A profit and loss statement (P&L) is a financial statement that reflects the revenues and the expenses of a company for a given accounting period. It is also commonly known as the income statement or the statement of operations. It is based on the revenue recognition, matching principle, and the accrual accounting concept.

Profit and Loss Statement Template

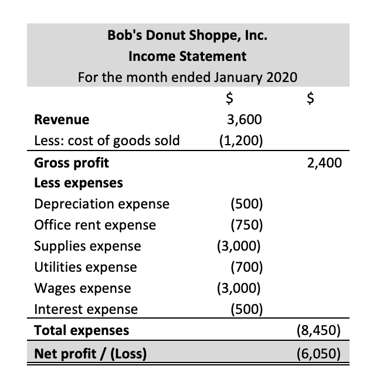

Throughout this series of financial statements, you can download the Excel template below for free to see how Bob’s Donut Shoppe uses the P&L statement (and others) to evaluate the performance of his business.

Profit and Loss Structure

The company’s profit and loss statement can be further sub-divided into the following categories:

- Revenues

- Cost of goods sold (COGS)

- Selling, general, and administration (SG&A) expenses

- Depreciation and amortization

- Interest expense

- Taxes

- Net income

Revenues

This is also called the “top line” and refers to the money received from the sale of goods and services before and any deductions of costs and expenses. Revenues are recorded in cash or through credit sales and will not include unearned income (for which goods and services have not been delivered during the year).

Cost of Goods Sold

These include only those costs that can be directly attributed to the goods being sold and delivered. For instance, direct material costs and direct labor costs will come in this category.

Selling, General, and Administrative Expenses (SG&A)

These would include all those operating expenses that are not directly tied to the manufacturing of a product or the delivery of a service.

These include selling expenses that are indirectly associated with the manufacturing or service process. These include product advertising and marketing, telephone bills, travel costs, sales personnel salaries, etc.

General and administrative expenses are also called the overheads of a company. These would be incurred even if the company shuts down its current operations. They are not directly attributable to any one product, function, or department of a business. Examples of SG&A expenses include rent, insurance, mortgage, utilities, and salaries of personnel not involved in the direct sales or production process.

Depreciation and Amortization

Amortization occurs when there is an intangible asset loses its value over time; whereas, depreciation is when a fixed asset loses its value. There are multiple ways of calculating the depreciation expense, the most common of which are the straight-line method and the declining balance method.

Interest Expense

A company might take debt as a source of financing its assets. It is the most common way to raise capital as the cost of debt is usually lower than the cost of equity. This will result in the company incurring a cost of borrowing in terms of the interest paid on the debt. Interest expense-related ratios are very important for investors and creditors to analyze the financial health of a company. Ratios like the interest coverage ratio will help determine whether the company can pay off its obligations.

Interest expense will usually appear just below the earnings before income and taxes (EBIT) component on the profit and loss statement.

Taxes

There is a difference between the tax number that is shown on the company profit and loss statement and the actual tax return payable to the government. This is because the tax return is made accordingly to the public tax policy whereas the accounting tax must adhere to the accounting standards.

Net Income

This is the final component of the profit and loss statement and it is also commonly referred to as the “bottom line” of the company. It is calculated after subtracting the interest expense and taxes from the earnings before the income and tax (EBIT) component.

Purpose of a P&L Statement

Certain advantages and uses of the profit and loss statement are given below:

- Provides a glimpse of how much revenue a company is earning in a period. This can then be compared with revenues of similar duration periods in the past to estimate the net growth or decline in a company’s business.

- Investors can calculate and analyze certain key ratios and figures such as operating margin, gross margin, interest coverage, earnings per share, etc. These will generally depict the health f a company. For instance, a company with a 25 % increase in the earnings per share will mean an upward trajectory in business performance (assuming the total number of outstanding shares has not changed).

- The profit and loss statement can become a foundation upon which the forecasts for the next 12 months, 3 years, or even 5 years can be made. These forecasts can then be used to value the business entity,

- It is one of the tools used to gather external financing as well. Creditors would want to look at the profit and loss statements to determine the financial risks involved in the business before loaning out any amount.

- For smaller private organizations, it can be released in either of the two formats: single-step income statement or multi-step income statement. The single-step format is much simpler and easier to prepare but will lack the necessary detail for a comprehensive analysis.

Profit and Loss Statement Example

We have not considered a tax scenario for Bob and his donut company as we have assumed he is operating in a tax-free country to make things simple. So, his earning before tax (EBT) would be the same as his net income/loss component.

We can observe from the above example the multiple components of the profit and loss statements that have been explained in detail previously. The process can be summarized below:

- Subtract the cost of goods sold from revenues to arrive at gross profit.

- Subtract selling, general and administrative expenses from gross profit to calculate EBITDA.

- Subtract depreciation and amortization from EBITDA to arrive at EBIT.

- Remove interest expense from EBIT, we get earnings before tax (EBT).

- Subtract taxes to arrive at the net income.

FAQs

1. What is a profit and loss statement?

A profit and loss statement, also known as an income statement, is a financial statement that reflects the revenues and the expenses of a company for a given accounting period. It is used by investors and creditors to analyze the financial health of a company.

2. What are the ways to prepare a profit and loss statement?

There are two ways to prepare a profit and loss statement: a single-step income statement or a multi-step income statement.

The single-step format is used by smaller businesses and is much simpler to prepare. It does not provide the same level of detail as the multi-step format, which is used by larger businesses.

3. Why are profit and loss statements important?

Profit and loss statements are important because they provide a snapshot of a company's financial health. Investors and creditors use them to calculate key ratios and figures, such as operating margin, gross margin, and earnings per share.

They can also be used to forecast a company's financial performance for the next 12 months, 3 years, or 5 years. This information can be used to value the business entity.

4. What is the difference between a profit and loss statement and a balance sheet?

The difference between a profit and loss statement and a balance sheet is that the profit and loss statement summarizes a company's revenues and expenses over a specific period, while the balance sheet summarizes a company's assets, liabilities, and equity as of a specific date.

5. Who prepares a profit and loss statement?

A profit and loss statement is prepared by the company's accountant. It is based on data from the company's accounting records.