The principal is the total amount borrowed from a lender or the initial amount invested. In other words, it is the original sum of money that has been borrowed or invested.

The principal can also refer to the face value of a bond, an individual party or parties, the owner of a private company, or the chief participant in a transaction.

Loan Principal

You can use the loan principal amount to calculate the interest expense for a period.

The interest expense, which can be accrued or accumulated, does not form part of the outstanding principal amount. The only time the interest will form part of the amount is if the loan is compounded.

A typical loan payment has two parts to the payment, the principal amount and the interest on the loan. The only way to reduce the loan is by making principal payments.

The bank will firstly deduct the interest amount and then the rest of the payment will go towards the principal loan amount. By reducing the loan amount the interest will decrease. In some cases, the interest is paid periodically but the principal of the bond is paid when the bond maturity date is reached.

Investment Principal

The principal amount is the original amount of investment made into an asset, such as a stock or business acquisition.

So, let’s say you invest $5,000 into a high-interest savings account and, over the course of 10 years, the account balance grows to $7,000. In this example, the $5,000 you initially deposited is the principal amount, and the additional $2,000 is the interest earned from that principal.

Bond Principal

When we’re talking about bonds and debt instruments, the principal would be the par value or face value.

The principal of a bond is exclusive of any coupon, recurring interest, or accrued interest and it essentially refers to the amount of money the bond issuer must repay when the bond matures.

For example, if you had a 10-year bond with a face value of $5,000 and a $100 annual coupon payment, the principal is the original $5,000 and does not include the $1,000 of coupon payments made over the life of the bond.

It’s worth noting that with the exception of when it is first issued, a bond’s principal is not the same as the market price. As the markets fluctuate, the bond can be purchased for more or less than the principal.

For example, back in October of 2016, Netflix issued a corporate bond offering with a face value (principal) of $1,000 per bond. At the time of the issue, this was also the market price of the bond.

Since that initial offering, the bond price has increased to between $1,040 and $1,070, but the principal of the bond is still $1,000.

Principal Example

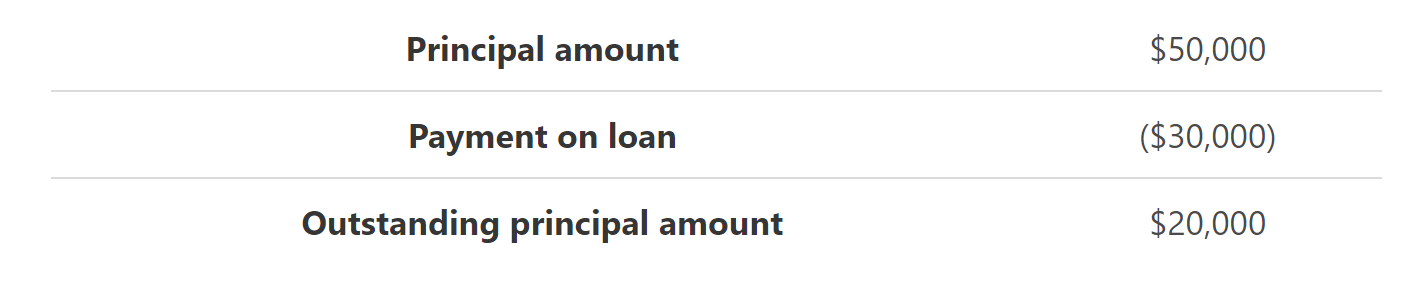

Let’s take the example of taking a mortgage out of $50,000. The principal amount is $50,000. You then receive a bonus from your work, and you make a payment of $30,000 on the mortgage. What is the balance on the mortgage?

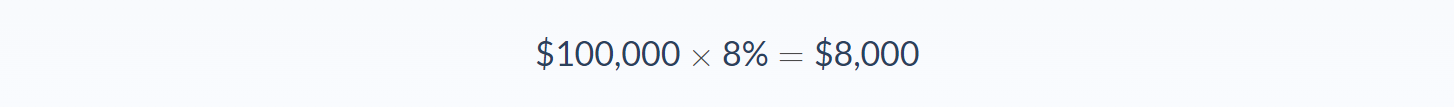

The interest that you pay on a loan is determined by the initial loan amount. Let’s look at the example: You borrow $100,000 and the bank offers you an annual interest rate of 8%. What would be the interest that you pay every year on the loan?

You will have to pay $8,000 for every year that the loan is outstanding.

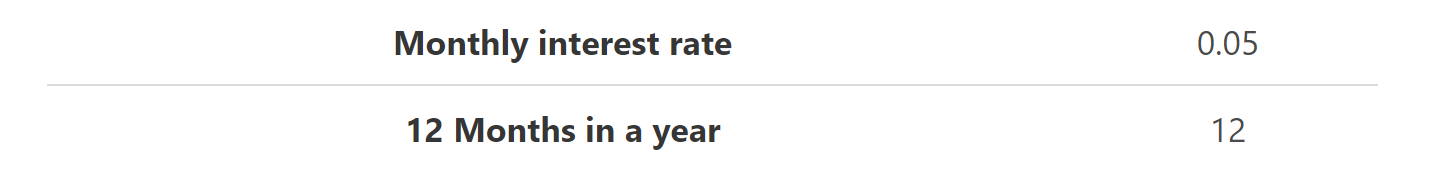

Let us look at another example. Joe’s Clothing is a clothing store located in Atlanta. Joe decided that it is time to expand the business premises. Joe gets a $150,000 loan from the bank for 24 months to fund his expansion. Joe approaches his accountant to find out how much will the outstanding amount on his principal be after one payment if the bank offered him a 5% interest rate and a monthly repayment of $6,580,71.

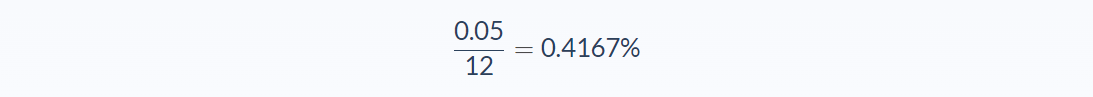

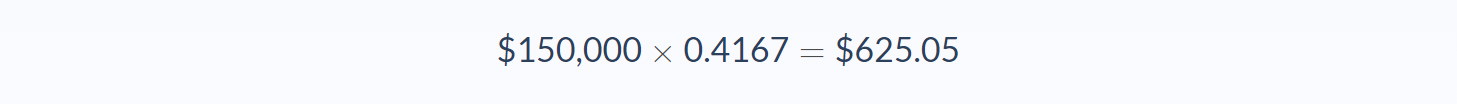

To start we first need to work out what is the interest that will be charged for loaning the money for one month. Our interest rate is 5% and there are 12 months in a year, we need to divide the 5% by the 12 months of the year to get the interest per month.

This is the amount of interest that will be charged per month on the principal amount. We can now work out what the amount of rent will be for the first month. We have the loan amount of $150 000 and we have the monthly interest rate of 0.4167%.

$625.05 is the amount of interest that will be paid in month 1. We can now work out what the value of the principal amount is after month one.

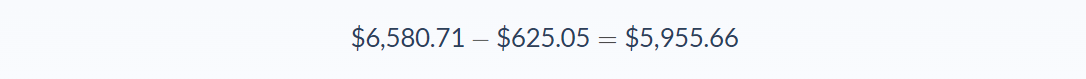

The payment for the first month is $6 580.71 and the interest paid for the first month is $625.05.

$5955.66 is the amount that will be deducted from the principal amount.

Outstanding principal amount after month 1:

Joe will owe $144,044.34 on his loan after month 1.

Principal Conclusion

- The principal amount is the initial capital amount that was loaned from the bank or paid into an investment.

- The bank will deduct the interest on the loan before deducting money from the principal amount.

- The only way to decrease the loan is by making payments towards the principal amount.

- The outstanding principal amount can be calculated by taking the principal amount and deducting the monthly payments and adding the monthly interest rates.

FAQs

1. What is principal?

The principal amount is the initial capital amount that was loaned from the bank or paid into an investment.

2. What are the different types of principal?

There are two types of principal: the amount of money that is originally invested or loaned, and the outstanding principal amount, which is the remaining balance on a loan after deducting payments and interest.

3. How does inflation affect the principal?

Inflation can affect the principal amount of the investment or loan is not fixed. This means that the purchasing power of the initial investment or loan decreases over time. It can also affect the outstanding principal amount if the interest rate is variable. This means that the amount of money required to pay off the loan increases over time.

4. Is it good to pay your principal?

There are a few benefits of paying on your principal. First, it decreases the outstanding principal amount, which can save you money in interest payments. Second, it reduces the time required to pay off the loan. Third, it builds equity in the investment or property. Finally, it can improve your credit score.

5. Can you pay off the principal before interest?

Yes, you can pay off the principal amount before interest. This will decrease the amount of money required to pay off the loan.