The interest expense to debt ratio (IE/D) determines the rate of interest paid by a business on its total debt. It’s a solvency ratio that reveals whether the company is experiencing financial difficulties or credit challenges. If a firm has been through fiscal trouble, it will have a higher interest expense to debt ratio.

Lending institutions charge interest rates according to the assessed risk of granting the loan. The more debt a company has, the less likely it will be to repay all of its liabilities on time. This means any additional loan will have to come with greater interest.

The most crucial value involved in calculating this is the company’s interest expense figure. You can find this on their income statement. This value should include the interest cost on the business's short-term and long-term debt, including any borrowings and capital leases they’re paying interest on.

Interest Expense to Debt Ratio Formula

Calculating this ratio is a pretty basic process. And you can pull the amount of their total debt right off the balance sheet under the liabilities category.

The interest cost is the total interest accumulated by a borrower who is paying a debt throughout the life of the loan. In consumer mortgage loans, this amount must cover all points paid to bring down the interest rate. Points are technically considered pre-paid interest.

Additionally, the total debt covers long-term liabilities like mortgages and other loans. These will not mature until after many years, along with short-term obligations like credit card and accounts payable balances.

Interest Expense to Debt Ratio Example

The ceramics manufacturing industry suffered immensely due to an economic recession, causing D&D Ceramics’ sales to spiral downward. The CEO is worried about the business's financial health and would like to look specifically into the firm’s cost to borrow. He asks his team to supply the company’s numbers over the last three years.

He found that its total interest expense was as follows:

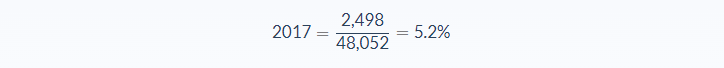

- $2,498 for 2017

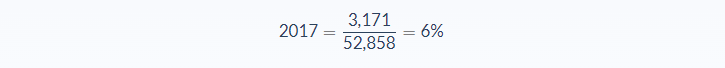

- $3,171 for 2018

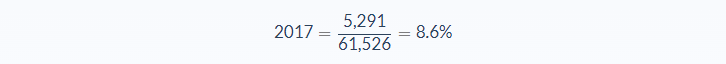

- $5,291 for 2019

The CEO also learns that the company’s total debt was:

- $48,052 for 2017

- $52,858 for 2018

- $61,526 for 2019

(numbers in thousands)

Let’s calculate the interest expense to debt ratio for each year:

With these results, the CEO concluded that D&D Ceramics is likely going through financial trouble and credit problems, considering that the cost of borrowing has increased steadily over three years.

This ratio can be used to compare against other companies in the same industry to see what the expected lending costs are for the competition. If these numbers were considerably higher than the industry standard, the CEO and team would need to investigate the numbers further.

It’s also worth noting that the increase in interest expense to debt could be explained by the company taking on further debt at a different interest rate, or if they recently completed an M&A project, taking on debt from the acquired company.

Interest Expense to Debt Ratio Analysis

While examining this ratio, the competitors’ or peers’ lending costs should be considered as well. If a company’s interest expense to debt ratio is considerably larger than that of the others, it is important to investigate to find out the reasons. Perhaps it’s because of an acquisition undertaken by the company or a big recent loan with a high-interest rate.

The issues behind a company’s high or low ratio must be carefully analyzed so that management can have an accurate and solid basis for making financial decisions going forward.

A lower interest expense to debt ratio is often a positive sign that shows the business's capacity to earn an income at lower interest costs. But it should be remembered that rising debt generally costs slightly lower than that equity (debt enjoys the extra cushion of a tax shield).

It could be that the firm is not maximizing its use of leverage benefits, or the company may have obtained funding at low-interest rates with restrictive conditions. In such a case, a lower ratio can be considered a sign of good financial standing.

Conversely, a substantial rise in this ratio happening in any quarter or year should be a cause for concern. However, you should investigate whether the reason is financial trouble or any one-time event. An acquisition is one scenario that can increase a company’s interest expense to debt ratio without being a signal of things going south.

As with other financial ratios, it’s important to understand any factors involved in the interest expense to debt ratio. Why is it questionably high or low in comparison to its competitors? This can help you make sound decisions involving a company’s financial standing, especially in terms of taking on new debt.

Interest Expense to Debt Ratio Conclusion

- The interest expense to debt ratio is the rate of interest a business pays on its total debt.

- This formula requires two variables: Total Interest Expense and Total Debt.

- The interest expense to debt ratio is expressed as a percentage.

- The interest expense to debt ratio is a solvency ratio that can help determine if a company firm is going through financial issues or credit difficulties.

- The higher a company’s interest expense to debt ratio, the more financial problems it is usually experiencing.

- When analyzing the interest expense to debt ratio, a company should consider the numbers of its peer or competitor companies so it will have a solid basis for assessing its financial position and making crucial decisions.

Interest Expense to Debt Ratio Calculator

You can use the interest expense to debt ratio calculator below to quickly calculate the rate of interest a business is paying on its total debt, by entering the required numbers.

FAQs

1. What is the interest expense to debt ratio?

The interest expense to debt ratio is the rate of interest a business pays on its total debt. It is a solvency ratio that can help determine if a company is going through financial issues or credit difficulties.

2. Why is the interest expense to debt ratio important?

The interest expense to debt ratio is important because it shows how much it costs the company to borrow money. It can also help you understand if the company is using too much debt or if it is having financial difficulties.

In addition, the interest expense to debt ratio can be compared to the interest expense to debt ratios of other companies to get a better understanding of how well the company is doing financially.

3. How do you calculate the interest expense to debt ratio?

To calculate the interest expense to debt ratio, divide the company's total interest expense by its total debt. This will give you a percentage.

The formula requires two variables: Total Interest Expense and Total Debt.

4. What is a good interest expense to debt ratio?

Generally, a good interest expense to debt ratio is anything below 1.0. However, this varies from company to company depending on their industry and financial position.

5. What is an example of an interest expense to debt ratio?

An example of the interest expense to debt ratio is if a company has $1,000 in total interest expense and $10,000 in total debt, the interest expense to debt ratio would be 10%.

Another example would be if a company has $1,000 in total interest expense and $100,000 in total debt, the interest expense to debt ratio would be 1%.