A qualified retirement plan is a specific type of retirement account that offers tax advantages and other benefits.

According to the IRS, "A qualified plan must satisfy the Internal Revenue Code in both form and operation."

This means that qualified retirement plans must meet specific requirements that are outlined in the Employee Retirement Income Security Act (ERISA).

Qualified plans must comply with ERISA's reporting, disclosure, and fiduciary requirements.

A qualified plan is funded through an employer. The most common types of qualified retirement plans are 401(k)s and pensions, but there are many others to choose from as well.

They offer participants different investment options designed to help people save for retirement.

Generally, contributions to a qualified retirement plan are deductible from your income taxes, and earnings on the investments in the account are also tax-deferred until you withdraw them.

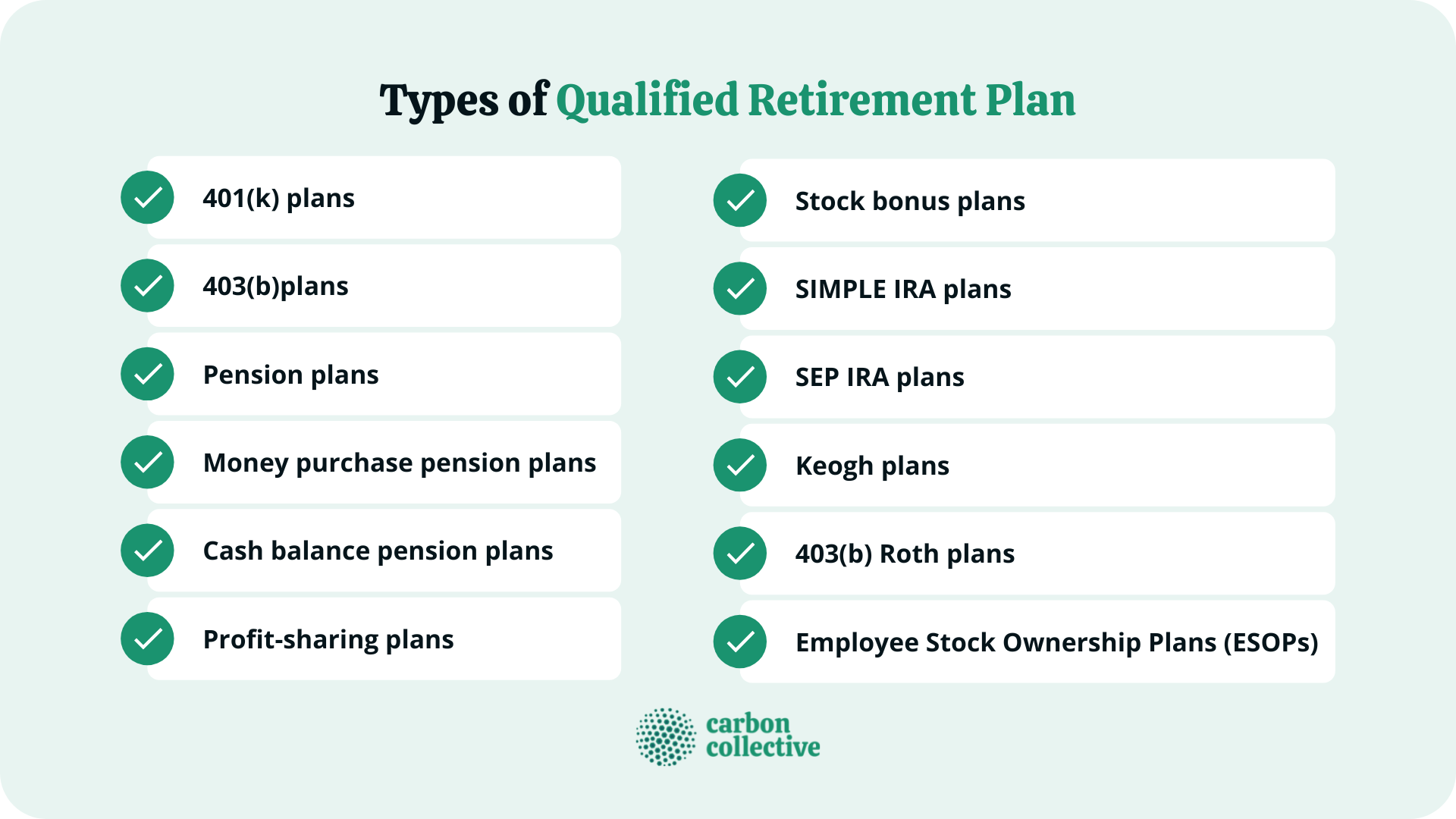

Types of Qualified Retirement Plan

There are many qualified retirement plan types, including:

A 401(k) is a qualified retirement plan that allows employees to contribute pre-tax income to the account. The contributions are not taxed until they are withdrawn, and participants can choose from various investment options.

- 403(b) plans

A 403(b) plan is a qualified retirement plan that allows employees of public schools and tax-exempt organizations to invest in their retirement.

It’s similar to a 401(k), but participants must contribute to the account through payroll deductions.

It is a qualified retirement plan for employees of public schools and other not-for-profit organizations. Similar to 401(k)s, contributions are made pre-tax, and earnings grow tax-deferred.

- Pension plans

A pension plan is a qualified retirement plan that pays periodic income payments after you retire. It’s usually offered by employers, and the contributions are not taxed until they are withdrawn.

- Money purchase pension plans

A money purchase pension plan is a qualified retirement plan in which participants contribute to the account on a regular basis.

The contributions are not taxed until they are withdrawn, and the investments in the account grow tax-deferred.

- Cash balance pension plans

A cash balance pension plan is a qualified retirement plan that allows employees to contribute pre-tax income to the account.

The contributions are not taxed until their withdrawal, and participants can choose from various investment options.

- Profit-sharing plans

A profit-sharing plan is a qualified retirement plan in which employees regularly contribute to the account. The contributions are not taxed until their withdrawal, and the investments in the account grow tax-deferred.

- Stock bonus plans

A stock bonus plan allows employees to own company stock, which can be a valuable asset in retirement.

Contributions to this plan are discretionary but must be substantial and recurring. This means that employers are not required to contribute to the account, but if they do, the contributions must be significant and occur on a regular basis.

- SIMPLE IRA plans

A SIMPLE IRA plan is a qualified retirement plan for businesses with 100 or fewer employees. Employees can contribute to the account on a pre-tax or Roth basis, and the investments grow tax-deferred.

- SEP IRA plans

A SEP IRA plan is a qualified retirement plan for self-employed individuals and businesses of any size. Contributions are made on a pre-tax basis, and earnings grow tax-deferred.

- Keogh plans

A Keogh plan is a qualified retirement plan that allows self-employed individuals to contribute pre-tax income to the account. The contributions are not taxed until they are withdrawn, and participants can choose from various investment options.

- 403(b) Roth plans

A 403(b) Roth plan is a qualified retirement plan that allows employees of public schools and tax-exempt organizations to invest for their retirement. It’s similar to a 403(b), but contributions occur on an after-tax basis, and earnings grow tax-free.

- Employee Stock Ownership Plans (ESOPs)

An ESOP is a qualified retirement plan that allows employees to contribute pre-tax income to the account. The contributions are not taxed until they are withdrawn, and participants can choose from a variety of investment options.

How Does a Qualified Retirement Plan Work?

Qualified retirement plans allow employees to invest a portion of their income in the plan on a pre-tax basis. This reduces their taxable income, which can result in significant savings over time.

Employers may also contribute to qualified plans on behalf of their employees. The amount depends on the type of qualified plan and other factors, such as income and eligibility requirements.

For example, a company may match contributions to a certain percentage or dollar amount each year if you enroll in its qualified retirement plan. You may also contribute more than your employer if you are eligible to do so, or vice versa.

The most common qualified retirement plan is a 401(k). Employees can make contributions on a pre-tax basis into these accounts, which allows them to save money for the future while reducing their taxable income in the present day.

Qualified plans also offer employees different investment options. This allows them to choose the investments that best fit their individual needs and goals.

Employers often match employee contributions, which can help you save more for retirement. Contributions are typically made on a pre-tax basis, which reduces your taxable income in the present day.

You can also choose your investments, which gives you more control over your future.

Qualified Retirement Plan and Investing

When it comes to investing, there are different options available within qualified retirement plans. Employees can choose to invest in stocks, bonds, mutual funds, and other securities.

This allows them to build a diversified portfolio to suit their needs and goals. Additionally, qualified retirement plans allow employees to invest in employer stock. This can be a great way to save for retirement and invest in the company’s future.

Qualified Retirement Plan and Taxes

One of the benefits of qualified retirement plans is that they allow employees to save for the future while reducing their taxable income in the present day. This can result in significant savings, which is why qualified plans are so popular.

For example, a company may match contributions to a certain percentage or dollar amount each year if you enroll in its qualified retirement plan. You may also contribute more than your employer if you are eligible to do so, or vice versa.

Qualified plans also offer employees different investment options. This allows them to choose the investments that best fit their individual needs and goals.

Employers often match employee contributions, which can help them save even more for retirement. Contributions are typically made on a pre-tax basis, which reduces your taxable income in the present day.

You can also choose your own investments, which gives you more control over your future.

Qualified and Non-Qualified Retirement Plans: What is the Difference?

A qualified plan is a retirement plan that meets requirements set forth by the IRS and other regulatory agencies. These plans include 401(k) and 403(b) plans.

Non-qualified retirement plans are not subject to the same requirements as qualified plans and typically offer employees fewer investment options. They also do not provide the same tax benefits as qualified plans.

For this reason, it is crucial to understand the differences between qualified and non-qualified retirement plans before choosing one for your needs.

Types of Non-Qualified Retirement Plans:

Individual-sponsored:

- Traditional IRAs

- Roth IRAs

- Self-directed IRAs

Employer-sponsored:

- 457 plans

- Executive bonus plans

- Deferred compensation plans

The Bottom Line

Qualified retirement plans offer employees numerous benefits, including the ability to save for the future while reducing their taxable income in the present day.

Employees can choose from a variety of investment options, and many employers match contributions. These plans are a great way to secure your financial future.

If you’re looking for a qualified retirement plan, be sure to research your options and compare different plans before making a decision. There are numerous great plans available, and each one has unique benefits.

Be sure to also consult with an accountant or financial advisor to make sure you’re making the most advantageous choices for your particular situation.

FAQs

1. What is the minimum age for a qualified retirement plan?

The minimum age for a qualified retirement plan depends on the type of plan. For 401(k)s, the minimum age is 21. For 403(b) plans, the minimum age is 18.

2. What is the maximum age for a qualified retirement plan?

There is no specific maximum age for qualified retirement plans. However, employees must begin taking required minimum distributions by April of the year following the year in which they turn 73.

3. What is the minimum service requirement for a qualified retirement plan?

The IRS requires the employee to complete one year of service before they are eligible to participate in a qualified retirement plan.

4. How much can I contribute to a qualified retirement plan?

The amount you can contribute to a qualified retirement plan depends on the type of plan and your income level. For 401(k)s and 403(b), the maximum employee contribution is $22,500 in 2023. Whereas, the maximum combined contribution for employer and employee is $66,000.

5. How much can my employer contribute to a qualified retirement plan?

The amount your employer can contribute to a qualified retirement plan depends on the type of plan and your income level. For 401(k)s and 403(b), the maximum combined contribution for employer and employee is $66,000.