The Sortino ratio is a measurement of an asset’s rate of return, adjusted for risk. It is based on the Sharpe ratio, which looks at downside deviation to separate bad risk from regular risk.

Essentially, let’s say you have two negative portfolios. In the first, the portfolio went into a negative because of the typical risk from the market. In the second, assets specifically affected the portfolio’s negative direction. Sharpe’s goal for creating the Sharpe ratio was to mathematically confirm whether or not various investments’ returns increased or decreased because of performance or just the market change alone.

Alternately, the Sortino ratio uses an asset’s return and deducts the risk-free rate before dividing the difference by its downside deviation. Developed by famed economist, Frank A. Sortino, this financial metric is very handy for investors, analysts, and portfolio managers when assessing an investment’s return for a particular degree of bad risk.

Since the Sortino ratio’s risk measurement is no more than the downside deviation, it resolves the question of whether or not to use standard deviation or total risk. This is important, considering positive risk is favorable to investors and does not usually bother them. Conservative retail investors, in particular, are more inclined to use this enhanced version of the Sharpe ratio since they are more concerned about their investments’ downside risks.

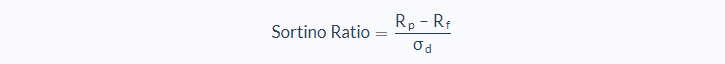

Sortino Ratio Formula

- Rp = actual or expected portfolio return

- Rf = risk-free rate

- σd = standard deviation of negative asset returns (downside deviation)

The Sortino ratio formula takes the difference between the minimum acceptable return and the portfolio’s actual return and divides it by the downside deviation or negative asset returns’ standard deviation. By eliminating the minimum acceptable rate of return, also referred to as the risk-free rate, from the expected return, the degree to which expectations surpass the minimum rate can be determined. Adjustment for the negative returns then becomes possible.

As a variation of the Sharpe ratio, the Sortino ratio formula is pretty simple. It is the user’s job to determine the minimum acceptable return (MAR) breakpoint when measuring downside risk. Two commonly used MAR values are the risk-free rate and a hard-target value such as 0%.

The higher the Sortino ratio, the more favorable it is. Everyone wants a significant excess beyond the risk-free rate, coupled with a bit of downside deviation. In such a case, a big Sortino ratio can be expected. When analyzing Sortino values, the asset class must be taken into account.

Generally speaking, a higher Sortino ratio means the portfolio or investment is doing well, and there is no significant risk of incurring a major loss. In this aspect, this ratio is more accurate than the Sharpe method in assessing an investment’s total risk.

Sortino Ratio Example

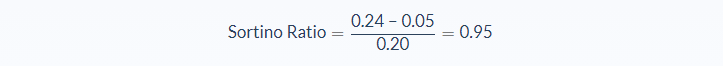

Let’s say a mutual fund would like to see how its 2019 fiscal position has improved compared to its performance a year earlier. It decides to use a number of metrics, including the Sortino ratio. If the mutual fund’s 2019 figures include an annualized return of 24% and a 20% downside deviation, and the risk-free rate is 5%, what is the fund’s Sortino ratio for 2019?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Expected/actual return: 24%

- Risk-free rate: 5%

- Standard deviation of the downside: 20%

We can apply the values to our variables and calculate the Sortino ratio:

In this case, the fund company would have a 2019 Sortino ratio of 0.95.

The fund’s Sortino ratio for 2018 was 0.85, which clearly indicates an improvement in its 2019 figure. However, while it may seem like the mutual fund is doing well on an annualized basis, its returns are still not coming in very efficiently.

Although the risk-free rate of return is generally used, the expected return can also be used for these calculations. The formula will still work correctly as long as there is consistency in the type of return.

Sortino Ratio Analysis

People can rely on the Sortino ratio to measure the return they need to achieve a certain financial goal. For instance, they can use this metric to know how long they have to save money for a down payment, such as when buying a house or a car.

Investors often rely on this value to assess the investments’ risk and performance in mutual funds and similar portfolios. Also, investment managers can use it as a yardstick since it reflects the returns beyond the investors’ minimum acceptable rate achieved for the period.

Another difference between the Sortino ratio and the Sharpe ratio is that the former separates the downside or harmful risk from overall risk. Specifically, the Sortino ratio only punishes returns that dip below a user’s target or desired rate of return. In contrast, the Sharpe ratio penalizes upside as well as downside volatility equally.

The Sortino ratio is better than the Sharpe ratio in several ways, but most especially in measuring and comparing the performance of managers whose programs have skewed return distributions. In any case, when choosing the right ratio, users should decide if they are interested only in downside deviation, or in standard or total deviation. Both ratios are used by investment communities for a whole range of applications.

Like other financial metrics, the Sortino ratio has limitations. For example, because this ratio is only focused on downside deviation, all limitations of the risk automatically apply to the calculation. When it comes to downside deviation, the calculation only becomes relevant when there are enough negative observations.

Overall, today’s markets behave more erratically and in more extreme ways than ever. Still, the Sortino ratio is centered on downside risk and can be more helpful than people can imagine.

Sortino Ratio Conclusion

- The Sortino ratio is a measurement of an investment asset or portfolio’s risk-adjusted return.

- The Sortino ratio formula requires three variables: actual return, risk-free rate of return, and the standard deviation of negative asset returns.

- It is unique from the Sharpe ratio because it only focuses on the downside risk’s standard deviation vs. overall risk.

- The Sortino ratio is believed to offer a more accurate picture of the portfolio’s risk-adjusted performance, assuming the positive risk is favorable.

- As the Sortino ratio only involves downside deviation, every limitation of this measure of risk is instantly carried over.

Sortino Ratio Calculator

You can use the Sortino ratio calculator below to quickly measure your investment asset or portfolio’s risk-adjusted return by entering the required numbers.

FAQs

1. What is the Sortino ratio?

The Sortino ratio is a calculation that measures an investment or portfolio’s risk-adjusted return.

2. How is the Sortino ratio calculated?

The Sortino ratio is calculated by taking the actual return, subtracting the risk-free rate of return, and dividing that number by the standard deviation of negative asset returns.

3. What can the Sortino ratio tell you?

The Sortino ratio can tell you how risky an investment is and its risk-adjusted return.

4. What is a good Sortino ratio?

A good Sortino ratio is anything that is above zero.

5. What is the difference between the Sortino ratio and the Sharpe ratio?

The Sortino ratio only measures downside deviation while the Sharpe ratio measures both upside and downside deviation.