What Are Sector Funds?

Sector funds are a form of mutual or exchange-traded fund (ETF) that invests in a certain industry.

They offer investors the ability to target a specific market area and potentially provide higher returns than broad-market index funds. However, they carry a higher risk, as sector-specific investments are more volatile.

How Sector Funds Work

Sector funds invest in a specific sector of the economy. They are managed by professionals who aim to outperform the market or a benchmark index that tracks the performance of a particular industry.

Sector funds can be actively managed or passively managed. Active management involves picking stocks that the fund manager believes will outperform the market. Passive management simply tracks the sector index.

By investing in businesses that operate in the sector the fund has selected, sector funds concentrate on a certain portion of the market—one line of company that sells the same or a related product makes up a sector.

The banking industry and the technology sector are two specific industries. Due to economic investing catalysts, some industries may have significant development potential; yet, investing in one industry has a higher risk potential and more volatility since it is a concentrated investment without economic diversification.

Portfolio restrictions on a sector fund will force the portfolio manager to select investments for the fund that is consistent with the fund's primary goal. According to the firm's mission, the investment manager cannot invest in other industries.

Investors may invest in the fund or sector as part of a larger portfolio plan. Thus, the investment manager must inform them if the fund's strategy changes.

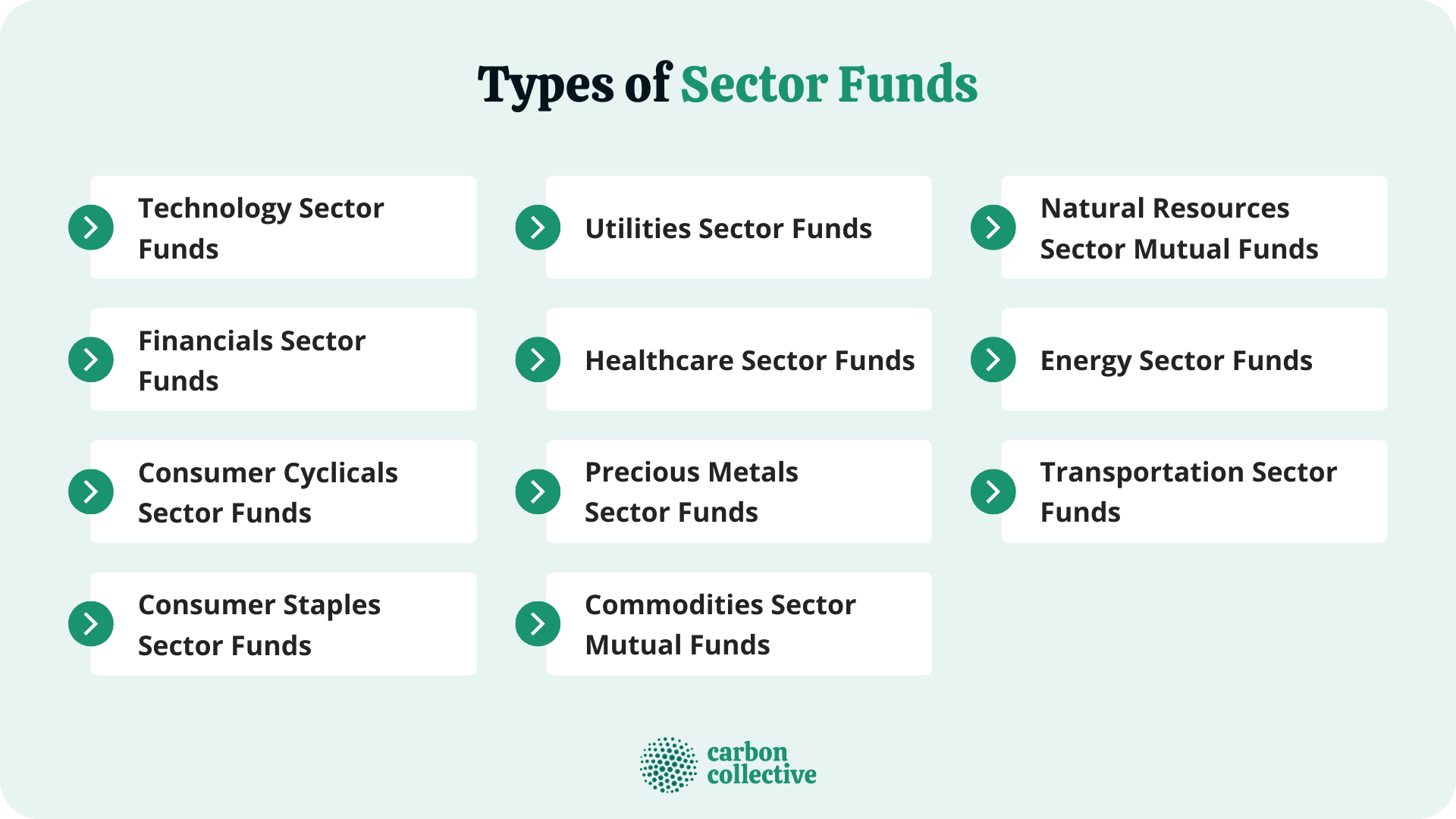

Types of Sector Funds

The market has been explicitly classified into numerous sectors by several organizations.

However, an industry standard known as the Global International Classification Standard (GICS) enables stock analysts to evaluate company valuations, risks, and returns. It also makes it simpler for investors to choose and buy funds representing a certain sector.

Companies are divided into 11 sectors under the GICS, which was created by S&P Dow Jones Indices and MSCI Inc.:

- Technology Sector Funds

- Financials Sector Funds

- Consumer Cyclicals Sector Funds

- Consumer Staples Sector Funds

- Utilities Sector Funds

- Healthcare Sector Funds

- Precious Metals Sector Funds

- Commodities Sector Mutual Funds

- Natural Resources Sector Mutual Funds

- Energy Sector Funds

- Transportation Sector Funds

Who Should Invest?

Sector funds are a good choice for investors who have a strong opinion about the future performance of a particular sector and are willing to take on more risk for the potential of higher returns.

Well-informed and active investors who regularly monitor their investments may be more suited for sector funds. Sector funds are also appropriate for investors with a long-term investment horizon.

Lastly, investors looking to make tactical allocation changes may also find sector funds helpful.

Things to Consider Before Investing

When considering investing in sector funds, there are a few things you should take into account:

Investment Objectives

One should be clear about their investment objectives before investing in these funds. If they want to get the highest return on their sectoral fund investment, they should have an investment horizon of at least five years. It's easy to understand why.

Any industry must have enough time to grow to its peak. As a result, while investing in these funds, you should have long-term objectives in mind, such as retirement or paying for a child's school.

Investment Risks

Sectoral funds are focused investments; thus, your portfolio's diversity is not provided by them.

The risk in your portfolio increases with a decrease in diversity. Sectoral funds are merely constrained inside the boundaries of one sector. They cannot concurrently benefit from other sectors, unlike other equity funds that engage in businesses across several sectors.

Therefore, if the industry is experiencing difficulties, there isn't another investment in your portfolio that can offer you protection. Even if the return potential looks spectacular, the dangers are also substantial.

Exposure Cap

Sectoral funds carry a very high level of risk; thus, you shouldn't give them a lot of weight in your portfolio. The percentage of your portfolio you should invest in sectoral funds should not exceed 5 to 10 percent.

Expense Ratio

You need to be transparent about the costs that reduce your profits. Asset Management Companies charge you a fee known as an expense ratio for managing the sectoral fund you intend to invest in.

This fee is used to pay for the fund's overhead costs, including the fund manager's salary. The fee is assessed annually.

Benefits of Sector Funds

Sector funds offer several benefits, including:

- The ability to invest in specific sectors that have the potential to outperform the overall market.

- Take advantage of emerging trends and changes in the economy.

- The opportunity for higher returns than more diversified mutual funds.

- Determine the underlying holdings in detail.

Risks in Sector Funds

Sector funds also come with several risks, which include:

- Performance is based on a specific sector, which can be more volatile than the overall market.

- Lack of diversification can lead to higher risk.

- Changes in the economy or sector can impact performance.

Bottom Line

Mutual funds that invest in a certain economic area, such as healthcare, energy, or finance, are known as sector funds.

These funds are appropriate for individuals with a long investing horizon who are willing to take on additional risk.

It offers the ability to invest in specific sectors that have the potential to outperform the overall market, but they also come with higher risks.

Before investing in sector funds, be sure to consider your investment objectives, risk tolerance, and exposure limits.

FAQs

1) What is a sector fund?

A sector fund is a mutual or exchange-traded fund (ETF) that invests in a particular economic sector, such as healthcare, energy, or financials.

2) How do sector funds work?

Sector funds invest in a specific sector of the economy and are subject to the same risks and rewards as that sector.

3) What are the different types of sector funds?

There are many sector funds, but the most common are healthcare, energy, and financials.

4) Who should invest in sector funds?

Sector funds are suitable for investors with a long-term investment horizon and the ability to tolerate more risk.

5) What are the dangers of investing in sector funds?

The risks of investing in sector funds include the volatility of the sector, lack of diversification, and changes in the economy.