The preferred dividend coverage ratio shows a company’s capacity to pay preferred shareholders their dividends, which are predetermined and fixed. The better a company’s fiscal position, the higher its preferred dividend coverage ratio, and the more capable it is of paying owed preferred dividends. The ratio is also used to assess a company’s overall financial health.

Also called times preferred dividend earned ratio, the preferred dividend coverage ratio examines a company’s net income to know if it’s enough to cover the fixed dividend payments due on its outstanding preferred shares. Hence, it is helpful to all shareholders, would-be shareholders and debt holders as a tool for assessing a company’s financial status.

Preferred stock dividends are paid either quarterly or yearly, making them somehow similar to other fixed-income investments such as bonds. Preferred stocks are attractive to investors looking for a constant income supplement. These are investors who will likely keep the stock long-term. And, of course, there are exchange-traded funds (ETFs) too, which focus on purchasing shares of preferred stocks.

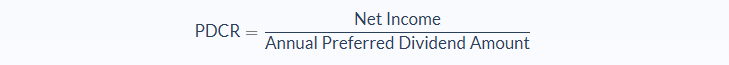

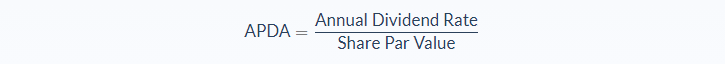

Preferred Dividend Coverage Ratio Formula

Calculating a company’s preferred dividend coverage ratio starts with calculating the year’s preferred dividends, where the formula is:

Both the annual dividend rate and the share par value can be obtained from the prospectus of the preferred stock issue.

The resulting value can then be used as the denominator (bottom half of the fraction) to work out the preferred dividend coverage ratio.

Calculating the preferred dividend coverage ratio can also be done quarterly by dividing the annual net income and the annual dividend dollar amount by 4, and then using the resulting values to calculate the ratio.

Companies will generally have more than enough profit to make this dividend payment, but not in some cases. A preferred dividend coverage ratio of at least 1 indicates that the company can fulfil its preferred dividend obligation, while a ratio under 1 means the business is in a seriously compromised fiscal state and has no capacity to pay the dividend.

In a way, a company paying preferred dividends is like a homeowner paying his monthly mortgage. If the homeowner spends most of his earnings on his mortgage, he will easily default with any tiny change in his earnings – for example, if he contracts an illness or meets an accident that makes him unfit for work. In the same way, a company that is making just enough money to make its preferred dividend payments may lose the ability to do so when affected by serious fiscal issues.

This is why a higher ratio is always more favorable. It shows that the company has enough financial leeway to still meet its preferred dividend obligation under any circumstances. If a company’s preferred dividend coverage ratio is low, its financial statements should be scrutinized further to assess its overall financial stability. Sometimes, it could just be due to a bad period, which is why comparing coverage ratios over a number of quarters or even years is important to get a more accurate picture of the company’s true state.

Preferred Dividend Coverage Ratio Example

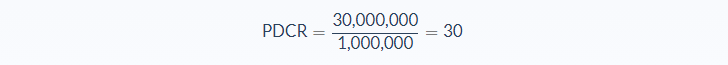

Sam is a financial manager in search of opportunities to expand his portfolio. He scans the web for top ten lists of companies that pay the highest preferred dividends and finds that insurance company 123 Inc. is consistently on top. He does further research and learns that the tech giant’s net income in the prior year was $30 million, and the preferred issue was for a total par value of $20 million at 5%. This also means the company’s annual preferred dividend amount for that year was $1 million.

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Net income: $30,000,000

- Annual preferred dividend amount: $1,000,000

Now let’s use our formula:

In this case, 123 Inc. would have a preferred dividend coverage ratio of 30.

With a preferred dividend coverage ratio of 30, it is clear that 123 Inc. is more than capable of meeting its yearly preferred dividend obligation with its annual profits. In fact, it can cover 30 times more than what it is required to pay, so preferred shareholders need not worry about receiving their dividends. On top of that, the ratio indicates that 123 Inc. is in a generally good fiscal position.

Preferred Dividend Coverage Ratio Analysis

Banks, lenders and other creditors also use the preferred dividend coverage ratio to look into a company’s ability to pay for future debt. Even common stock shareholders may benefit from this coverage ratio as it is applicable to all kinds of stock dividends.

Whether paid quarterly or yearly, these preferred dividends are similar to other fixed-income investments such as bonds. Preferred stocks are attractive to investors looking for a constant income supplement. These are investors who will likely keep the stock long-term. And, of course, there are exchange-traded funds (ETFs) too, which focus on purchasing shares of preferred stocks.

It’s also important to remember that there are several types of coverage ratios that can help shed light on a company’s capacity to fulfill its financial responsibilities. Since the market does not consider dividends as a standard or requirement, it may not be very accurate to compare one company with a low preferred dividend coverage ratio to another that doesn’t even pay any dividends.

Furthermore, preferred dividends are cumulative. This means that if dividends are unpaid within a certain quarter, the amount due will be carried over to the next payout. Hence, preferred shareholders should not obsess about a missed a payout. It’s normal for cash flows and costs to fluctuate within a year. When a company decides against paying out dividends for a certain quarter, it should not automatically raise concerns. If the ratio appears to be declining over the next few quarters, that is the time to investigate further.

Preferred Dividend Coverage Ratio Conclusion

- The preferred dividend coverage ratio is a sign of a company’s capacity to pay dividends to preferred stock shareholders.

- This formula requires two variables: net income and annual preferred dividend amount.

- The preferred dividend coverage ratio is often expressed as a plain decimal number.

- This calculation is used by common shareholders to determine whether or not a company is likely to pay a dividend on common shares.

- Preferred shares pay a fixed and predetermined dividend and are therefore a revenue-earning investment akin to bonds.

Preferred Dividend Coverage Ratio Calculator

You can use the preferred dividend coverage ratio calculator below to quickly measure a company’s ability to pay preferred dividends to shareholders, by entering the required numbers.

FAQs

1. What is preferred dividend coverage ratio?

The preferred dividend coverage ratio is a measure of a company's ability to pay dividends on its preferred shares. The market does not consider dividends as a standard or requirement, so it may not be very accurate to compare one company with a low preferred dividend coverage ratio to another that doesn't even pay any dividends.

2. How is preferred dividend coverage ratio calculated?

The preferred dividend coverage ratio is calculated by dividing a company's net income by its annual preferred dividend amount. This ratio is expressed as a decimal number.

3. What is a good preferred dividend coverage ratio?

There is no definitive answer to this question, as the preferred dividend coverage ratio varies from company to company. However, a good ratio would be one that is above 1, indicating that the company has more than enough funds to cover its annual preferred dividend obligations.

4. What does preferred dividend coverage ratio show us?

The preferred dividend coverage ratio shows us how well a company can cover its annual preferred dividends. A ratio that is above 1 is good, while a ratio that falls below 1 may indicate that the company is not able to pay its annual preferred dividends.

5. Why is preferred dividend coverage ratio important?

The preferred dividend coverage ratio is important because it indicates a company's ability to pay dividends on its preferred shares. This information is useful for common shareholders who want to know whether or not the company is likely to pay a dividend on its common shares.