The term “margin of safety” is used in multiple contexts. In accounting, the margin of safety is the gap between present or estimated future sales and the break-even point. This is the minimum sales level needed to prevent loss from selling the product. By calculating the margin of safety, companies can decide to make adjustments or not based on the information.

For investing, the margin of safety can also mean the difference between the market price of a security and its intrinsic value. The market price is its true value. The intrinsic value is the value assessment of an asset, including security. Intrinsic value by no means is calculated arbitrarily or subjectively. Instead, it needs to be measured properly using methodological approaches like fundamental and technical analysis or complex financial models. By comparing market price and intrinsic value of different securities, you can decide which security would suit your risk preferences.

Investors prefer the security that has lower market value than the intrinsic one, i.e. they want to purchase the security at a ‘discount’ price. The bigger the margin of safety, the less money will be lost if the security value is going downhill. A high margin of safety ratio minimizes the risks of investing.

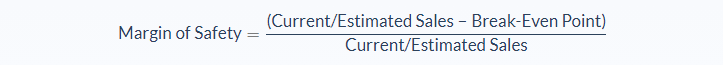

Margin of Safety Formula

We need the figure for sales to calculate the margin of safety in accounting. As we can see, Both current or estimated sales can be used to evaluate the ratio. For instance, a company’s manager may see that their sales figure are going down in the current period. It might be threatening to touch the break-even point. To counter this, they can opt to make adjustments midway by cutting production expenses. This will widen the gap and increase the margin of safety.

We need the figure for sales to calculate the margin of safety in accounting. As we can see, Both current or estimated sales can be used to evaluate the ratio. For instance, a company’s manager may see that their sales figure are going down in the current period. It might be threatening to touch the break-even point. To counter this, they can opt to make adjustments midway by cutting production expenses. This will widen the gap and increase the margin of safety.

Estimated sales can also be adopted by looking at the condition of the market. If a company forecasts that the figure of sales is satisfactory and the margin of safety is acceptable, they can go ahead and proceed with the current plan. Otherwise, some modifications can further be implemented just like before.

The second variable we need is the break-even point. The break-even point is the point where the associated cost to produce a product equals the revenue collected from selling it. Basically, the number of a product’s sales and production costs are ‘even.’

The company gets neither profit nor loss from the business. It goes without saying that companies don’t want this to happen. They want the margin of safety ratio to be as high as possible.

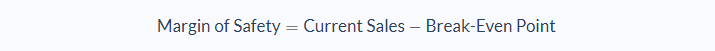

To work out the actual dollar value margin of safety, you would deduct the break-even point amount from the actual sales:

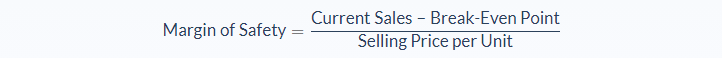

A managerial accountant might also want to calculate the margin of safety in units. To do this, subtract the break-even point from current sales and divide the result by the selling price of each unit:

A managerial accountant might also want to calculate the margin of safety in units. To do this, subtract the break-even point from current sales and divide the result by the selling price of each unit:

As mentioned before, we can also look at “margin of safety” as an investing term. You use it similarly to how investors compare the real or market value of a security and its intrinsic value. Naturally, they don’t want to buy a security that has a higher market value than its intrinsic value. This is the security ‘true’ value based on careful calculations from various factors.

As mentioned before, we can also look at “margin of safety” as an investing term. You use it similarly to how investors compare the real or market value of a security and its intrinsic value. Naturally, they don’t want to buy a security that has a higher market value than its intrinsic value. This is the security ‘true’ value based on careful calculations from various factors.

Whether in investing or accounting, the terms involving margin of safety are, in essence, almost the same. To put it simply, it’s the difference between the real-world value of a variable asset—whether product sales or market value of the security—and the point in which those values are considered safe. This would either be the break-even point or intrinsic value. There’s no perfect figure for the margin of safety ratio. Different type of companies and investors have their own standards.

Margin of Safety Example

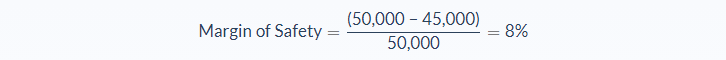

A net café decides to calculate their margin of safety to determine if they can afford to invest in new equipment. To do this, they use the figure of current sales to calculate the ratio. From the financial statements, they can see that the sales revenue is $50,000. Meanwhile, the break-even point is summed up to be $40,000, obtained from a total of fixed costs and variable expenses. What is the margin of safety ratio of the net café?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Current Sales: $50,000

- Break-even Point: $46,000

In this case, the margin of safety would be 0.08 or 8%.

In this case, the margin of safety would be 0.08 or 8%.

From this result, we can see that the net café still manages to at least gain profit from the business. However, to determine if they can invest in more equipment, they need to align the result with the margin of safety they comfortable with.

For instance, if the desired margin of safety is 10% or more, they may need to lower expenses instead. On the other hand, it’s fine to continue with the plan if the margin of safety is acceptable and the current market outlook is looking good.

Margin of Safety Analysis

Margin of safety can be an important tool to decide which direction a company should take. By looking at the margin of safety, they can choose to either expand the operation or to cut expenses to prevent losses. With that said, margin of safety is not an all-powerful instrument and business should consider other factors as well, such as the condition or trend of the market.

In the context of investing, investors can use the ratio to decide if or when to invest in a security. They can set the target for margin of safety and only purchase the security if the desired price is met. This way, they can minimize the downside risk—the potential of a security to suffer a decrease in value depending on the market.

For example, an investor may follow his established principle of only buying a security if the margin of safety is 30% or more. This means that if one particular security has an intrinsic value of $100, he will only buy the security if the security’s market value reaches $70.

The security may never touch this value in the future and he won’t even buy the security at all, assuming the intrinsic value stays the same. If it does reach, however, then he will purchase it. Note that this method doesn’t guarantee profits but at least it would reduce the risk of substantial losses.

Margin of Safety Conclusion

- The margin of safety is a ratio measuring the gap between sales and break-even point or the difference between market value and intrinsic value.

- The formula for margin of safety requires two variables: current/estimated sales and break-even point.

- The term margin of safety is used in different contexts but most of them have a similar meaning in finance.

- Margin of safety can decide which direction an entity needs to take with its project. Companies can use it to determine what step to take and investors can determine whether to buy a particular security or not with the ratio.

Margin of Safety Calculator

You can use the margin of safety calculator below to quickly calculate the gap between sales and break-even point or the difference between market value and intrinsic value by entering the required numbers.

FAQs

1. What is a margin of safety?

The margin of safety is a ratio that measures the difference between sales and break-even point or the gap between market value and intrinsic value.

2. What is the margin of safety formula?

The margin of safety formula is:

Margin of Safety = (Current/Estimated Sales − Break-Even Point) / Current/Estimated Sales

3. What is a good margin of safety?

A higher ratio is considered a good ratio because it means that there is more room to produce or buy something.

For example, if you are trying to buy something but the price is $100, you may only be willing to pay up to $80 because that would mean you have enough room to cover any additional costs.

4. How is the margin of safety used in investing?

The margin of safety is used by investors to determine whether or not to invest in a particular security. The ratio will decide if they want to buy the security and it can also be used as a guide for when they should sell the security.

5. How important is the margin of safety?

The margin of safety can be an important tool in investing by helping investors avoid losses. The ratio is not the only factor to consider when making a decision but it does help investors make better decisions overall.

For example, an investor may follow his own principle of only investing in a security if the margin of safety is 30% or more. This means that he will only invest in a security if its market value reaches $30 out of every $100.

This way, he can minimize his downside risk—the potential of investment to suffer a decrease in value due to the market.