Registered Health Underwriter (RHU) Defined

The Registered Health Underwriter designation is a mark of professional excellence in the field of health insurance underwriting that employers and peers recognize.

The American College of Financial Services grants this employment credential to persons who complete a test focusing on the benefits of group and health insurance for individuals and families.

Individuals who earn the RHU designation have demonstrated their commitment to lifelong learning and professional development in the field of health insurance underwriting.

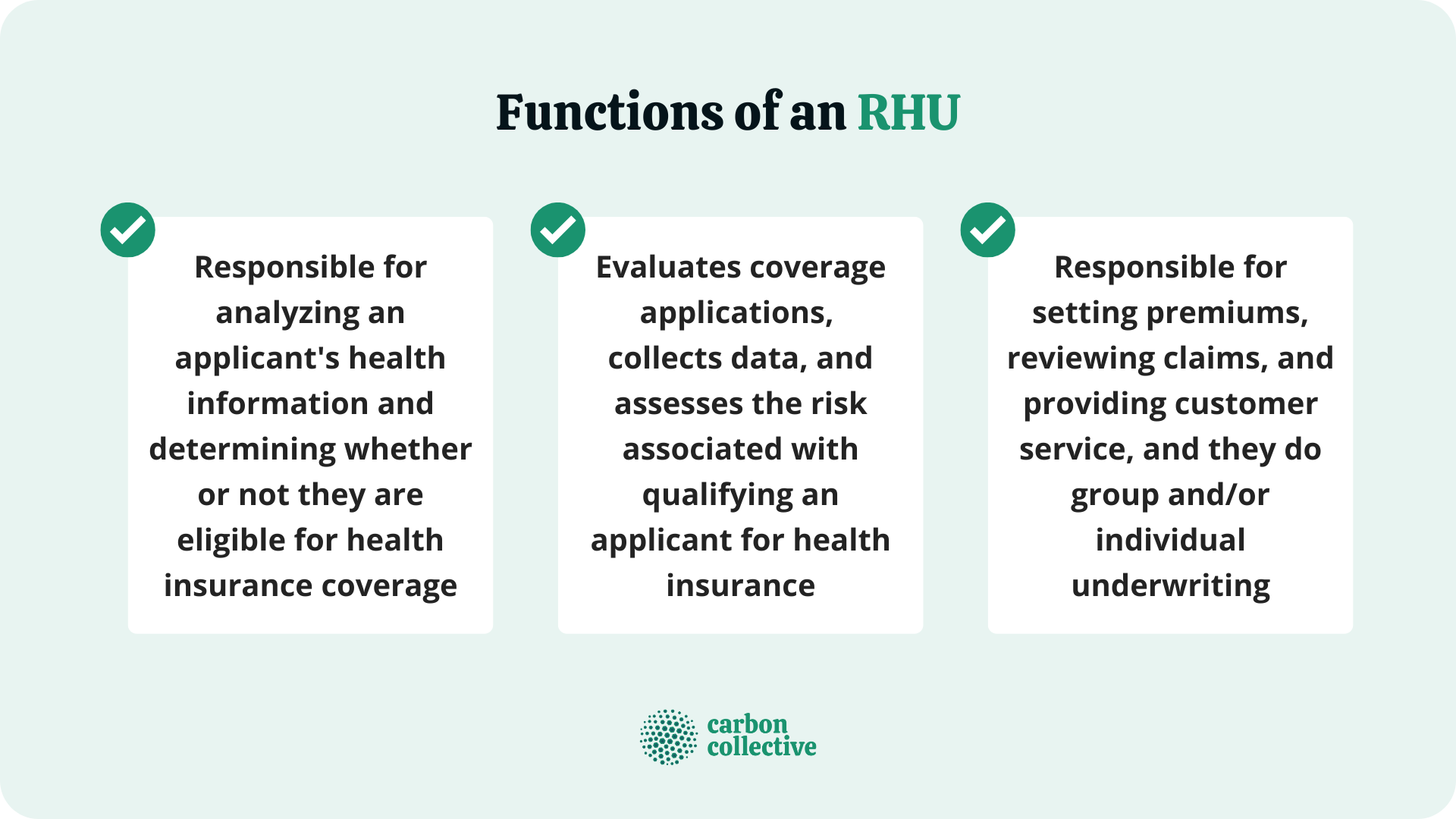

Functions of an RHU

A Registered Health Underwriter is responsible for analyzing an applicant's health information and determining whether or not they are eligible for health insurance coverage.

A Health Underwriter evaluates coverage applications, collects data, and assesses the risk associated with qualifying an applicant for health insurance.

They may also be responsible for setting premiums, reviewing claims, and providing customer service, and they do group and/or individual underwriting.

Eligibility Requirements

A bachelor's degree may be required, and around 2 to 4 years of relevant experience.

RHU applicants who have completed three basic courses and two electives and passed all eight tests of 100 questions in two hours are considered successful.

The RHU training focuses on critical performance protection rules like the Employee Retirement Income Security Act (ERISA), the Consolidated Omnibus Budget Reconciliation Act (COBRA), and the Health Insurance Portability and Accountability Act (HIPAA).

Program Learning Objectives

After finishing this curriculum, the student should be able to:

- Describe the legal requirements and procedures involved in benefits management

- Describe the essential characteristics of generally available group insurance benefit plans, such as relevant rules, contract clauses, marketing, underwriting, rate setting, plan design, and cost reduction

- Describe the essential components of the Affordable Care Act as they apply to group health benefits and ethically counsel clients toward legal compliance while avoiding tax fines and related employment expenses

- Determine the primary characteristics of employer-provided benefits

- Describe the COBRA election process and explain the rules for its determination and payment

- Understand the fundamentals of ethical business operations

- Enumerate the regulations and standards for HIPAA Privacy and Security and ERISA

- Preparations to Become an RHU

The first step is to join The American College of Financial Services as a student member, which provides access to the courses needed to prepare for the Registered Health Underwriter designation.

Prospective students should have a basic understanding of insurance and some experience in the industry, although it is not required.

It is recommended that individuals have at least two years of experience working with health insurance before applying to the program.

Advantages of RHUs

The Registered Health Underwriter designation is a mark of professional excellence in the field of health insurance underwriting that employers and peers recognize.

Individuals who earn the RHU designation have demonstrated their commitment to lifelong learning and professional development in the field of health insurance underwriting.

The RHU designation is one way to demonstrate your professional commitment to the industry and sets you apart from your peers.

Key Takeaways

The Registered Health Underwriter designation is a mark of professional excellence in the field of health insurance underwriting that employers and peers recognize.

Individuals who earn the RHU designation have demonstrated their commitment to lifelong learning and professional development in the field of health insurance underwriting.

The RHU designation is one way to demonstrate your professional commitment to the industry and sets you apart from your peers.

FAQs

1) What is a Registered Health Underwriter?

A Registered Health Underwriter is a professional designation earned by individuals who have demonstrated their commitment to lifelong learning and professional development in the field of health insurance underwriting.

2) How do I become a Registered Health Underwriter?

To become a Registered Health Underwriter, individuals must complete three basic courses and two electives and pass all eight tests of the designation program.

3) What are the benefits of becoming a Registered Health Underwriter?

The RHU designation is one way to demonstrate your professional commitment to the industry and sets you apart from your peers.

4) How long does it take to earn the Registered Health Underwriter designation?

The length of time it takes to earn the Registered Health Underwriter designation varies depending on the individual's prior experience and knowledge in the field of health insurance underwriting.

5) What preparations are needed to become an RHU?

If you want to become a Registered Health Underwriter, the first step is joining The American College of Financial Services as a student member. This gives access to the courses necessary to prepare for the designation. It is also recommended that individuals have at least two years of working experience with health insurance coverage before enrolling in this program.