What Is an In-Service Rollover?

An in-service rollover is a type of retirement plan distribution in which an individual moves their retirement assets from one eligible retirement plan to another.

It is an IRS-approved transaction that allows you to change your investment mix, consolidate retirement accounts, or both.

Types of In-Service Rollover

There are two types of in-service rollovers:

Direct

A direct in-service rollover transfers assets from one plan administrator to another. This type of rollover is the simplest and most common.

Indirect

With an indirect in-service rollover, the assets are first distributed to the account holder and then deposited into the new plan within 60 days. This type of rollover is less common and may be subject to income taxes and, in some cases, early withdrawal penalties.

How Does an In-Service Rollover Work?

In-service rollovers are typically done by contacting the new plan administrator and requesting a direct rollover of assets.

The new administrator will then set up an account for you and arrange to transfer the assets from your old plan.

You can do an in-service rollover yourself if your current plan allows it. Check with your plan administrator to see if this is an option.

When Can You Do an In-Service Rollover?

The ability to do an in-service rollover depends on the retirement plan's rules.

Some plans allow in-service rollovers at any time, while others have restrictions, such as requiring that you be at least 59½ years old or have worked for the company for a certain number of years.

What Assets Can Be Rolled Over?

Most plans that allow in-service rollovers permit the transfer of all types of assets, including 401(k)s, 403(b)s, 457s, and IRAs.

The ability to roll over Roth assets depends on the plan. Some plans do not allow the rollover of Roth assets, while others only allow the rollover of Roth assets that have been in the plan for at least five years.

Who Is Eligible for an In-Service Rollover?

In-service rollovers are available to anyone still working and has assets in an eligible retirement plan.

This includes employees of for-profit and non-profit organizations and government workers.

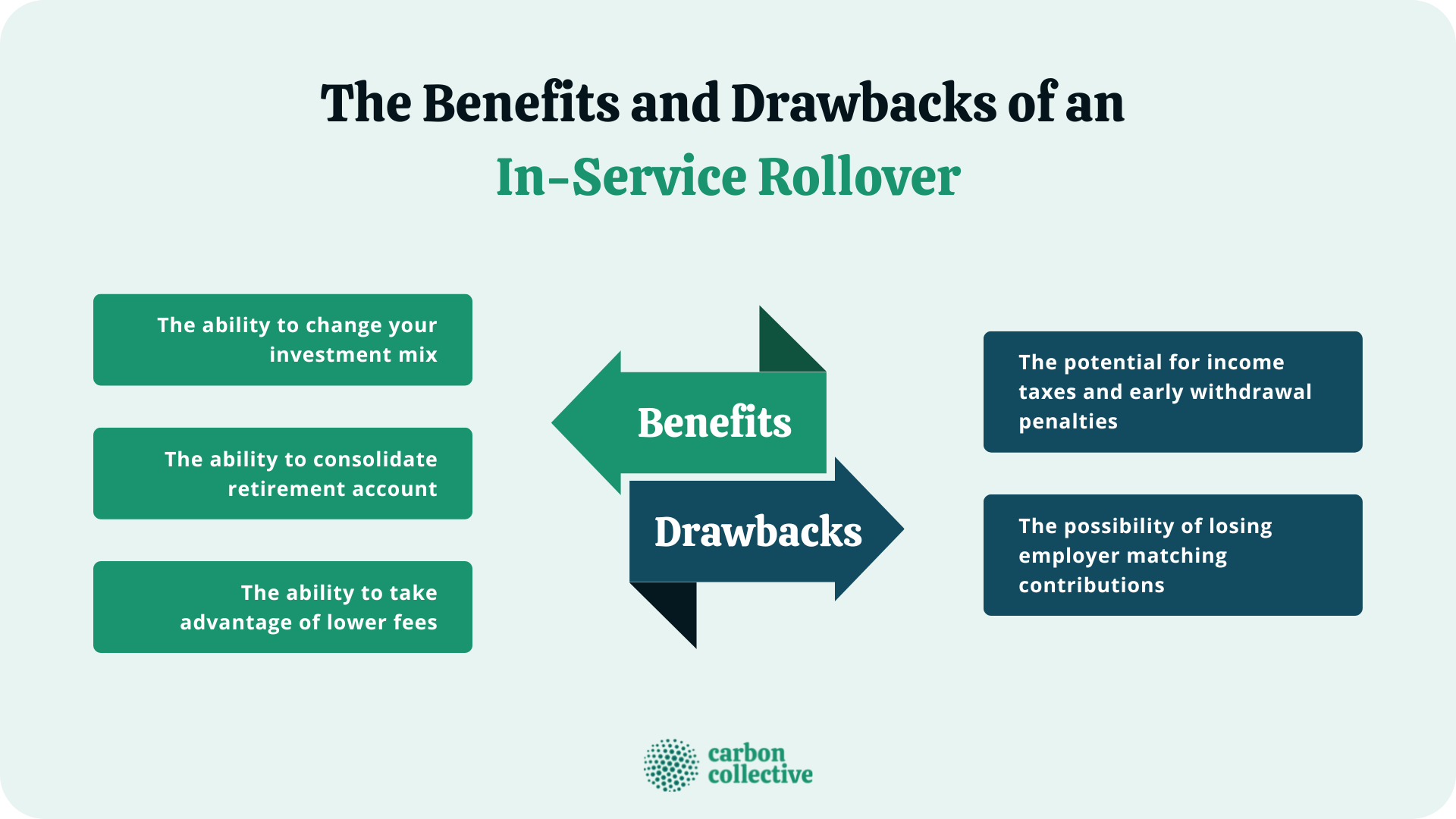

The Benefits of an In-Service Rollover

There are several benefits of an in-service rollover, including:

Ability to Change Your Investment Mix

If you're not happy with the investment options in your current plan, an in-service rollover allows you to move your assets to a plan with better investment choices.

Ability to Consolidate Retirement Accounts

An in-service rollover allows you to consolidate multiple retirement accounts into one, making it easier to keep track of your investments and manage your overall portfolio.

Ability to Take Advantage of Lower Fees

You can sometimes reduce your investment expenses by doing an in-service rollover to a plan with lower fees.

The Drawbacks of an In-Service Rollover

There are also some drawbacks to consider, including:

Potential for Income Taxes and Early Withdrawal Penalties

If you do an indirect in-service rollover, the assets will be distributed to you and deposited into the new plan. This may trigger income taxes and, in some cases, early withdrawal penalties.

Possibility of Losing Employer Matching Contributions

If you leave your current employer, you may lose any employer-matching contributions that have not been vested.

The Bottom Line

An in-service rollover allows you to change your investment mix, consolidate retirement accounts, or both. However, there are also some potential drawbacks to consider before an in-service rollover.

It's important to talk to a financial advisor is important to see if an in-service rollover is right for you.

FAQs

1. What is an in-service rollover?

An in-service rollover transfers assets from one retirement plan to another. This rollover is typically done to change the investment mix or consolidate multiple retirement accounts.

2. What are the two types of in-service rollovers?

There are two types of in-service rollovers: direct and indirect. A direct in-service rollover is the simplest and most common type. While in an indirect in-service rollover, the assets are first distributed to the account holder and then deposited into the new plan within 60 days.

3. Who is eligible for an in-service rollover?

In-service rollovers are available to anyone still working and has assets in an eligible retirement plan. This includes employees of for-profit and non-profit organizations and government workers.

4. What are the benefits of an in-service rollover?

An in-service rollover's benefits include changing your investment mix, consolidating retirement accounts, or both.

5. What are the drawbacks of an in-service rollover?

An in-service rollover's potential drawbacks include income taxes, early withdrawal penalties, and the possibility of losing employer matching contributions.