Residual income (RI), also known as economic profit, is income earned beyond the minimum rate of return. It is among several financial metrics used to assess internal corporate performance. residual income measures net income after all capital costs necessary to make that income have been considered.

In personal finance, residual income is money an individual has left for himself after deducting all of his personal debts and expenses from his total earnings. The formula for residual income is the same, whether the metric is used for personal or business finance

Additionally, residual income serves as a way to track the flow of your earnings. It is also a method of determining a company’s stock value. You calculate a company’s stock value by adding their book value and the current residual income value. residual income measure the profit left behind after you subtract opportunity costs.

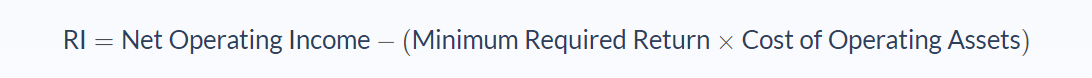

Residual Income Formula

The equation is as basic as it is useful for managers. This is because it concerns one of the crucial indicators of a department’s success: its required rate of return. This metric helps management assess the company’s financial position. Specifically, is the department earning enough cash to expand, sustain, or shut down operations?

Also, residual income is equal to the net income minus the equity charge. This is the equity capital value multiplied by the equity cost (or the equity’s required rate of return). Considering the equity cost, it is possible for a company’s net income to be positive while its residual income is negative.

Essentially this number is an opportunity cost measurement. It is often used to help a company compare departments and decide where to invest capital. For example, if investing in one department gives a 10% return, the other department should earn a minimum of 10% before managers consider investing there. If the other department gives a return lower than 10%, it may be redirected or closed altogether.

The residual income business calculation gives managers a simple way to confirm if an investment they’ve made is reaching its minimums. A positive residual income means the department is earning above its minimum, while a negative residual income indicates otherwise. Managers may also use the residual income alongside the return on investment ratio.

Residual Income Example

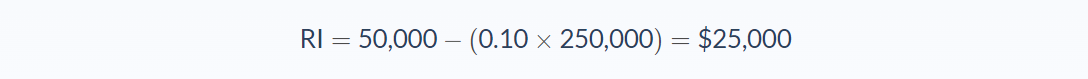

Ethan would like to know how much residual income he’s making from his meat shop. Ethan spent a total of $250,000 to buy meat-cutting machines and other equipment. He has a net operating revenue of $50,000 for the year. He presently earns a return of 10%, so he aims for a minimum required return of 10%. What is Ethan’s Delicatessen’s residual income?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Net operating income: 50,000

- Minimum required return:10%

- Cost of operating assets: 250,000

We can apply the values to our variables and calculate the residual income:

In this case, Ethan’s Delicatessen would have a residual income of $25,000.

This means Ethan has a remaining net income of $25,000 after the capital cost has been deducted. This also proves that his meat shop is earning more than the minimum 10 percent required. As a result, he can use his excess earnings to fund an expansion, pay debts, or distribute dividends to any investors.

Residual Income Analysis

There are varied uses of the residual income as a financial metric. In terms of personal finance, residual income, also known as discretionary income. It refers to earnings or salary that remains after an individual has paid his mortgage, car loan, and other monthly expenses.

Residual income is an important part of personal finance. Banks usually rely on this value to determine if someone can afford a loan. It’s common knowledge that banks check whether or not a loan applicant is earning enough income to cover his current costs, plus a new loan. A high residual income will help a loan application get approved. Likewise, a low residual income will likely lead to a rejection.

The investment community may also define residual income as revenue that comes from a passive source. Simply put, that is a source that keeps the earnings coming without any time or effort directly devoted to it. The investment, by itself, opens up additional channels where income can stream through. Common examples of passive income are royalties, interest and rent. A dividend stock, for instance, will continue generating dividends after a one-time cash investment. There is no need to spend time or resources to make it earn those dividends. It just does by design.

Passive income and residual income, however, two entirely different concepts. Passive income is cash flow made from a passive source. On the other hand, residual income is not actually an income. Instead, it is merely a calculation of how much earnings will be left after all costs have been paid or the minimum rate of return has been met.

Business residual income, on the other hand, is defined as the amount of unused operating revenues after the capital cost required to earn the revenues has been paid. It is thus synonymous with net operating income, or the money that comes in excess of the minimum required return.

Residual Income Conclusion

- The residual income is the net income earned outside the minimum rate of return.

- This formula requires three variables: net operating income, minimum required return, and the cost of operating assets.

- The residual income is usually expressed as a monetary amount.

- Personal residual income is the result of an investment that produces continual profits.

- Residual income is also called “passive income.”

- Corporate residual income is the profit left after all capital costs are paid.

Residual Income Calculator

You can use the residual income calculator below to quickly calculate your company’s income after it meets its minimum rate of return by entering the required numbers.

FAQs

1. What is residual income?

Residual income is income that continues to be generated after the initial labor and operation costs have been paid for. In other words, it's the money you continue to earn from your business investments even once you've already earned back what it cost you to create those assets.

2. How is residual income calculated?

There is a number of ways to calculate residual income, but the most recognized formula is: RI = Net Operating Income − (Minimum Required Return × Cost of Operating Assets) For example, if your net operating income is $3000, the minimum required return is 10%, and the cost of operating assets is $1000, then your RI will be $2000.

3. Is residual income the same as passive income?

No, residual income and passive income are actually two different calculations that can sound similar. Residual Income is used in business contexts and calculates the amount of money an individual makes after their initial work is done, which means it would include things like royalties or licensing fees where you don't have to be present for your money to continue coming in. Passive income is the same thing as residual income, but it's used in personal finance contexts to describe revenue streams that require no effort on a part of the person who generates them in order for them to keep coming in.

4. What are the types of residual income?

Residual income is the result of an investment that produces continual profits. There are three types: (1) Operating Residual Income This type of residual income is created when you own an online business and, as a result, receive monthly checks for your service based on the number of people who use your service during a given month. (2) Royalty Residual Income Royalty residual income is another type of residual income created when you own an online business that uses a recurring billing process for its users or customers, which provides them access to certain features on your website for the life of their membership. (3) Business Residual Income This is the third type of residual income created when you sell or transfer an asset for more than your cost to acquire it.

5. How can I make residual income?

One way to make a residual income is by investing in real estate. You can purchase a house and then rent it out for more than your monthly payment. Another way to make a residual income is through affiliate marketing where you promote other people's products and services on your website, blog, or social media accounts for a percentage of their product sales.