Sales to operating income is an efficiency ratio that is used by companies to see how a company’s net sales compares to its operating income. Financial analysts and company managers can use it to calculate how many multiples of operating income can go into net sales. In other words, it shows how many units of net sales are made per each dollar of operating income.

If the number of net sales is greater than the operating income, then the ratio is considered high. This means that a large percentage of the net sales is used up and does not end up as operating income. However, if the ratio is low, it means that most of the net sales end up as operating income and won’t go towards settling other non-operational expenses.

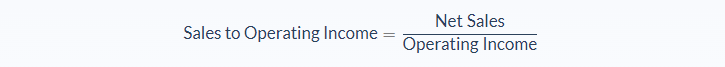

Sales to Operating Income Formula

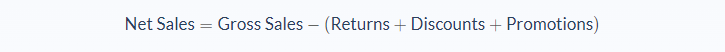

The net sales is the revenue generated after accounting for returns, discounts, promos, and interests during sales. So the net sales is given as the difference between the gross sales and the sum of returns, discounts, promos and interests.

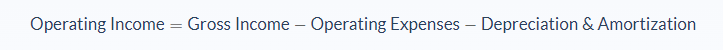

Operating income, on the other hand, is the amount left after the deduction of all direct and indirect costs of production from the sales of goods and services. The indirect costs here include the administrative costs such as rent, utility bills, and other salaries paid to non-production staff.

Note also that the gross income here does not include income from other sources which are not part of the core operations of the company.

If the net sales increases, the sales to operating income ratio will also increase. However, if the operating income increases while the net sales is constant, then the sales to operating income ratio will decrease.

Sales to Operating Income Example

A mobile phone manufacturing company, Lushan, has concluded its fiscal year last month. The total number of phones sold last year were 450,000 at $120 per phone. For the same year, 70 phones were returned as defective within a month of purchase. The cost of production per phone is $50. The total cost of the phones sold is $22,500,000. Total non-production staff salaries for the past year was $10,000,000. Other administrative expenses amounted to $4,000,000. Furthermore, Lushan made an extra $2,000,000 from an investment in another company in the agricultural industry. In preparation for their board meeting, you are asked to calculate the sales to operating income ratio.

To solve this problem, the first step is to collect the data available from the example above.

In calculating the sales to operating income ratio, we need to first calculate the variables. For net sales, we’ll first need to find the gross sales by multiplying the total number of phones sold by the price per phone. So the gross sales is $54,000,000. We can multiply the phones returned by the cost per phone, so the cost of returns is $8,400. Finally, to calculate net sales, subtract the cost of returns from the gross sales.

Next, we need to find the operating income by figuring out the gross income. We can subtract the cost of goods sold from the net sales, making the gross income $31,491,600. Finally, you can subtract the operating expenses from the the gross income, resulting in an operating income of $17,491,600.

- Net sales = $53,991,600.

- Operating income = $17,491,600

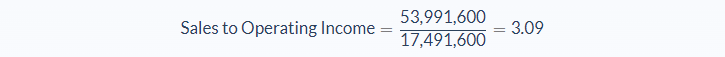

Now we can calculate the sales to operating income ratio using the formula:

The sales to operating income ratio is 3.09. This means that the net sales is about three times the operating income. For every dollar made in operating income, 3 dollars were made in net sales.

Sales to Operating Income Analysis

The sales to operating income ratio is a profitability ratio. It’s used to determine how much of the net sales becomes operating income. It is typically used by companies to compare their performances over time. If a company notices that the sales to operating income ratio is increasing over the years, it means that the company is losing much of its net sales to costs which may be directly or indirectly related to production.

Understanding these results will enable management to seek out new ways to cut down costs. However, if the ratio is decreasing over time, it is an indicator that the company is getting more efficient in converting net sales into operating income, thereby reducing costs. While it is a good indicator, it shouldn’t be the only factor considered. It’s best to view this metric in combination with other ratios and evaluations.

The ratio can further be used to compare companies in the same industry to determine which is more efficient. It is not advisable to use it between companies in different industries as the companies will most likely not have similar profitability factors. If a company is looking to decrease their total sales to operating income ratio, they should begin by attempting to increase sales while decreasing their operating income. They can look for ways to reduce overhead and lower the production cost per product. This should cause a rapid decrease in the sales to operating income ratio.

Sales to Operating Income Conclusion

- Sales to operating income ratio is used to compare the net sales and operating income of a company.

- This ratio requires two variables: net sales and operating income.

- The higher the ratio, the more costs the company has to envelop, causing lower profits.

- A lower ratio means the company has less costs per sale, increasing their profit margin.

- The sales to operating income ratio should not be used to compare companies in different industries as their profitability factors are not the same.

Sales to Operating Income Calculator

You can use the sales to operating income ratio calculator below to quickly calculate the sales to operating income ratio by entering the required numbers.

FAQs

1. What are the sales to operating income ratio?

The sales to operating income ratio is a profitability ratio that determines how much of the net sales become operating income. Financial analysts and company managers can use it to calculate how many multiples of operating income can go into net sales.

2. How is sales to operating income ratio calculated?

The sales to operating income ratio is calculated by dividing the net sales by the operating income. The formula is:

Sales to Operating Income = Net Sales / Operating Income

3. What is a good operating income to sales ratio?

A higher operating margin to sales ratio is good as it indicates that the company is making more money from each sale. The higher the ratio, the more efficient the company is in converting sales into profits. For most businesses, an operating margin higher than 15% is considered good.

4. What is a good operating margin for a nonprofit?

Not-for-profit organizations should aim to have an operating margin of at least 25%. This will ensure that they are making a profit on their operations and are not just relying on donations and grants.

5. How can a company improve their sales to operating income ratio?

There are several ways in which a company can improve their sales to operating income ratio. They can work on increasing their sales while decreasing their costs. This will cause the ratio to go down. Additionally, they can look for ways to reduce their overhead and lower the production cost per product. Doing so will cause the ratio to go down even more.