What Is an IRA?

IRA stands for Individual Retirement Account. IRA accounts are tax-advantaged investment vehicles made available by the United States government so that people can save for their retirement.

IRAs come in a few different varieties, the most common of which are traditional IRAs and Roth IRAs. IRAs are provided by financial institutions such as banks, brokerage firms, and mutual fund companies.

If you work for a company with a 401(k) plan, an IRA is often the best account to use as a vehicle for your retirement savings because it will allow you to diversify your investments and potentially reduce your tax burden.

IRAs are also portable, meaning they can easily switch from one IRA provider to another.

How an IRA Works

An IRA comes with a variety of account features. IRA accounts typically earn dividends and interest just like a standard savings or checking account and offer the opportunity to buy and sell investments such as stocks and bonds.

The money placed into IRA accounts can be invested in almost any type of financial product, including real estate, collectibles, bars of gold, and mutual funds. IRA plans are more widespread than many other types of retirement plans because of their simplicity to use and alignment with the individual account holder's needs.

Types of IRA Account

You can choose from several types of IRA accounts.

Traditional IRAs

Most people are familiar with this IRA account. Contributions are tax-deductible, and distributions are taxed as ordinary income when taken out of the IRA by the IRA owner.

Roth IRAs

Roth IRA accounts come with limits on contributions and eligibility, but income limits do not apply. Contributions to Roth IRA accounts occur with after-tax dollars, and the earnings grow tax-free, making it a good choice for many savers and investors.

SEP IRAs

A Simplified Employee Pension IRA is a good choice for self-employed entrepreneurs or small business owners. This IRA operates in much the same way as a traditional IRA, but it allows you to shelter up to 20% of your income from taxes.

SIMPLE IRA Plans

The Savings Incentive Match Plan for Employees IRA plan makes it easy for small business employers to offer IRA accounts to their employees. This plan uses a SIMPLE IRA account, which is similar to the 401(k).

IRA Contribution Limits

For IRA accounts, there are limits on the amount of money that can be contributed each year. These contribution limits are known as IRA contribution limits.

Traditional IRA Contribution Limits

The IRA contribution limit for 2022 is $6,000 for those aged 50 and below. If you are 50 and older, a catch-up contribution of $1,000 brings the maximum contribution to $7,000.

In 2023, these limits are increased to $6,500 and $7,500, respectively.

Roth IRA Contribution Limits

Just like the traditional IRA, If you are 50 or below, the IRA contribution for 2022 is $6,000. For those individuals over 50, IRA contributions have a catch-up raise of $1,000, which brings IRA contributions up to $7,000.

In 2023, these limits have been increased to $6,500 and $7,500, respectively.

SEP IRA Contribution Limits

The maximum contribution you can allocate is $61,000 in 2022 and $66,000 in 2023.

SIMPLE IRA Contribution Limits

In 2022, a SIMPLE IRA has a lower contribution limit of $14,000, which increases to $17,000 for those over 50. For 2023, these limits have increased to $15,500 and $19,000, respectively.

Eligibility for an IRA

To contribute to an IRA, you must meet IRA eligibility requirements.

If you are under 18, you may not be able to open your own IRA account because of legal requirements regarding custodianship.

There are also income restrictions that apply to Roth IRA contributions. For 2022, you can contribute up to the Roth IRA limit if your Modified Adjusted Gross Income (MAGI) falls below $129,000.

If you have a 401(k) or IRA from a previous employer, this money will generally transfer to your new employer's IRA account.

There are no income restrictions on traditional IRA contributions.

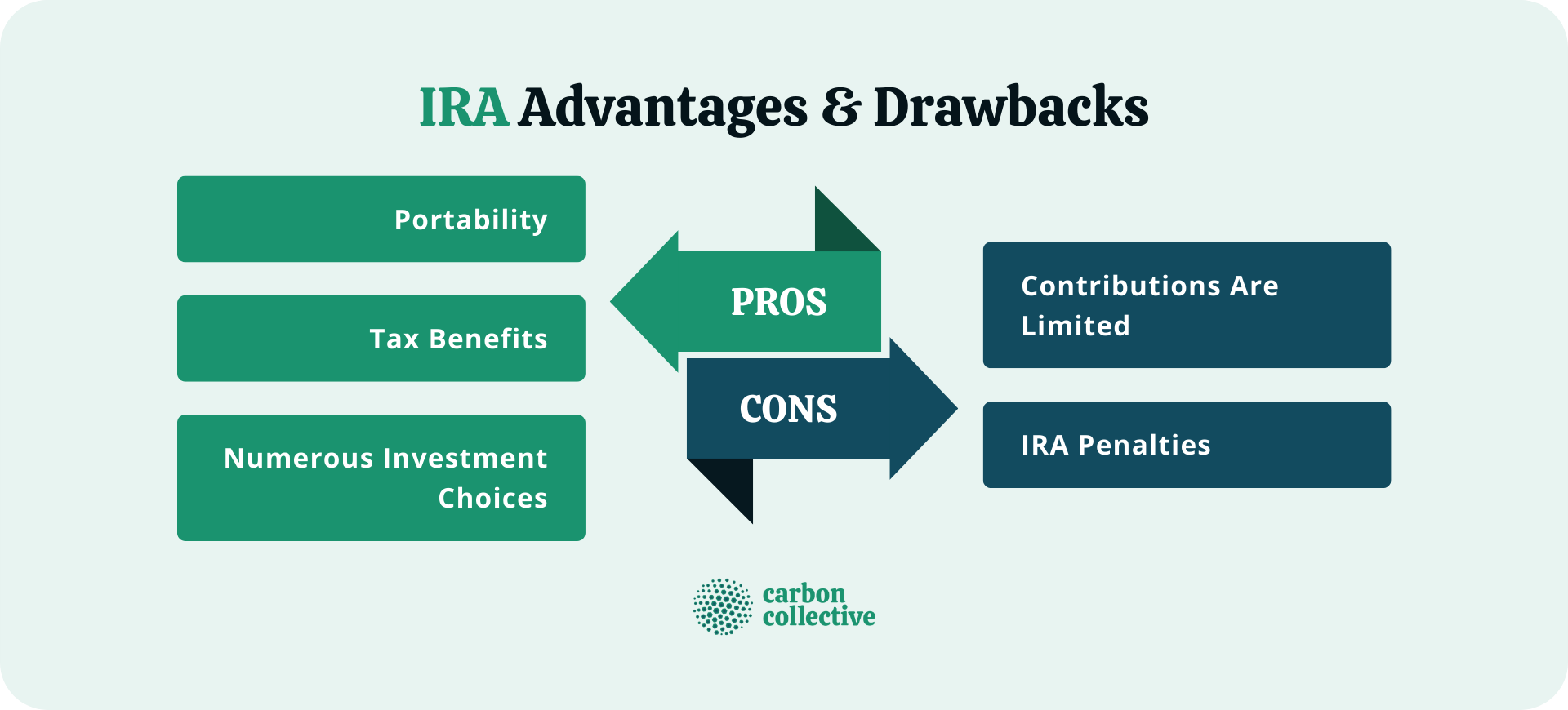

IRA Advantages

There are several benefits when you contribute to IRA plans.

Portability

IRA accounts are portable, meaning they can transfer to another IRA provider with ease.

Tax Benefits

IRA accounts offer tax benefits under certain circumstances. Traditional IRA account holders get a tax deduction when making IRA contributions, and their distributions in retirement are taxed at ordinary income rates.

Roth IRA account holders pay taxes on their contributions up front, but distributions in retirement are not taxed.

Numerous Investment Choices

IRA plans give you the freedom to invest in almost anything, including real estate, art, metals, mutual funds, and more. IRA plans also offer investors the option of using different IRA investment strategies.

IRA Drawbacks

Although there are many benefits associated with IRA accounts, there are also drawbacks.

Contributions Are Limited

Accounts have contribution limits, so IRA investment opportunities may not be enough for your retirement savings needs. IRA accounts can also limit where you invest your IRA money.

IRA Penalties

There are no IRA penalties when withdrawing from IRA plans before you retire. However, if you withdraw IRA contributions without being over 59 and a half, you will be subject to IRA early withdrawal penalties, which amount to 10% of the withdrawn IRA contribution.

Final Thoughts

IRA accounts have benefits and drawbacks, just like any other investment account. IRA investment accounts offer freedom with IRA investments, but IRA account holders must adhere to contribution limits.

IRA plans also have some drawbacks, such as contribution limits and early withdrawal penalties. IRA plans also have advantages, such as tax deductions and investment strategies.

It is crucial to consider contributions limits, investment choices, and withdrawals before opening an IRA account. If you carefully consider these factors, IRA accounts can boost your personal or business retirement savings.

FAQs

1. What is an IRA?

An IRA, or Individual Retirement Arrangement, is a type of account that allows you to save for retirement.

2. How does an IRA work?

IRA contributions are made with after-tax dollars, and your investments will grow over time without being taxed until withdrawal.

3. Who can contribute to an IRA?

You may be eligible to contribute to an IRA if you are at least 18 and meet income requirements.

4. Why should I invest in an IRA?

IRA accounts offer various benefits, including tax deductibility and flexible withdrawal options.

5. What is the difference between a Roth IRA and a traditional IRA?

Roth IRAs are not tax-deductible, but your investments will grow tax-free, and you can withdraw the funds completely tax-free after retirement. Traditional IRAs are tax-deductible, and your investments will grow without being taxed until withdrawal.