Your age may define the type of retirement account you can hold, as well as how much money you can contribute annually.

Age limits for IRA contributions are vital to know. This is because they determine whether or not you can continue making contributions to your retirement accounts.

The IRS sets the age limits for IRA contributions. Therefore, the laws are constantly changing. IRA owners need to keep their finger on the pulse of changing laws, so they may continue to make the maximum contributions to their accounts each year.

IRAs Contribution Limits 2023

Traditional IRAs and Roth IRAs

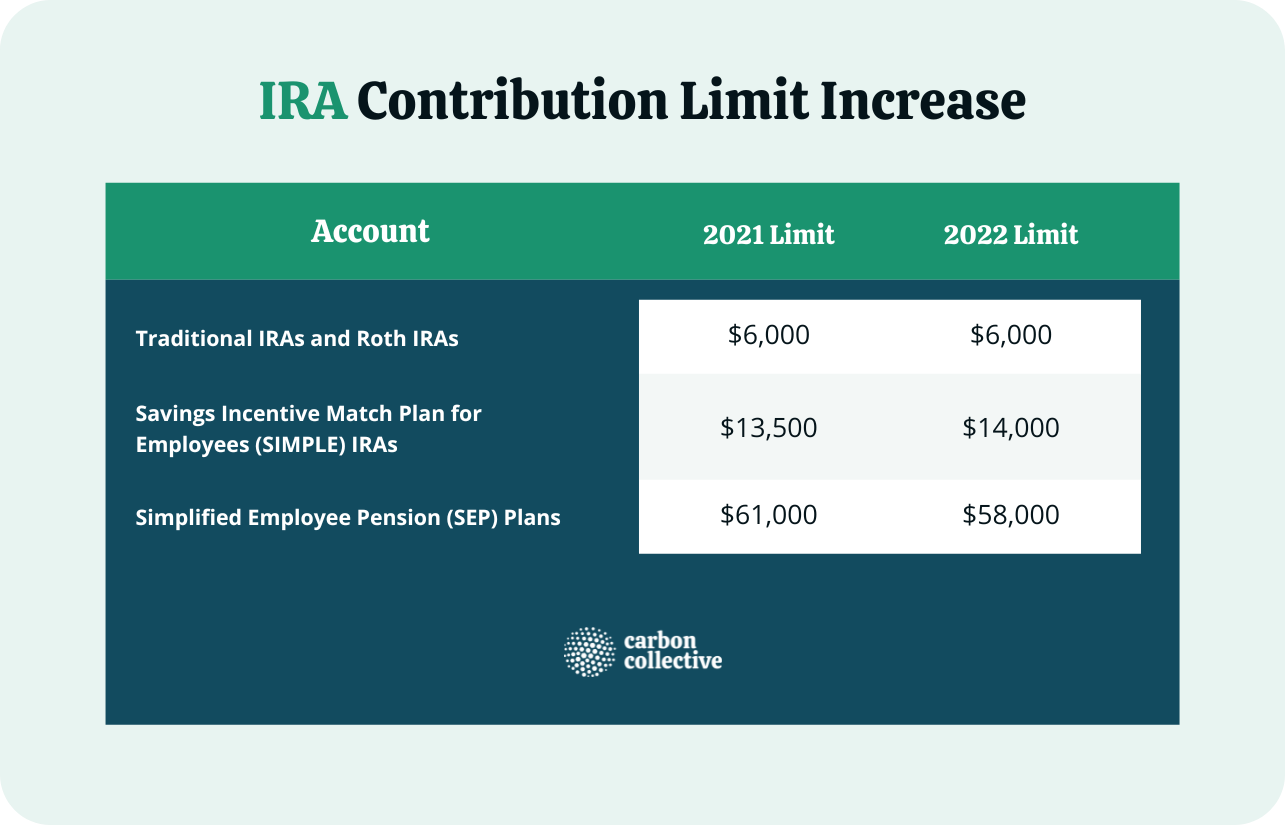

Contribution limit: For 2023, the IRA contribution limit – for traditional IRAs and Roth IRAs – for people aged 50 and younger is $6,500. The catch-up contribution for those older than 50 is $1,000.

The maximum amount you can contribute to a Roth IRA is income-dependent. For you to qualify to contribute the maximum amount in 2023, your Modified Adjusted Gross Income (MAGI) must be lower than $138,000 if you are single or $218,000 if married or filing jointly.

Age limit: There is no maximum age limit at which you can contribute to a traditional IRA.

This means that you can make a contribution if the Required Minimum Distribution (RMD) rules still remain in force at 73, depending on when you were born, and have sufficient taxable compensation to support the contribution amount.

The same applies to a Roth IRA. However, there are no RMDs with Roth accounts. To avoid penalties, beneficiaries of a Roth IRA may need to take RMDs.

Savings Incentive Match Plan for Employees (SIMPLE) IRAs

Contribution limit: The 2023 annual contribution limit for SIMPLE IRAS is $15,500. In 2022, the limit was $14,000. Individuals aged 50 or older can make an additional $3,500 in catch-up contributions, for a total of $19,000.

Employer contributions are compulsory and can be made using one of two methods:

- Match an employee’s contributions on a dollar-for-dollar basis up to 3% of their salary.

- Contribute 2% of each employee's salary, regardless of whether the employee makes contributions or not.

Age limit: You can open a SIMPLE IRA at any age. Your employer must continue to make matching or non-elective contributions regardless of your age. However, you must still take RMDs at age 73.

Simplified Employee Pension (SEP) Plans

Contribution limit: In 2023, the maximum limit that a self-employed business owner can contribute is $66,000. This figure is up from $61,000 in 2022. Employer contributions cannot exceed 25% of an employee's compensation.

SEP IRA plans can be availed by a variety of small-business types. These include partnerships, limited liability companies, sole proprietorships, S corporations, and C corporations.

Withdrawals made from SEP IRAs in retirement are taxed as ordinary income, like a traditional IRA.

Age limit: There is no age limit for enrolling in a SEP plan. Employers can contribute to your account regardless of your age. However, you need to begin taking RMDs at age 73.

Importance of Knowing IRA Contribution Age Limits

You can set up an IRA for your golden years. While it’s easy to set up the account, you should know some facts before proceeding.

You must be aware of the contribution limits and tax laws that apply to the different accounts under the umbrella of IRAs.

Knowing the age limits for IRA contributions is also essential to avoid penalties. For example, you will be hit with taxes and penalties if you try to make a contribution past the age limit without withdrawing from any other accounts.

Furthermore, if you are under 59.5, your distributions may be subject to income tax and an additional 10% tax.

Other Age-Related IRA Rules

There are two additional age-related IRA rules that all holders of IRA accounts should take note of.

Age 59.5

At age 59.5, it is possible to access your IRA funds and withdraw from your IRA without facing any early-withdrawal tax penalties. However, ordinary income taxes will still apply for the withdrawal.

This rule applies to traditional IRAs, but it works differently for Roth IRAs.

You can withdraw your contributions any time regardless of your age with a Roth IRA. However, age limits or time limits are applied to decide what portion is taxed for investment gains or when converted amounts are withdrawn.

Age 73

You must start your required minimum distributions from traditional IRAs, as well as most qualified retirement plans, at this age, such as your 401(k)s, 403(b)s, and SEPs.

RMD rules do not apply to Roth IRAs while you are living. However, designated Roth accounts offered in a 401k plan and inherited Roth IRA accounts will apply to RMD rules.

The Bottom Line

It is important to capitalize on the benefits of IRA accounts. However, before opening an account, you must ensure you are aware of all the rules and regulations that apply to IRAs.

Knowing about these rules ensures that you can have a sound financial future for your retirement years.

A financial advisor can help you establish an IRA account that will help you maximize your returns. They can also help you build a sound financial portfolio that will keep your retirement years financially solvent.

FAQs

1. Can you contribute to a traditional or Roth IRA if a retirement plan at work covers you?

Yes, the IRA contribution limits apply to all individuals, whether married or single. As long as you meet the income requirements, you can contribute the maximum amount allowed by law to an IRA.

2. How much is the maximum contribution to an IRA account?

For the tax year 2023, the maximum amount you can contribute to a traditional IRA is $6,500. The catch-up contribution for workers over 50 years old is $1,000.

3. At what age can you no longer contribute to a Roth IRA?

You can have the maximum Roth IRA contribution after you reach age 73. You can leave amounts in this account as long as you live.

4. Can you contribute to your IRA if you are on Social Security?

Yes, you can contribute to a Roth IRA if you are on Social Security.

5. Can you open more than one IRA account?

Yes, you can set up multiple IRA accounts with different providers to diversify your investments or retirement planning strategy.