The profit margin ratio, also referred to as return on sales ratio or gross profit ratio, is a profitability ratio that determines the percentage of a company’s sales that has been turned into profit. Put simply, it measures whether a company or a business is generating profits from its business activities.

Through the comparison of the net income and net sales of a company, creditors, investors, and management can use the profit margin ratio to see how effectively a company converts sales into net income. For investors, this is a way to see that profits are high enough to generate a return for them, while creditors will also want to see that profits are high enough for the company to repay its debt.

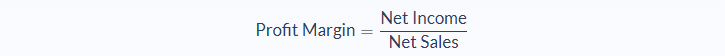

Profit Margin Formula

The formula for calculating profit margin is simple and straightforward: divide a company’s net income from net sales.

To get the net income or profit of a business, you will subtract a company’s expenses from its total revenue. This is often known as the bottom line since it’s the last figure reported on an income statement.

Net sales are calculated by subtracting any returns or refunds from gross sales.

Profit Margin Analysis

As you can see in the formula, the profit margin ratio takes into account two basic components in its calculation and it measures how much profits are produced by a given amount of sales.

For a business to maximise its profit margin ratio it can reduce the cost of goods sold (COGS) or increase revenue without increasing expenses (for example, by increasing the price of a product).

Generally, reducing the cost of goods sold and reducing budgets is a more effective way for management to improve the profit margin ratio because generating additional revenue is more difficult to do without also increasing expenses.

Investors consider businesses with higher profit margin ratios to be favorable for investing as it indicates a company or business is in good financial health and will allow them to get a return in the form of dividend payments.

On the other hand, a lower profit margin ratio is unfavorable for investments, borrowing funds, and monitoring the outcomes of business practises. This is because it indicates that the company is not efficient at converting sales into net income and low profit is a sign that management is not handling the costs properly.

The profit margin ratio is expressed as a percentage and should be used to compare companies of similar size in the same industry. It’s also an effective ratio for measuring past performance.

Profit Margin Example

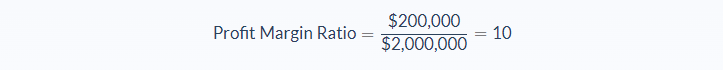

Maria is an entrepreneur who sells Vidalia onions online. Last year, she recorded the highest sales ever surpassing their sales target for the year. From her income statement, net sales were $2,000,000 and net income was $200,000.

Let’s calculate Maria’s return on sales ratio:

The ratio implies that only 10% of Maria’s sales were converted into profits. This year, her net sales were $1.5m with a net income of $300,000. Even though her sales were $500,000 less this year, the profit margin is now 20% because she was able to reduce the farming and shipping costs of the onions.

Profit Margin Conclusion

When calculating the profit margin for a company, the below points are worth bearing in mind as a quick recap of what it is, why it’s used, and how to use it:

- Profit margin ratio is a profitability ratio that determines the percentage of a company’s sales that has been turned into profit

- Companies should express this ratio as a percentage and not as a value as it allows an easy comparison of the profit margin ratio of different companies in the industry

- A higher profit margin ratio for a business is considered a favorable one by investors as it indicates a company is in good financial health to generate enough profits and pay off their debts

- Lower profit margin ratio indicates possible flaws with business operations.

- Net sales and net income used to calculate the profit margin ratio are recorded in a company’s income statements

- The ratio can also tell us how a company handles its expenses when compared to the sales it makes.

- Since companies in different industries have different margins you will get a more meaningful result by comparing the gross profit margin for companies in the same industry

- The ratio has its limitations just as with any other accounting financial ratio, and it would best to use it with other measures of profitability

Profit Margin Calculator

You can use this profit margin calculator to calculate the profit margin ratio of a company by entering the net income and net sales values.

FAQs

1. What is profit margin?

Profit margin is a profitability ratio that determines the percentage of a company's sales that has been turned into profit. It is expressed as a percentage, and investors consider businesses with higher profit margin ratios to be favorable for investing.

2. How do we calculate the profit margin?

The profit margin ratio is calculated by dividing the net income by the net sales. The result is expressed as a percentage.

3. What is a good profit margin?

A good profit margin is one that is greater than the percentage of the industry average. It varies from industry to industry, so it is important to compare companies within the same industry when determining what is a good profit margin.

4. How do you interpret profit margins?

When a company has a higher profit margin ratio, it means that they are in good financial health and are generating more profits than its expenses. This is considered to be a favorable indicator for investors. A lower profit margin ratio, on the other hand, suggests that the company may not be handling its costs properly.

5. Why is profit margin important?

Profit margin is important because it is a key indicator of a company's financial health. It tells us how efficiently a company is turning its sales into profits. This information can be used to make comparisons between companies and determine whether an investment would be wise.