What Is a Public Benefit Corporation?

A public benefit corporation, also known as a benefit corporation or B Corp, is a unique type of company that provides benefits to society and its shareholders.

Unlike traditional corporations, benefit corporations are required to make sure they provide a social good, in addition to turning a profit. This is achieved by donating money to charity, creating jobs in underprivileged areas, or investing in sustainable practices.

Public benefit corporations can be found in 45 U.S. states and the District of Columbia.

Benefit Corporation Examples

Here is a list of a few examples of public benefit corporations:

- Green Mountain Power: Green Mountain Power is a Vermont-based energy company that uses sustainable practices to generate electricity.

- Tom's of Maine: Tom's of Maine is a natural personal care product company that gives back to society through charitable programs.

- King Arthur Flour Company: The King Arthur Flour Company is a flour company that gives employees paid time off to volunteer in their local community.

- Warby Parker: Warby Parker is a for-profit company that sells eyeglasses at an affordable price and gives a pair of glasses to people in need for every purchase.

- Kickstarter: Kickstarter is a website that allows people to raise money for creative projects.

- Accompany: Accompany is a for-profit business that provides pro bono consulting to nonprofit organizations.

- Stonyfield Farm: Stonyfield Farm is a yogurt company that uses sustainable farming practices.

- AltSchool: AltSchool is a for-profit company that provides affordable, personalized education to children.

- Giving Assistant: Giving Assistant is a for-profit company that allows people to donate to their favorite charities while they shop online.

- Cabot Creamery Co-op: Cabot Creamery Co-op is a dairy company that supports local family farms.

- Laureate Education: Laureate Education is a for-profit company that provides educational opportunities in underserved communities.

- Allbirds: Allbirds is a for-profit company that sells sustainable shoes made from natural materials.

- Divine Chocolate: Divine Chocolate is a chocolate company that supports Fair Trade certified farmers.

- The Tea Spot: The Tea Spot is a for-profit company that provides employment opportunities to cancer survivors.

- Badger Body & Skin Care: Badger Body & Skin Care is a for-profit company that uses natural and organic ingredients in its products.

- Plum Organics: Plum Organics is a for-profit company that makes organic baby food and toddler snacks.

- Patagonia: Patagonia is a for-profit company that makes outdoor clothing and gear from sustainable materials.

What Makes Public Benefit Corporations Unique?

Public benefit corporations are unique in that they must consider the impact of their decisions on society, not just their shareholders.

This means they must balance making a profit with providing a social good.

For example, a public benefit corporation might invest in sustainable practices, even if it means sacrificing short-term profits.

Or, a public benefit corporation might choose to donate money to charity, even if it means not making as much money as possible.

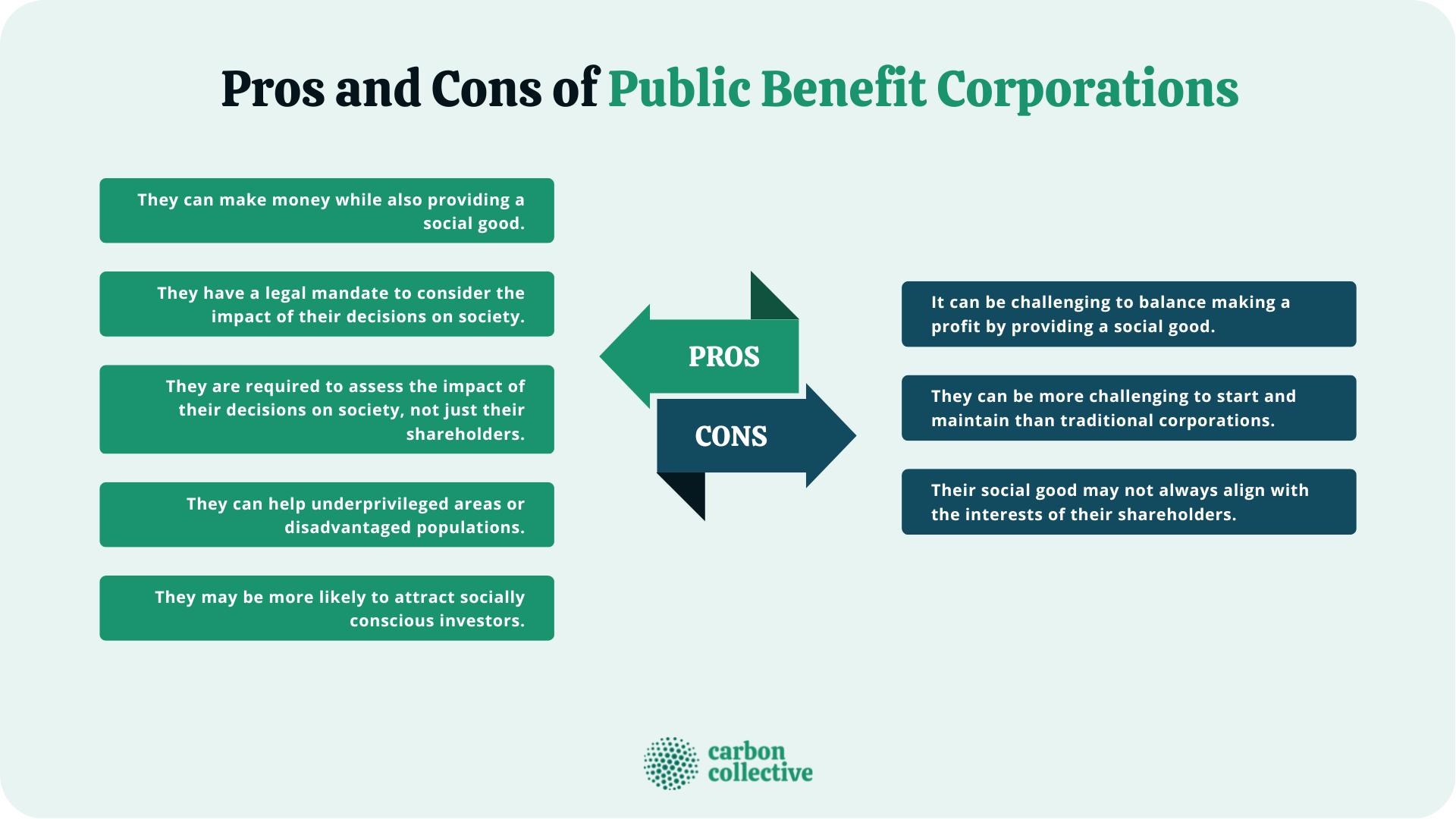

Pros and Cons of Public Benefit Corporations

There are pros and cons to being a public benefit corporation:

Public Benefit Corporations are still a relatively new concept, so there is not a lot of case law yet governing how they operate. This means there is some uncertainty about how courts and regulators will treat them.

Benefit Corporations Eligibility

According to B Lab, benefit corporations must meet the following conditions when starting a business:

- Performance: The companies should score a minimum of 80 points on the B Impact Assessment and file to recertify every three years.

- Accountability: The directors should consider how the company's actions affect all stakeholders.

- Transparency: The companies should publish a public report of social and environmental performance and make it available to the public.

- Availability: Any business except nonprofits can become a benefit corporation, regardless of its country or state of incorporation.

- Cost: The companies should pay certification fees to B Lab. The amount of the fee varies depending on the company's revenue.

Benefit Corporations, Sustainability and Social Responsibility

Many benefit corporations are focused on sustainable business practices. This means that they take into account the environmental and social impact of their actions. This can include things like using recycled materials, reducing emissions, and supporting Fair Trade practices.

Benefit corporations are required to consider how their actions affect all stakeholders, not just shareholders. This means that they take into account the needs of employees, customers, suppliers, and the community. This can result in different business practices than traditional businesses.

Benefit Corporations and Impact Investing

Benefit corporations can attract impact investors. These are investors who are interested in making a positive social or environmental impact with their investments. Impact investing is a growing field and if that is something you are interested in, Carbon Collective can help you build a portfolio where your money can help support the positive changes you are hoping to see.

Benefit Corporations and Taxes

Benefit corporations are taxed the same as any other business entity. The main difference is that they are required to consider how their actions affect all stakeholders, not just shareholders. This may result in different tax strategies than traditional businesses.

The Bottom Line

Public benefit corporations are a unique type of corporation that can make money while providing a social good.

But there are pros and cons to being a public benefit corporation, so it is essential to weigh these factors carefully before deciding if this type of business structure is right for you.

FAQs

1. Are there public benefit corporations in all states?

Public benefit corporations can be found in 35 U.S. states and the District of Columbia.

2. Where can I learn more about public benefit corporations?

It is being taught in some business schools, as well as some high schools that offer MBA programs. You can also visit the Benefit Corporation's website for more information or resources.

3. Can nonprofits register as benefit corporations?

Nonprofits cannot register as benefit corporations, but they can create one.

4. Does being registered as a benefit corporation affect tax?

There are specific provisions in the tax code that apply to benefit corporations. But no, tax status is not directly affected by being a benefit corporation. They are still taxed the same as other corporations. Consult a lawyer for more information about how becoming a public benefit corporation may affect your business legally.

5. How are shareholders' interests protected in a benefit corporation?

The interests of shareholders are protected in the same way as in any other corporation, through state and federal laws. But being a public benefit corporation also requires that the company considers the impact of its decisions on society, not just shareholders. This means that shareholders may not always get what they want in the short term, but they may be more likely to see long-term benefits.