A profit-sharing plan is a retirement plan that allows employers to share profits with their employees. A profit-sharing plan is a great way to reward your employees for their hard work and help them save for retirement.

A business owner can set up a profit-sharing plan for their employees by contributing money to the plan on behalf of their employees.

Employees can then use this money to save for retirement or pay for qualified expenses, such as medical bills or college tuition.

A profit-sharing plan is like your 401(k) with the employee's contributions removed. While we're on the topic of 401(k) plans, learn how to set up a sustainable 401(k) for your company.

Profit-sharing plans can consist of cash bonus payments or contributions to employees' accounts.

How Does Profit-Sharing Plan Work?

Employers make profit-sharing contributions to the plan on behalf of their employees, and these contributions are not taxable income to the employee.

The contributions grow tax-deferred, just like contributions to a 401(k) plan.

When the employee retires or leaves their job, they can take the profit-sharing money out of the plan as a lump sum or periodic payments.

If the employee takes it as a lump sum, it will be taxed as income at that time.

If the profit-sharing money is taken out in periodic payments, it will be taxed as income each time it is paid out.

A profit-sharing plan isn't best for every employer. Use the 401(k) comparison tool if you're thinking about shopping around for other options.

Profit-Sharing Plan Rules

There are a few rules that employers and employees must follow when it comes to profit-sharing plans:

- Employers must make profit-sharing contributions on behalf of their employees.

- The IRS limits the amount an employer can contribute.

- Employees cannot contribute to a profit-sharing plan.

- Contributions grow tax-deferred, just like contributions to a 401(k) plan.

- Employees must begin taking distributions from the profit-sharing plan by April of the year they turn 73 years old.

- If an employee leave their job, they can take their profit-sharing money with them or leave it in the plan.

Profit-Sharing Plan Limits

The IRS limits the amount an employer can contribute to a profit-sharing plan. The limit is based on the employee's salary and how much the company contributes as a percentage of profits.

The most an employer can contribute in a year is:

25% of the employee's compensation, or

$66,000 for 2023 (whichever is less)

Types of Profit-Sharing Plan

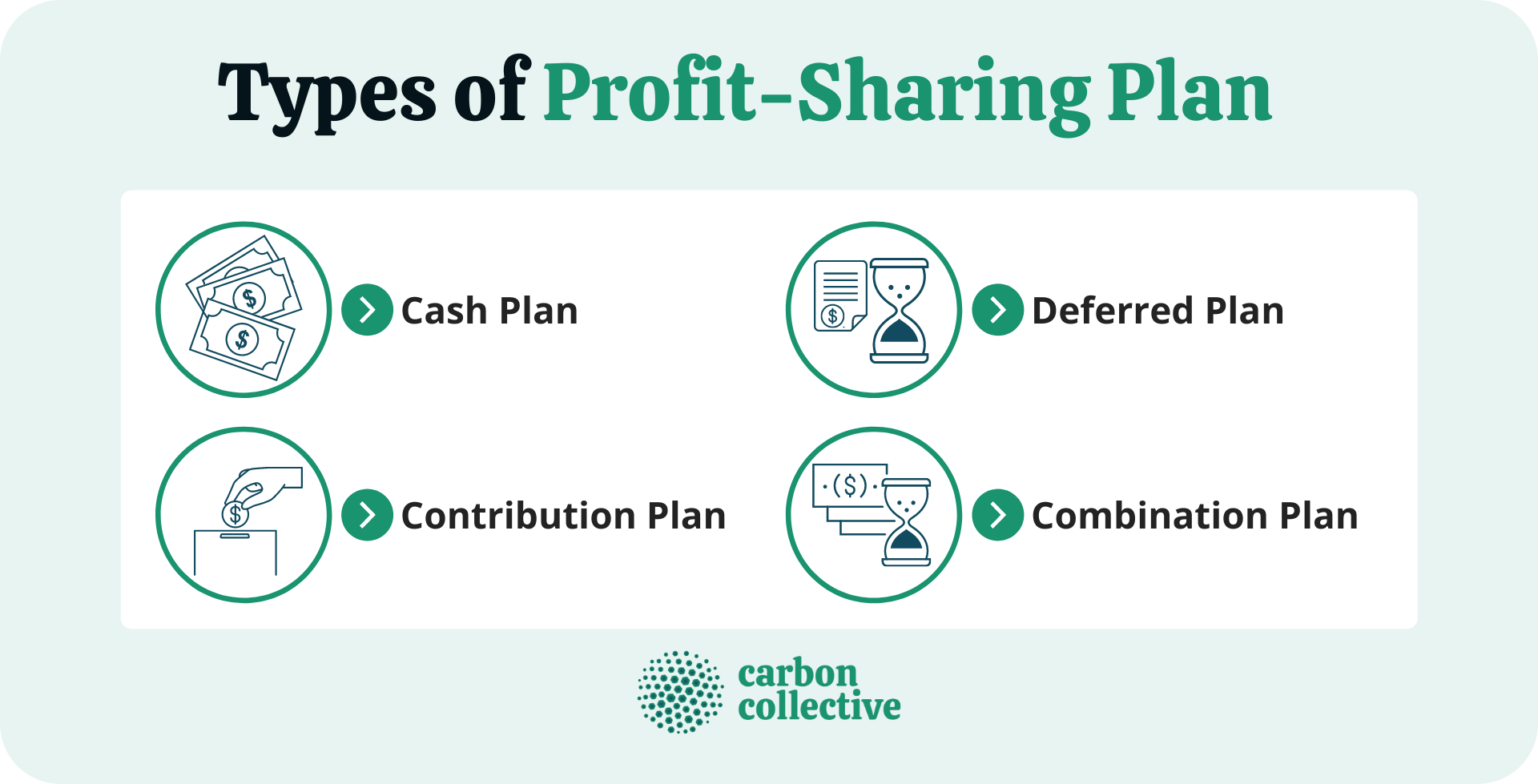

There are four different types of profit-sharing plans:

Cash Plan: A cash profit-sharing plan is the most common type. In a cash profit-sharing plan, employers make bonus payments to employees in cash.

Contribution Plan: A contribution profit-sharing plan is where employers contribute money to employees' accounts regularly. This type of profit-sharing plan is less common than a cash profit-sharing plan.

Deferred Plan: A deferred profit-sharing plan is where employers contribute money to employees' accounts, but the employees do not have access to the money until they retire or leave their job.

Combination Plan: A combination profit-sharing plan is a mix of cash plans and deferred plans. Employees receive partly cash payments from the employer, and the employer also contributes to employees' accounts in a deferred profit-sharing plan.

How are Benefits Shared with Employees?

It is possible to divide the Profit-sharing plans by how the benefits are shared among employees. These plans are the following:

Pro-rata plan: In a pro-rata profit-sharing plan, the benefits are shared among employees based on how much they earn. So, an employee who earns more will receive a larger percentage of the profits than an employee who earns less.

Fixed Percentage Plan: In a fixed percentage profit-sharing plan, all employees receive the same percentage of the profits no matter how much they earn.

Age-weighted Plan: An age-weighted profit-sharing plan gives employees a larger percentage of the profits as they get older. This type of profit-sharing plan is designed to encourage employees to save for retirement.

New comparability Plan: A new comparability profit-sharing plan allows employers to give different percentages of the profits to employees based on how many hours they work, their age, or whether they are full-time or part-time workers.

Why Choose a Profit-Sharing Plan?

As a business owner, there are a few reasons why you might want to consider setting up a profit-sharing plan for your employees:

- It's a great way to reward your employees for their hard work.

- It can help you attract and retain talented employees.

- It's a tax-deductible way to contribute to your employee's retirement savings.

- Profit-sharing plans are less complicated than 401(k) plans.

Profit-Sharing Plans vs. 401(k)s

There are a few key differences between profit-sharing plans and 401(k)s:

- The Employee Retirement Income Security Act of 1974 (ERISA) regulates 401(k) plans, but they do not regulate profit-sharing plans.

- Employees can contribute to 401(k) plans, but employees cannot contribute to profit-sharing plans.

- 401(k) contributions grow tax-deferred, while profit-sharing contributions do not.

- Employees must start taking distributions from 401(k) plans by April of the year they turn 73 years old. Employees do not have to take distributions from profit-sharing plans.

- If an employee leaves their job, they can take their 401(k) money or leave it in the plan. If an employee leaves their job, they cannot take their profit-sharing money.

- 401(k) plans are more popular than profit-sharing plans.

The Bottom Line

A profit-sharing plan is a retirement plan that allows employers to contribute money to employees' accounts. Employees can receive contributions in cash, deferred payments, or both.

The benefits are shared among employees based on how much they earn or how old they are. Profit-sharing plans are less complicated than 401(k) plans and are not regulated by ERISA.

Business owners may want to consider setting up a profit-sharing plan for their employees because it's a great way to reward them for their hard work, and it can help attract and retain talented employees.

FAQs

1. Can I ask my employer to contribute to my profit-sharing plan from their taxes?

Yes, you can ask your employer to contribute to your profit-sharing plan. However, your employer is not required to do so. If they agree to contribute, they may be able to deduct the contribution from their taxes.

2. Can you lose money in a profit-sharing plan?

No, you cannot lose money in a profit-sharing plan. However, the money in your account may not grow as fast as it would if it were invested in a tax-deferred account like a 401(k).

3. Can I set up a profit-sharing plan if I am self-employed?

No, you cannot set up a profit-sharing plan if you are self-employed. However, you may be able to contribute to a SEP IRA or SIMPLE IRA.

4. Can I take the money in my profit-sharing plan if I am terminated or resign?

If you leave your job, you cannot take the profit-sharing money with you. However, you may be able to roll over the money into an IRA or another retirement plan.

5. How much do you get taxed on a profit-sharing plan?

Profit-sharing contributions are not taxable upon initial setup. However, the money in your account will be taxed when you withdraw it.