What Is a Stepped-up Basis?

The stepped-up basis pertains to a tax rule allowing a person to adjust the cost basis of an asset or property gained by a beneficiary after death.

A stepped-up basis occurs when the price of an inherited asset on the date of the owner's death is above its original purchase price.

Understanding Stepped-Up Basis

A stepped-up basis readjusts the cost basis of an inherited asset from its purchase price to the higher market value of an asset on the date of the owner's death.

For instance, suppose Sam purchases a share of stock at $2. After his death, the market price of this stock is $15. Sam would be liable for capital gain tax on a gain of $13 as he had sold the stock at $15 before dying.

If the stock is later sold at the price of $15, which was the cost basis of his heir, no capital gains tax would be due. The capital gain tax would have been expected on the rise in the share price from $2 to $15, absent Sam's death is never collected.

Further, the IRS steps up the cost basis of the properties or assets inherited by someone, which means that the IRS sets the original cost basis of any investment asset given to its value when the asset is inherited for capital gains tax.

How Does Stepped-up Basis Work?

Generally, the stepped-up basis is set on the date of death. It implies that the asset's fair market value of the stock or real property on the date of death is the adjusted inherited cost basis.

To take advantage of the stepped-up basis, the heir must keep records documenting the asset's value at the time of death. This can be done by obtaining a professional appraisal or finding comparable sales prices in public records.

The stepped-up basis is essential because when the asset is ultimately sold, the beneficiary will need to report any capital gain or loss.

Assets That Qualify for the Stepped-up Basis

The most common types of assets that qualify for the stepped-up basis are:

- stocks

- mutual funds

- bonds

- businesses

- equipment

- real estate

These assets can receive a stepped-up basis when an investor dies. The fair market value of a particular asset on the date of death becomes the new cost basis for their heirs.

It means that if an heir sells a particular asset at a later date and it has increased in value, they will only be required to pay capital gains tax on the increase in value after the date of death.

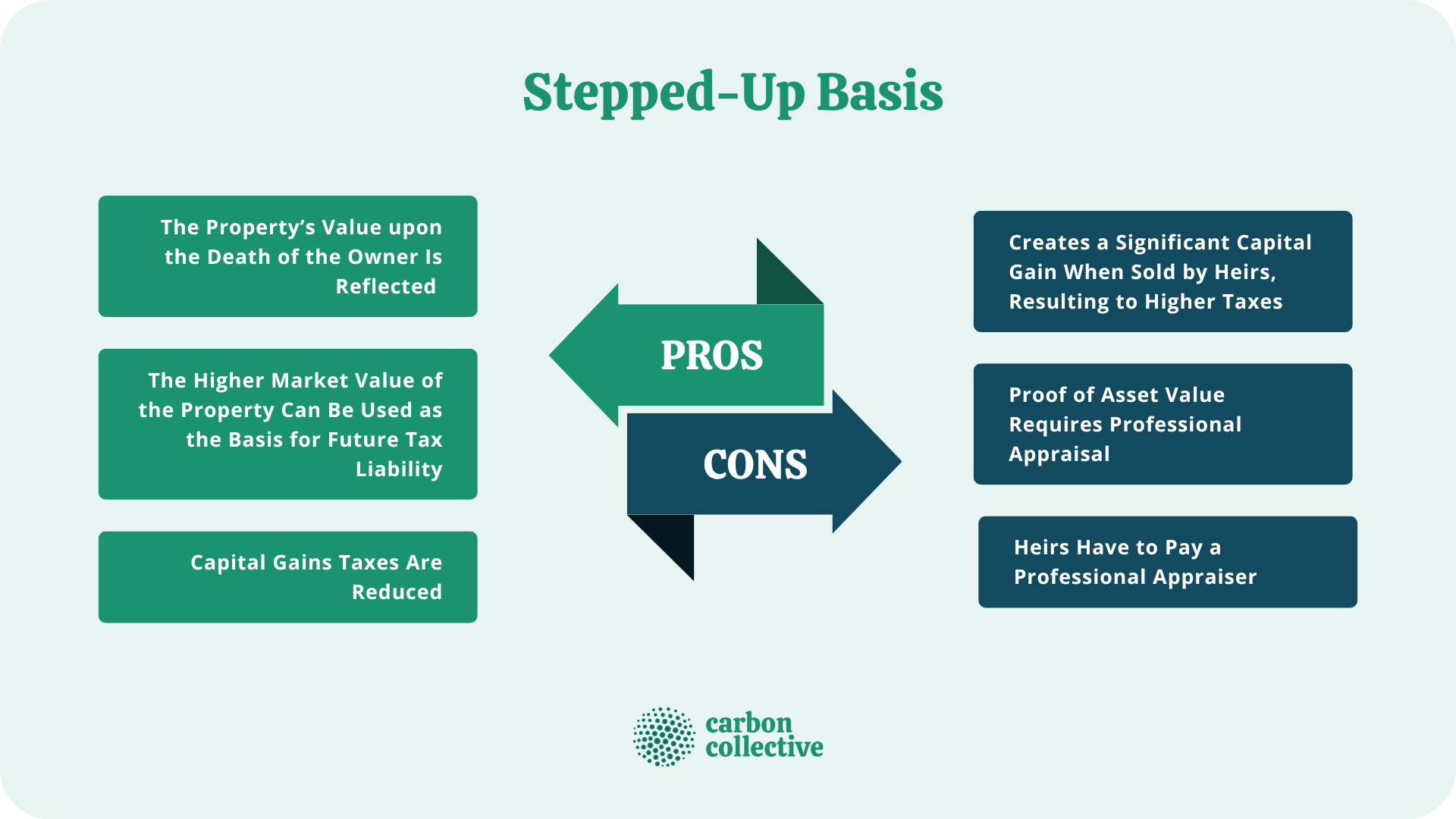

Stepped-Up Basis Pros and Cons

There are some pros and cons to the stepped-up basis which are worth taking into account:

PROS

- A stepped-up basis for the surviving beneficiary is adjusted to reflect the property's value at death.

- The beneficiary would have the chance to utilize the higher market value of the property as their cost basis in the property to compute tax liability in the future.

- When the property basis is stepped-up, the beneficiaries will have fewer capital gains taxes to pay than carrying over.

CONS

- The stepped-up basis can create a significant capital gain when the property is eventually sold by the heir, which may be subject to a higher tax rate.

- It can be challenging to prove the value of an asset at death if there is no professional appraisal or documentation.

- An heir may have to pay for a professional appraisal to take advantage of the stepped-up basis.

Final Thoughts

The stepped-up basis is an essential tool for investors and can be used to minimize capital gains taxes.

It is important to keep in mind that the stepped-up basis only applies to assets that are inherited, not those that are gifted during life.

If you are thinking about passing on assets to your heirs, you must consult a financial advisor to determine the best way.

They can help you understand the stepped-up basis, how it works, and any other tax implications that may be involved.

FAQs

1. What is a stepped-up basis?

A stepped-up basis is when the cost basis of an inherited asset is reset to its current market value. This can be beneficial for heirs because it can minimize their capital gains tax liability in the future.

2. How is the stepped-up basis calculated?

The stepped-up basis is generally set on the date of death. This implies that the asset's fair market value of the stock or real property on the date of death is the adjusted inherited cost basis.

3. What assets may need to be qualified for a stepped-up basis?

Not all assets qualify for a stepped-up basis, including IRAs, pensions, 401(k) accounts, money market accounts, etc.

4. Who can take advantage of the stepped-up basis?

The heir must keep records documenting the asset's value on the date of death to take advantage of the stepped-up basis.

5. What are some of the disadvantages of a stepped-up basis?

Some disadvantages of a stepped-up basis include that it can create a significant capital gain when the heir eventually sells the property, and it may be difficult to prove the value of an asset at death.