Return on invested capital, or ROIC, is a measurement of a company’s profitability using shareholders’ money. Essentially, it measures a company’s management performance. It examines how the money invested is used to earn additional income.

Investors and company management alike can rely on this value to determine how well the business is being managed, especially in terms of capital utilization. Investors are specifically concerned about this ratio because it indicates whether or not management has been successful in its role. They want to know the return they are making on their investment per dollar.

Remember though that this ratio doesn’t reflect individual asset performance. It just determines the overall return on the money that has been invested in the company. Investors can also use the ROIC when making comparisons of companies within the same industry to see which one is best at making a profit for their respective investors.

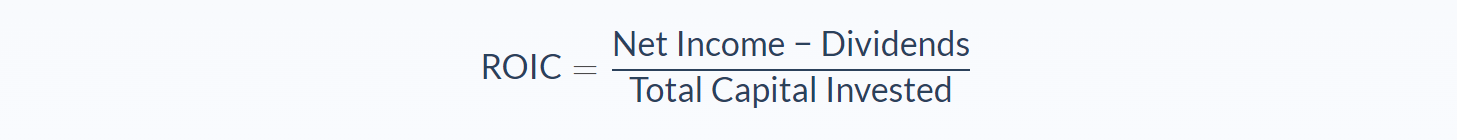

Return on Invested Capital Formula

The formula for calculating ROIC is plain and simple. Investors usually use this equation when measuring the profit they make on their investments and dividends distributed among shareholders. Such dividends should not be included in the net income on the numerator. Also, the denominator should not include all capital but rather only invested capital. This gives investors a clear look into the company’s performance and accurate measurement of their investment’s returns.

Because ROIC measures a company’s returns as a percentage of the invested capital, a bigger return is naturally more favorable than a lower return. It follows that a higher ratio is better than a lower one. A higher ratio means that management is performing better and using shareholders’ and bondholders’ money more efficiently. Such returns may be sourced from any area of operations.

On the other hand, a lower ROIC paints the opposite scenario. The ratio is always obtained as a percentage and is typically indicated as an annualized or trailing 12-month value. It must be considered with respect to the company’s cost of capital to see whether the business is indeed producing value.

If the ROIC is bigger than a company’s weighted average cost of capital (WACC), the most widely used metric for cost of capital, value is being produced and such companies will trade at a premium. A return above 2% of the company’s cost of capital is a typical standard for evidence of value creation. Should a business’ ROIC fall lower than 2%, it is automatically considered a value destroyer. Some companies operate with zero return, and even if they aren’t destroying value, such firms have zero excess capital to reinvest into the business and fuel its future growth.

Return on Invested Capital Example

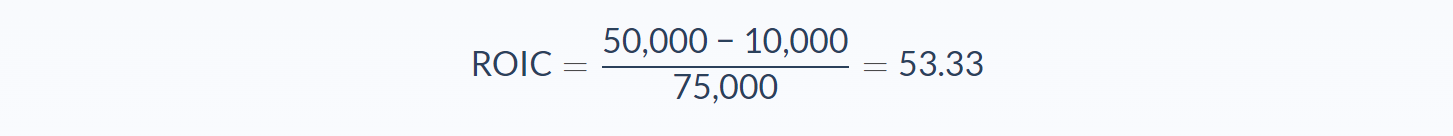

Dave’s Chicken is a small business selling fried chicken and other take-out food. Dave and his partner, Mark, are currently co-owners of the business, but their common friend Rachel is interested to join in. Of course, before she invests any money, she wants to learn more about the business. Rachel finds out that in the prior year, Dave’s Chicken made a Net Income of $50,000, with Dividends totalling $10,000 and Total Invested Capital at $75,000. What is Dave’s Chicken’s ROIC?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Net income: 50,000

- Dividends: 10,000

- Total capital invested: 75,000

Now let’s apply the values to our variables in the formula and calculate the ROIC:

In this case, Dave’s Chicken would have a return on invested capital of 53.33%.

This means Dave and Mark gained 53.33% – or .5333 cents – of each dollar they invested in the business. Keep in mind that to become a true indicator of a company’s performance, this ratio should be compared over a number of years. Management can easily control the number using accounting techniques, like putting expenses under a different period or skipping dividend payments, both of which can influence the ROIC ratio. However, if Rachel wants to be sure about her investing or not investing in Dave’s Chicken, she has to calculate its ROICs over multiple years, look for a pattern, and decide accordingly.

Return on Invested Capital Analysis

The ROIC is among the most crucial and telling valuation ratios a business can use. It is also more important for certain industries than others, such as semiconductor manufacturers, which invest more capital compared to most other types of businesses.

As mentioned, this equation makes no distinction between individual or business investments. Instead, it reflects the state of the business as a whole. It uses the averages of everything to yield the Net Income value. It’s impossible to determine which investments are earning or losing the most money. For instance, management may decide to invest in another existing company or put in money from shareholders to purchase new equipment. This can either boost production or join a new market.

One limitation of this ratio is its inability to provide information as to which section or area of operations is generating value. When Net Income (minus dividends) is used rather than Net Operating Profit After Tax (NOPAT), the result can even be more general. This is because the return comes from an event that only occurs once.

The ROIC gives the context needed for other metrics, such as the price to earnings (P/E) ratio. When considered alone, the number may hint that a company is oversold. But the decrease could be caused by a declining rate at which the business is generating value for shareholders, if at all. Conversely, businesses that constantly generate high returns on invested capital should likely trade at a premium to other stocks, regardless of their seemingly restrictively high P/E ratios.

Return on Invested Capital Conclusion

- The return on invested capital ratio is a measure of management’s efficiency in using a company’s capital to generate revenues.

- This formula requires three variables: Net Income, Dividends, and Total Capital Invested.

- The return on invested capital is often expressed as a percentage.

- These results may be used as a standard for calculating the value of other companies within the same industry.

- If a company’s return on invested capital is higher than 2%, it is creating value; otherwise, it is destroying value.

Return on Invested Capital Calculator

You can use the return on invested capital calculator below to quickly measure your business’ profitability based on the capital invested by entering the required numbers.

FAQs

1. What is the Return On Invested Capital (ROIC)?

Return on invested capital, or ROIC, is a measurement of a company’s profitability using shareholders’ money. Essentially, it measures a company’s management performance. It examines how the money invested is used to earn additional income.

2. How do you calculate the Return On Invested Capital (ROIC)?

The calculation for return on invested capital is: ROIC = Net Income−Dividends / Total Capital Invested

3. What is a good Return On Invested Capital (ROIC)?

Most inventors would consider a return on invested capital of more than 2% to be good. This means that the company is creating value for shareholders.

4. Is ROI the same as the Return On Invested Capital (ROIC)?

No, ROI is different from ROIC. ROI is short for return on investment and measures how much money a company makes on its investments. ROIC, or return on invested capital, is a more specific measurement that considers both the income and the investments of a company.

5. What does the Return On Invested Capital (ROIC) show you?

ROIC shows you how effectively a company is using the money invested by shareholders to generate income. It can help you determine whether a company is creating value for its shareholders or not. For example, a company with an ROIC of 5% is earning more on its investments than a company with an ROIC of 1%.