The present value interest factor of annuity (PVIFA) is a factor used to calculate the present value of a series of annuity payments. In other words, it is a number that can be used to represent the present value of a series of payments.

Since present value interest factor of annuity is a bit of a mouthful, it is often referred to as present value annuity factor or PVIFA for short.

The initial payment earns interest at the periodic rate (r) over a number of payment periods (n). PVIFA is also used in the formula to calculate the present value of an annuity. Once you have the PVIFA factor value, you can multiply it by the periodic payment amount to find the current present value of the annuity.

This simplifies the decision-making process for investors and generally makes it easier for you to calculate the present value without having to perform complex calculations. The most common way to do this is using present value factor tables (which I’ll explore in more detail later in this article).

Present Value Annuity Factor Formula

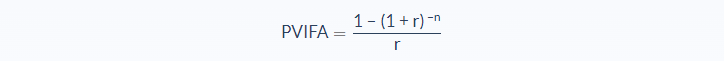

The formula to calculate PVIFA is:

- r = Periodic rate per period

- n = Number of periods

The formula calculates the future value of one dollar cash flows. What does this mean? Put simply, it means that the resulting factor is the present value of a $1 annuity.

This makes it very easy for you to multiply the factor by payment amount to work out the total present value of the annuity.

Present Value Annuity Factor Example

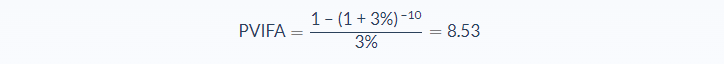

David has invested in a local business selling designer clothes and will receive 10 annual payments at an interest rate of 3% per year. How can he work out the present value of the investment?

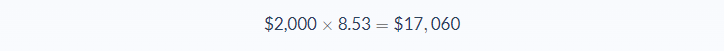

This means that every $1 he receives is worth $8.53 in present value. David can now work out the present value based on the payment amount. So let’s say he is receiving a payment of $2,000 a year:

Present Value Annuity Factor Analysis

Like all present value formulas, the PVIFA is based on the time value of money concept, which basically states that $1 today is worth more today than at a future time.

The formulas allow you to work out the present value of an annuity so that smart investors can see how much their money is worth today because money has the potential for growth over a period of time.

So let’s say you have the option to receive a payment of $10,000 today or in two years time. You would pick the first option, right? It’s the same amount of money whenever you receive it, but time is the important factor. The $10,000 received today has more value and use to you than waiting to receive it later.

There are opportunity costs to not receiving the money today, such as any potential interest you could earn over the two years.

Present Value Annuity Factor Table

You can calculate the present value of an annuity in a number of ways. At the bottom of this article, I have a calculator you can use but you can also use Excel spreadsheets or manually calculate the PV using the formula.

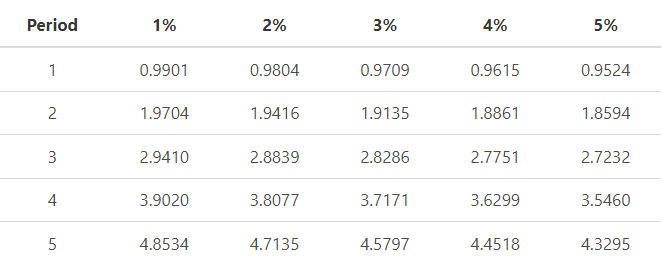

One very common method is to have a PVIFA table or chart. This makes it very easy to see the interest rates and periods in a table, and look up the factor.

You can then use that factor to multiply by the payment amount to calculate present value. Here’s an example of what a present value interest factor of annuity table looks like:

Present Value Annuity Factor Calculator

You can use the present value interest factor of annuity (PVIFA) calculator below to work out your own PV factor using the number of periods and the rate per period.

FAQs

1. What is the present value interest factor of an annuity?

The present value interest factor is the return you would earn if your initial payment (or series of payments) is invested at a given rate for a number of periods. It can be used to find out how much money you would have now if you invest an annuity.

2. How do you calculate PVIFA?

You can calculate the PVIFA with this formula:

PVIFA = 1 − (1 + r)−n / r

r = Periodic rate per period

n = Number of periods

3. What is the relationship between the present value factor and the annuity factor?

Both the PVIFA and AFA are related since they both calculate the same factor.

The PVIFA is only suitable for annuities that make a single payment, while the AFA can be used for all types of annuities. This means you cannot use it to solve problems where the series of payments increase or decrease over time.

4. What is an annuity factor?

An annuity factor is the present value of an annuity when interest rates are expressed on a per-period basis. It can be used in problems involving annuities in growth, non-growing, and decreasing terms.

5. How do you calculate the present value of an annuity factor in Excel?

You can calculate the present value of an annuity factor in Excel by using the PVIFA function. The syntax for this function is:

=PV(RATE,NPER,PMT)

The formula takes these values:

• rate = The interest rate per period expressed as a decimal number. For example, if the interest rate is 6%, enter 0.06.

• nper = The number of periods an annuity takes to complete expressed in years. For example, if it takes 10 years to complete an annuity, enter 10. If it does not take a whole number of years, round up or down to make this value an integer. For example, if your annuity will take 7.5 years to complete, enter 8.

• pmt = The constant payment amount per period of a regular annuity expressed in dollars and cents. This is an optional value and if you leave it blank, the formula calculates the present value for a regular annuity with one payment at the end.