Other comprehensive income (OCI) includes all those revenues, expenses, gains and losses that affect a company’s equity side of the balance sheet and have not yet been realized. As per the GAAP and IFRS standards, these items are not included in the income statement and must be shown separately on the equity side of the balance sheet. This will help reduce the volatility of the net income since the value of unrealized gains and losses can significantly move up and down each period.

The gain or loss is realized and reported on the income statement only when it is sold. For instance, Company A has many treasury bills and the yields for those have decreased during the period. As long as the company still holds these treasury bills, any unrealized gain (due to a reduction in yields) will be recorded in the other comprehensive income statement. If the company decides to sell these securities and realize the gain, the unrealized amount on the OCI would be removed and transferred as a realized gain on the sale of T-bills on the income statement.

Other Comprehensive Income Statement Template

Throughout this series of financial statements, you can download the Excel template below for free to see how Bob’s Donut Shoppe uses financial statements to evaluate the performance of his business.

Components of Other Comprehensive Income

Other comprehensive income is shown as a line item on the balance sheet. Some common examples of the items included in the OCI account are:

- Gains or losses on investments categorized as ‘available for sale’.

- Gain or losses on a derivative contract held as hedging instruments.

- Gain or losses on foreign currency exchange.

- Pension plan gains and losses.

Investment Gains and Losses

Small larger companies like banks, insurance companies, and other financial institutions have large portfolios of investments. These investments could include treasury bond and bills, equity stakes in other companies, term finance certificates, etc.

For investments that are sold, these companies report the realized gains or losses in the income statement. However, there will many investments which are still held by the company at the end of the financial period. The unrealized gains and losses on these ‘available for sale’ securities are shown as other comprehensive income on the balance sheet.

Gains and Losses on Derivative Contracts

A company will enter into derivative contracts for a variety of reasons including hedge risks. For instance, a company can enter into a futures contract to hedge the increasing prices of oil which constitutes a large portion of their production cost. As the derivative contract is initiated, the prices of oil will fluctuate in the market throughout the financial period. This would mean that the company will have unrealized gains or losses on its derivative contracts based on which direction the prices moved.

Gains and Losses on Foreign Currency

If a company has revenues coming from overseas, then currency fluctuations will have an impact on its profitability. A stronger domestic currency would negatively impact the overall sales and profitability of a company. Therefore, foreign exchange adjustments will appear as unrealized gains or losses in other comprehensive income. Once the earnings are remitted back to the home country, these unrealized gains or losses will be recorded in the income statement and realized.

Gains and Losses on Pension Plans

A company funds its pension obligations by creating a portfolio of assets. As long as the company is making the required return on its planned assets to cover any increase in pension obligations, it will have a gain called ‘funded surplus’. The opposite will hold if the company’s assets are unable to fund the pension fund obligations. This funded status (surplus or deficit) will appear on the OCI.

OCI Related Reporting Standards

As per the standards, unrealized gains and losses cannot be reported on the income statement. To still show the changes on the equity side of the balance sheet, these unrealized gains and losses are reported as ‘accumulated other comprehensive income’. Only once the gains and losses are realized, we will need to transfer the balance to the income statement to record it as a realized item.

Importance of Other Comprehensive Income

The advantages are as follows:

- Other comprehensive income provides a level of detail to the whole financial reporting process. It confirms the reliability and transparency of the statements to the investors, creditors, or any other stakeholders. If these were excluded completely, the company’s overall financial position could not be very well judged.

- The unrealized gains and losses can be used in forecasting the financial statements.

- Investors are preempted if there is a major loss down the road.

Format and Example of Comprehensive Income Statement

Throughout this series we have been focused on Bob’s Donut Shoppe, Inc. Bob’s scale of operations is still restricted to his local community, but eventually, he does plan to scale his business globally so that he is able to earn a significant part of his revenue from exports.

He currently also does not have a portfolio of investments but anticipates the need for the same will arise as his regional and global operations expand.

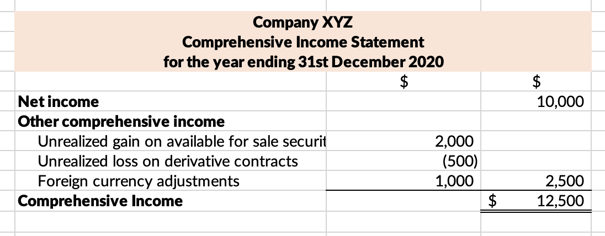

For this example, we’ll use the case of a hypothetical Company XYZ that has made a net income of $10,000. The following are the OCI components that need to be adjusted:

- The company has made an unrealized gain of $2,000 on available for sale securities.

- At the end of the period, it has an unrealized loss of $500 on its derivative contracts.

- The company also made an unrealized gain on its foreign currency of $1,000.

FAQs

1. What is other comprehensive income?

Other comprehensive income (OCI) includes all those revenues, expenses, gains, and losses that affect a company’s equity side of the balance sheet and have not yet been realized. As per the GAAP and IFRS standards, these items are not included in the income statement and must be shown separately on the equity side of the balance sheet.

2. What is the difference between other income and other comprehensive income?

Other income is a component of the net income and includes items such as interest income and dividends. Other comprehensive income, on the other hand, reflects all changes in equity from period to period, and is not included in the net income.

3. What is an example of comprehensive income?

An example of comprehensive income would be an individual’s net worth, which would include all assets and liabilities, both current and long-term.

4. What is included in other comprehensive income?

Other comprehensive income is shown as a line item on the balance sheet. Some common examples of the items included in the OCI account are:

- Gains or losses on investments categorized as ‘available for sale’.

- Gain or losses on a derivative contract are held as hedging instruments.

- Gain or losses on foreign currency exchange.

- Pension plan gains and losses.

5. What is other comprehensive income used for?

The primary purpose of other comprehensive income is to provide detailed information about all changes in a company’s equity from one period to another. This allows investors, creditors, and other stakeholders to better understand the financial position of the company. Another use of other comprehensive income is in forecasting the company’s financial statements. Because unrealized gains and losses can be indicative of future realized gains or losses, they are often included in forecasts.