The repairs and maintenance expenses to fixed assets ratio is a measurement that evaluates and compares the total amount spent for repairs and maintenance against the total value of the assets being repaired and maintained.

The term fixed assets refers to possessions that a company owns long-term and uses to bring in revenue. These assets are referred to as fixed because they cannot be easily liquidated and are expected to bring in cash for a long while before running out. Fixed assets could be things like trucks, machines or buildings that will be used for more than a year.

Repairs and maintenance expense is the total cost used to repair or revert company assets to their former states. It can also be used to prolong its life in its present condition instead of just replacing the asset. It could also refer to money being used to renovate a building or an office.

In addition, repairs and maintenance expense to fixed assets ratio not only compares the asset value to the repair cost, but it also enables business analysts to determine how old the assets are and the condition they are currently in. When the results of this ratio starts rising, this is a signal that your assets are getting a little too old and may need replacing instead of repairs.

By comparing the value of assets to repairs and maintenance costs, companies can find out if the money used to repair an asset is more than it’s worth, or how much it’s bringing in. This helps determine if some assets have outlived their usefulness or just need replacing.

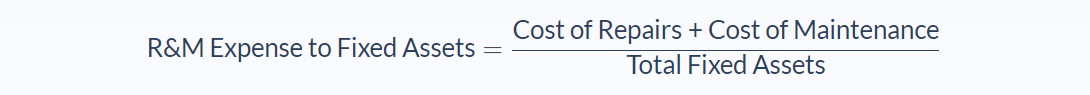

Formula

This formula, like the name, is quite straightforward. It simply adds the total cost of repairs and maintenance and divides it by the total value of the fixed assets that are being maintained and repaired.

This formula, like the name, is quite straightforward. It simply adds the total cost of repairs and maintenance and divides it by the total value of the fixed assets that are being maintained and repaired.

While having a high repairs and maintenance expense to fixed assets ratio is frowned upon, having a low repairs and maintenance expense to fixed assets ratio does not necessarily mean everything is in the clear as one has to be careful when calculating the repairs and maintenance expense to fixed assets ratio. A very low repairs and maintenance expense to fixed assets ratio could mean that assets are not being maintained and are in poor shape, or soon will be.

When the repairs and maintenance expense to fixed assets ratio is high, it stands to reason that management may want to simply replace the assets instead of spending ridiculous amounts in repairs. Before this is done, managers have to take note of the wear and tear involved with equipment in that particular industry so they don’t replace assets too early.

While a repairs and maintenance expense to fixed assets ratio of 10% is considered a reasonable expense, it is also very important to study the repairs and maintenance expense to fixed assets ratio over a lengthy period like months to get a better sense of how well the assets are.

Example

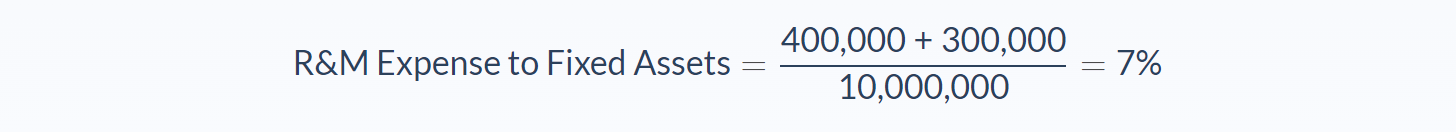

Jenny works for a company that makes designer shoes and handbags. It has $10 million worth of fixed assets before depreciation. The company spent $400,000 on repairs and $300,000 for maintenance in the last twelve months.

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Cost of maintenance = 300,000

- Cost of repairs = 400,000

- Total value of fixed assets = 10,000,000

Now let’s use our formula:

Having a repairs and maintenance expense to fixed assets ratio of 7% means that for each dollar that the company brings in via its fixed assets, $0.07 is spent on maintenance and repairs.

With this, one can assume that the company assets are still in their prime and doing very well with little issues.

Analysis

In a situation where the repairs and maintenance expense to fixed assets ratio has a high percentage, this insinuates that the money spent on repairing and maintaining assets is getting more than their worth. And it is time for replacing or upgrading the assets in question. But this also applies differently to industries whose operations involve wear and tear like mining or manufacturing. They tend to wear down equipment faster than other industries and so a high repairs and maintenance expense to fixed assets ratio is expected.

However, there are times when a high repairs and maintenance expense to fixed assets ratio means that the company has poor management issues, or is having a financial problem that is not allowing them to carry out the maintenance that would help prevent later repairs.

Most equipment functions better when they are constantly serviced, and a lack of doing so may later lead to breakdowns that cost more to repair. It is also considered a bad investment to invest in a company with high repairs and maintenance expense to fixed assets ratio as their assets could go off at any time.

When you study repairs and maintenance expenses to fixed assets ratio over time and notice a sharp rise in the ratio, this could mean that poor handling of equipment or change of weather and environment is affecting it.

Keeping assets that flourish in the cold in a very hot environment may cause fast deterioration hence increasing the frequency of repairs. This will mean that the solution is not to change the equipment but change their environments or operations.

Conclusion

- The repairs and maintenance expense to fixed assets ratio compares the total amount spent for repairs and maintenance against the total value of your assets being repaired and maintained.

- This formula requires three variables: total cost of repairs, the total cost of maintenance and the value of fixed assets.

- Repairs and maintenance expense to fixed assets ratio does not only compare the value of the fixed assets versus the amount of money that is used to repair them, but it also helps determine how old assets are and the condition they are currently in.

- When repairs and maintenance expense to fixed assets ratio starts rising, it is a signal that your assets are getting a little too old and may need replacing instead of repairs.

- Having a repairs and maintenance expense to fixed assets ratio that is more than 10% is considered high in most industries.

- A low ratio can sometimes mean that management is postponing repairs and risking the health of the assets.

Calculator

You can use the repairs and maintenance expense to fixed assets ratio calculator below to quickly get the repairs and maintenance expense to fixed assets ratio by entering the required numbers.

FAQs

1. What is a Repairs and Maintenance Expense to Fixed Assets Ratio?

The repairs and maintenance expense to fixed assets ratio is an important measure in business that helps you determine the age of your equipment or assets. The ratio compares the total value of your assets to the total amount you spend to keep them in working order.

2. What is the Repairs and Maintenance Expense to Fixed Assets Ratio formula?

The formula to calculate the maintenance expense to fixed assets ratio of a company is:

Repairs and Maintenance Expense to Fixed-Assets = (Repairs + Maintenance) / Total Fixed Assets

3. What does a high Repairs and Maintenance Expense to Fixed Assets Ratio mean?

A high ratio of repairs and maintenance to fixed assets may indicate that a company is committed to providing quality assets or is effectively maintaining them. It may also show that the rapid deterioration of assets is due to difficult operating conditions.

4. What does a low Repairs and Maintenance Expense to Fixed Assets Ratio mean?

Low ratios may indicate that the management is postponing needed repairs and risking the long-term operability of the assets.

5. What is considered a high Repairs and Maintenance Expense to Fixed Assets Ratio?

A ratio of repairs and maintenance expenses to fixed assets that is more than 10% is considered high in most industries.