Marital Trust Definition

A Marital Trust is a legal arrangement between a trustor and trustee for the benefit of the surviving spouse and the heirs of the married couple. It is an irrevocable trust, often known as an "A" trust, that takes effect after the first spouse dies.

Upon death, assets are transferred into the trust, and the income generated by these assets is distributed to the surviving spouse—in some cases, the surviving spouse may also receive principal payments. When the other spouse dies, the trust is transferred to the trust's chosen heirs.

Marital Trusts are commonly used to provide financial security for a surviving spouse. They can also be used to minimize estate taxes.

How Marital Trust Works

A marital trust helps the couple's heirs to avoid probate and pay less in estate taxes by fully utilizing the unlimited marital deduction.

The trust can be established with the assistance of an estate planning attorney. All assets and property held in the trust must be specified. This may encompass almost everything valuable. This covers equities, bonds, mutual funds, cash, and real estate.

Trust assets flow tax-free to the surviving spouse upon the trust grantor's death. This implies that the IRS will not impose federal estate taxes on those assets.

As a result, neither spouse must pay taxes on the transfer. This is made possible by Internal Revenue Code (IRC) Section 2056 or the marital deduction rule.

If a unique need occurs, the trustee may transfer any of the trust's principal or original investment to the surviving spouse.

The surviving spouse can also be granted "general power of appointment" by the trust founder, which empowers the surviving spouse to direct the trustee to transfer trust assets. The grantor may, however, limit the withdrawal to a specific sum.

When the surviving spouse dies, the trust assets usually transfer to the couple's children or other family members.

Advantages and Drawbacks of Marital Trust

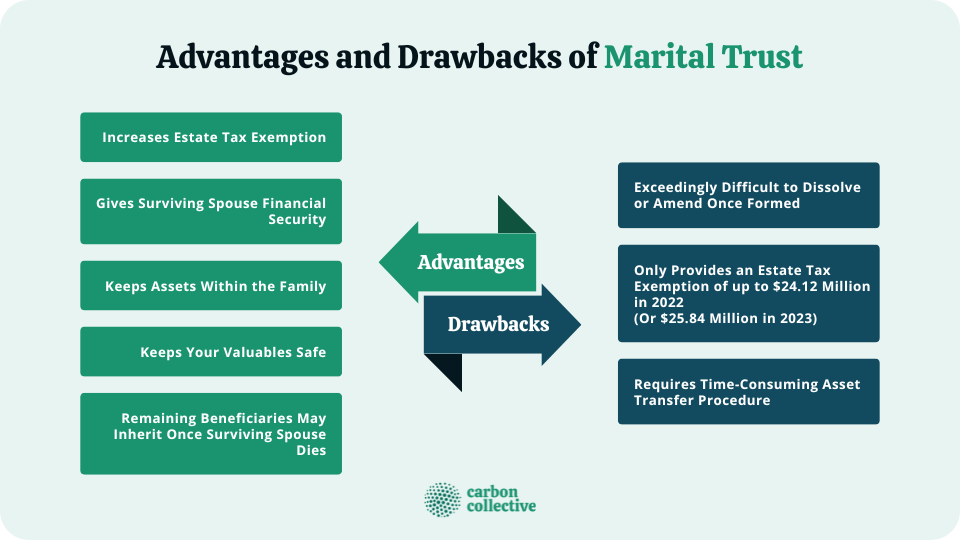

There are several advantages to using a marital trust, including the following:

-

Increases your estate tax exemption

-

Gives the surviving spouse income and financial security

-

Keeps assets within the family

-

Keeps your valuables safe from creditors and prospective new spouses

-

When the surviving spouse dies, the remaining beneficiaries may benefit financially

However, like with any financial strategy, there are drawbacks to using a marriage trust. Among the disadvantages are the following:

-

As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend

-

Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023)

-

Requires the transfer of assets into the trust, which can be a time-consuming procedure

Marital Trusts vs. Family Trusts

There are some key distinctions between marital trusts and family trusts.

-

A marital trust is created to take effect only after the first spouse dies, whereas a family trust may be created during the lifetime of both spouses.

-

A Marital Trust is an irrevocable trust that allows for estate tax deferral and possibly elimination. On the other hand, a family trust is generally revocable and will not achieve the same estate tax benefits.

Other Types of Spousal Trusts

In addition to Marital Trusts, several other types of trusts can be used for estate planning purposes. These include:

B Trust (Bypass Trust)

A bypass trust (also known as an AB or a credit shelter trust) is a technique that wealthy married couples use to maximize their estate tax exemptions lawfully.

After one spouse dies, the strategy entails establishing two separate trusts. The dead spouse's share of the couple's property is typically placed in the B trust up to the appropriate exclusion limit ($12.06 million in 2022 or $12.92 million in 2023).

This trust is irrevocable, and all beneficiaries other than the surviving spouse will benefit from it (usually their children).

The surviving spouse must follow the trust's plan without undue benefit, yet the trust frequently provides money to the surviving spouse to live on for the remainder of their life.

The surviving spouse's share of the property and any remaining assets of the dead spouse beyond the exclusion amount will be placed in trust A.

This trust is in the jurisdiction of the surviving spouse, who may utilize it as they see fit. Both trusts transfer to their appointed beneficiaries when the surviving spouse dies.

Qualified Terminable Interest Property (QTIP) Trust

Qualified Terminable Interest Property (QTIP) trusts are frequently utilized when a grantor has offspring from many marriages.

The surviving spouse is still the primary beneficiary. However, the grantor might name specific beneficiaries when the trust is established. This includes offspring from previous marriages, grandkids, and anybody else.

However, during the surviving spouse's lifetime, these beneficiaries must receive the QTIP's income at least yearly.

As you can see, one of the key advantages of the QTIP is that the trust creator, rather than the surviving spouse, can name additional beneficiaries.

Spousal Lifetime Access Trust (SLAT)

It is a trust established by the grantor for the benefit of the spouse and descendants. You would make a gift to the SLAT, shielding it from gift tax by utilizing a portion of your federal lifetime gift exemption ($12.06 million in 2022 or $12.92 million in 2023).

While you relinquish all rights and control over the donated assets, your spouse will have access to them as the SLAT's beneficiary.

Final Thoughts

Estate planning can be complex, and there are many ways to protect your assets and minimize taxes. Marital trusts are just one tool that may be used in this process. This trust is irrevocable, meaning it cannot be changed once established.

Marital trusts can provide many benefits like asset protection and estate tax deferral or elimination. However, there are also some drawbacks, such as the cost of setting up the trust and the hassle of transferring assets into it.

When deciding whether or not to establish a marital trust, you should consult a financial advisor or estate planning attorney to explore all your options and determine what's best for your unique situation.

FAQs

1) What is Marital Trust?

A Marital Trust is an irrevocable trust that allows for estate tax deferral and possibly elimination.

2) How does a Marital Trust work?

A marital trust can be created with the help of an estate planning attorney. The trust must specify all assets and property held by the owner. This might include nearly everything worthwhile, like equities, bonds, mutual funds, cash, and real estate.

3) What are the advantages of Marital Trust?

The Marital Trust offers many advantages, including asset protection and estate tax deferral or elimination.

4) What are the disadvantages of a Marital Trust?

There are some drawbacks to consider when setting up a Marital Trust, such as the cost of setting up the trust and the hassle of transferring assets into it.

5) What is the difference between a Marital Trust and a Family Trust?

A Marital Trust is created for the benefit of a spouse. At the same time, a Family Trust can be made for the benefit of any family member. Most marital trusts are irrevocable, whereas family trusts are usually revocable.