Don’t assume that in accounting, everything is straightforward, settled, and everyone uses the same systems. That is not the case. In fact, country to country we do not even spell words in the same way. For example, the word installment here is correctly spelled “instalment” in the UK, AUS, and elsewhere. Leaving that aside, however, there are, of course, some very accepted practices and a whole slew of customary and acceptable methods.

One of those well established and almost universally accepted practices is the installment method of accounting. This method captures the income from a sale that is paid in installments. The installment method is, in a nutshell, a way to account for a sale that is being paid for over a period of time

He Wrote the Book

Steven Bragg, CPA, is also the author of more than 160 business books and courses, including the best seller Cost Accounting Fundamentals. His thoughtful and comprehensive catalog of work has most definitely contributed to a better understanding of this highly complex field’s conventions.

He wrote that when a sale is being paid for overtime, “A prudent person would defer the (accounting) recognition of some portion of the sale – which is what the installment method does.”

Tracking and the Big Picture

Using the installment method prevents overstating the value of the sale, as gross profit is recorded in proportion to the actual, received payment levels. The reason for this is that there is always a risk that the seller will not receive all the money that is owed.

Generally speaking, installment sales can and should be accounted for separately from other sales. Obviously, it is very important that each time a payment is made, it is tracked to/correlated with the sale it is regarding. Using the installment method keeps the capital from an installment sale out of the “gross margin” until the installment payments have been received. Gross margin is the term for a company’s net sales minus their cost of goods sold.

Why Is It Needed?

This type of installment sale is usually done with very high-ticket items, such as real estate, automobiles, or machinery. But it is done, at least on occasion, in many fields. The installment method, as defined for tax purposes is the sale of property paid for by installment payments that will span more than a single tax year.

Usually, the installment method will involve a purchase for which payments are made monthly or quarterly. When the installment method is being used in accounting, the profit from the sale will increase each time a payment is made. But if instead, a business elects to use the accrual method of accounting, the gross profit is recorded immediately. This could make the company more likely to overestimate its actual collections and may artificially inflate projections.

It will be necessary over the life of the installment plan/s for there to be a more involved level of recordkeeping and attention to the transactions. Accountants will need to be tracking the deferred revenue for each installment plan, as well as the gross profit percentage on every installment account in each separate year.

Let’s Do the Math

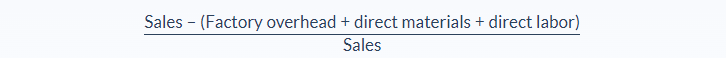

“Gross profit” or “gross margin” is the name for the actual cash that a business or individual has earned from the sale of goods or services which is expressed as a percentage. The percentage itself is closely observed over time to see if the company is being impacted due to any number of factors. According to Steven Bragg, CPA, the equation looks like this:

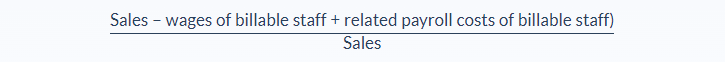

For a business that sells services, conversely, the calculations are as follows:

These gross profit/gross margin calculations are expressed over time and they are very useful barometers for how well the business is doing.

How Well Is It Doing?

If the percentage is dropping like a stone, it can indicate that the market is becoming more competitive and that the business in question will need to pull back on or slow down its expenses to stay profitable and in order to avoid losses. A decline can also indicate it should be considered whether any customer or group of customers is getting too much power, for example, and they are demanding inordinate price discounts. There are other reasons why gross profit may be dropping, so it is a useful metric to keep tracking.

Some companies choose to account for these installment transactions by using “accrual basis accounting,” which can be somewhat misleading. For example, using that system essentially means that a receivable/sale is recorded the minute a sale is made. That can easily give an overly rosy glow to a company’s balance sheets.

Obviously, it is not always possible for a business to accurately predict exactly how many debtors will not pay as agreed. This is another reason why the installment method of accounting is used as the numbers are consistently more accurate and dependable.

You Have Options

The “cost recovery method” is another more conservative approach to deal with payments over time. This method keeps its revenue recognition from happening longer than the installment method does. Cost recovery defers all gross profit until a business fully recovers the cost of the item sold. Some people would feel that’s the most accurate way to deal with this.

Another option is the “completed contract method,” which would mean that the company simply shows all the benefits of the installment sale but not until after the installments are completely charged off.

When the fiscal year is over, the installment sale revenue and the cost of sales from that year will be transferred to a separate account for deferred gross profits. Using the installment method of accounting is a good approach for businesses that want to keep an extremely accurate and conservative estimation of their fiscal health.

The Installment Method described here is one of the Generally Accepted Accounting Principles (GAAP or U.S. GAAP) which is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). It’s going to be a bedrock principle in most accounting situations.

FAQs

1. What is the installment method?

The installment method of accounting is a way to account for sales in which the customer pays over time. The sale is not recognized as income all at once, but rather as the payments are made.

2. Why is the installment method used?

The installment method is generally used in situations where a customer has permission to pay over time. In these situations, it is often difficult to determine exactly when the sale was made and when the money should be recognized as income. The installment method provides a more accurate way of accounting for these sales.

3. What is the journal entry for installment payment?

The journal entry for an installment payment is a debit to Accounts Receivable and a credit to Sales Revenue. This records the fact that the customer has paid part of the sale price and that the money will be recognized as income over time.

4. What is an example of an installment account?

An example of an installment account would be a mortgage. The mortgage is paid off in monthly installments, and the total sale price is not recognized as income all at once. Rather, the income is spread out over the life of the mortgage.

5. What is the difference between installment and revolving accounts?

The main difference between installment and revolving accounts is that installment accounts have a fixed payment schedule while revolving accounts do not. With revolving accounts, the customer can choose to pay more or less each month, depending on their needs.