A risk premium is a return on investment above the risk-free rate that an investor needs to be compensated for investing in higher-risk investments. Put simply, the more risk an investment has, the higher the return an investor needs to make it worthwhile.

It’s also known as the risk premium equation of the default risk premium and is commonly used by investors and finance students who deal with the financial markets. Risk premium is used to calculate how much a potential investor needs to be compensated for taking on extra risk when compared to a lower “risk-free” investment.

Typically, the US treasury bill (T-bill) is used as the risk-free rate in the US, but in finance theory the risk-free rate is any investment which has no risk.

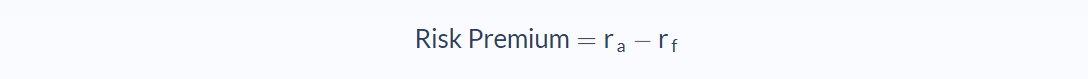

Risk Premium Formula

- ra = Return on asset/investment

- rf = Risk-free return

The risk premium of an investment is calculated by subtracting the risk-free return on investment from the actual return on investment and is a useful tool for estimating expected returns on relatively risky investments when compared to a risk-free investment.

Market Risk Premium

The market’s risk premium is the average market return less the risk-free rate. For shares, the word “market” can be connoted as a whole stock index such as the S&P 500 or the Dow. The risk premium on the market may be shown as:

- Rm = Market return

- Rf = Risk-free return

The market risk is called systematic risk. Unsystematic risk, on the other hand, is the amount of risk associated with a particular investment and is not market-related.

The amount of risk approaches that of the market as an investor diversifies their investment portfolio. The many clichés about diversifying the investment portfolio are extracted from systemic and unsystematic uncertainty and its relationship to returns.

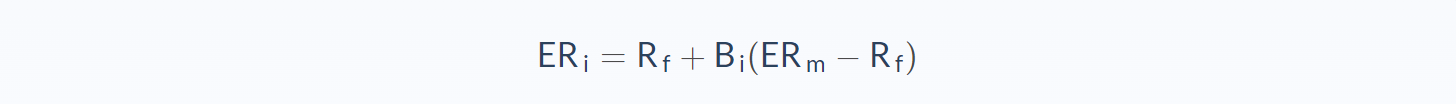

Risk Premium on a Stock Using CAPM

The risk premium for a particular investment using the capital asset pricing model is beta times the difference between market return and risk-free return on investment.

- ERi = Expected return of investment

- Rf = Risk-free rate

- Bi = Beta of the investment

- (ERm – Rf) = Market risk premium

As noted earlier, market risk premium refers to the return on the market minus the return on a risk-free investment and it’s used in CAPM to factor in the systematic risk of an investment

Risk Premium Example

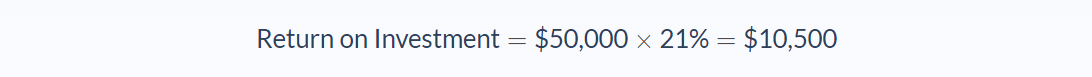

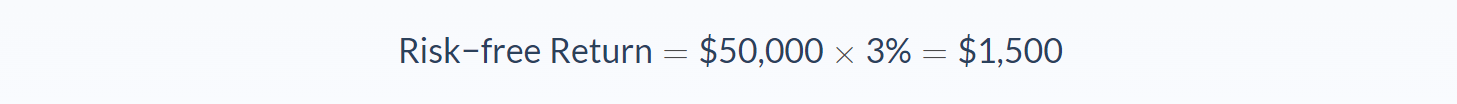

Amy is planning to invest $50,000 in order to get a large return. With the financial crisis, she is very aware of the potential risk and wants to strike an investment balance between risk and return.

She has the option to invest in risk-free investments like the US treasury bond which returns 3% a year, and also has the option to invest in a uranium stock, which is higher risk but has a potential 21% return.

Let’s calculate Amy’s risk premium:

So here we see that Amy has a risk premium of $9,000. This is a rough estimate of expected returns on the risky investment into uranium. It’s important to note that this is completely dependent on the performance of the stock and Amy would need to better understand the risk factors by studying the stock at length to decide whether it’s worth investment and if it can realize the risk premium return of $9,000.

Risk Premium Conclusion

When calculating risk premium, the below points are worth bearing in mind as a quick recap of what it is, why it’s used, and how to use it:

- The risk premium is the return on an investment minus the return on a risk-free investment.

- The market’s risk premium is the average market return less the risk-free rate.

- For shares, the word “market” can be connoted as a whole stock index such as the S&P 500 or the Dow.

- The market risk is called systematic risk. Unsystematic risk, on the other hand, is the amount of risk associated with a particular investment and is not market-related.

- The risk premium for a particular investment using the capital asset pricing model is beta times the difference between market return and risk-free return on investment.

Risk Premium Calculator

You can use the risk premium calculator below to work out your own risk premium by entering the investment amount, the investment rate, and the risk-free rate.

FAQs

1. What is a risk premium?

A risk premium is the extra return on an investment over and above the risk-free rate you would get for investing in Treasury bonds. It is also referred to as "expected excess return".

2. What are the three types of risk premium?

The systematic risk premium, unsystematic risk premium, and country risk premium.

3. Is a higher risk premium better?

No. A risk premium measures the returns on an investment relative to a risk-free investment like US treasury bonds, so it's just about comparing investments with different levels of risk. The higher the risk, the more you should expect in return because there is always a trade off between reward and risk.

4. How does risk premium affect the stock price?

A stock's price is determined by many factors, and how risky it is or what the market expects for its risk premium has a major role in determining the share price.

5. Why does risk premium change?

Risk premium changes with the return of the market. Also, risk factors for investment can change over time and this can affect its required rate of return or its risk premium.