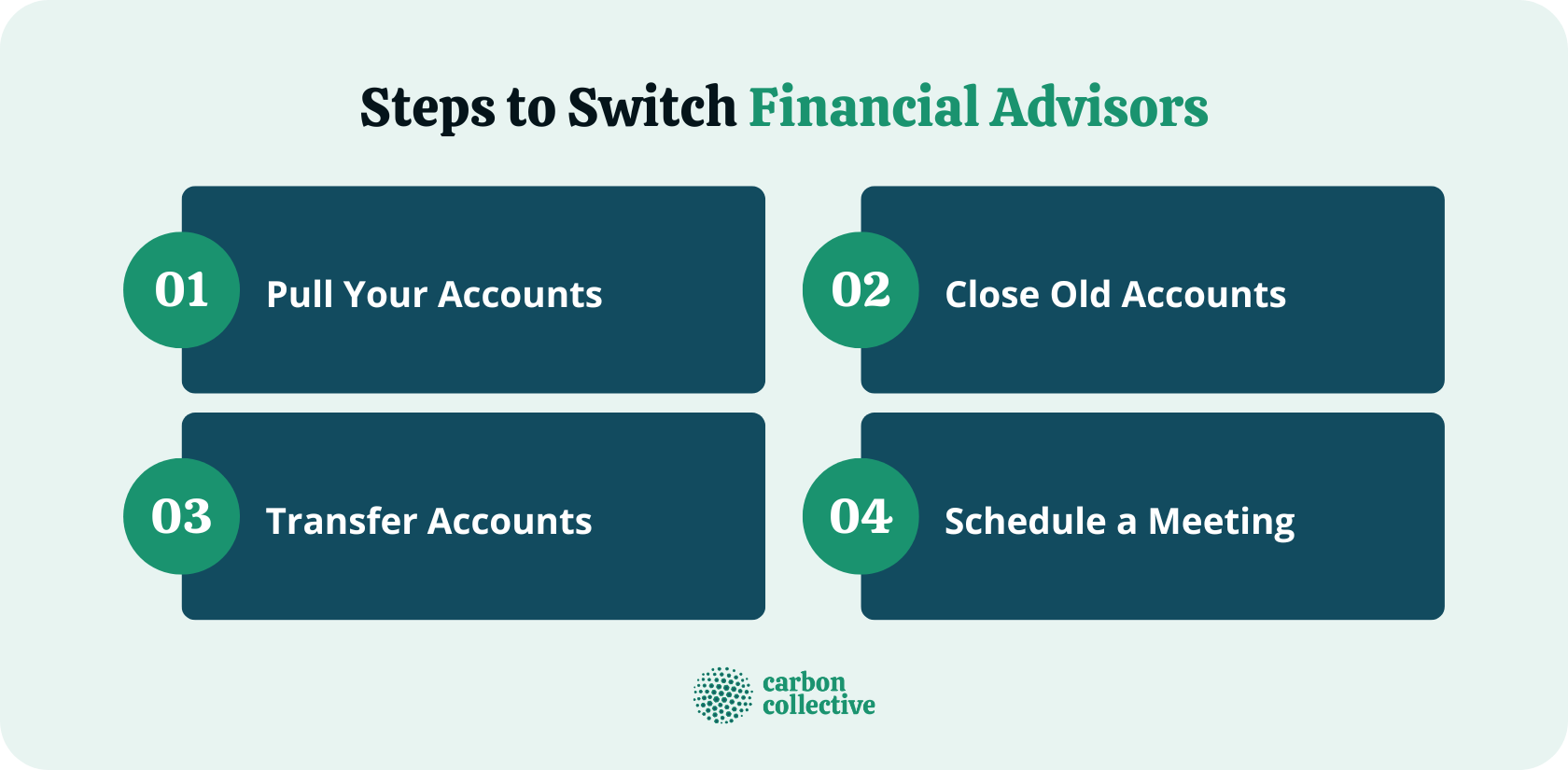

Making the Switch - Steps to Take

If you've decided to switch financial advisors, there are a few steps you need to take:

Step 1: Pull Your Accounts

The first step is to pull your accounts from your current advisor. This includes any investment accounts, retirement accounts, and bank accounts.

Step 2: Close Old Accounts

Once you've pulled your accounts, you'll need to close any old accounts that you no longer need. This includes any retirement accounts and investment accounts.

Step 3: Transfer Accounts

The next step is to transfer your accounts to your new financial advisor. This includes any investment accounts, retirement accounts, and bank accounts.

Step 4: Schedule a Meeting

Once you've transferred your accounts, you'll need to schedule a meeting with your new financial advisor. This is where you'll discuss your goals and develop a plan for moving forward.

The Bottom Line

Making the switch from one financial advisor to another can be a big decision. But, if you're not happy with your current advisor, it may be your best decision.

When you're choosing a new advisor, be sure to ask lots of questions and find one that's a good fit for your needs. And, once you've made the switch, be sure to stay involved in your finances and keep tabs on your progress.

FAQs

1. How often should I review my financial advisor?

You should review your financial advisor at least once a year or more frequently if you have any concerns. This is a good time to check in on your progress and ensure that your goals are still on track.

2. Can I fire my financial advisor?

Yes, you can fire your financial advisor at any time. You may need to close some accounts and transfer others, but you're not obligated to keep working with an advisor with whom you're not happy.

3. Can I switch financial advisors without penalty?

Yes, it is possible to switch financial advisors without penalty. Some advisors may charge a fee for transferring accounts, while others may not.

It depends on the contract you signed with your current advisor. Be sure to check the terms of your contract before making any decisions.

4. What should I do if I'm not happy with my financial advisor?

If you're unhappy with your financial advisor, you first need to talk to them about your concerns. If you're still unsatisfied, you may consider switching advisors.

5. What are the consequences of switching financial advisors?

There may be short-term consequences of switching financial advisors, such as closing old accounts and transferring others. However, in the long run, you may be better off with a new advisor that fits your needs better.