A subsidiary is a business that is controlled by another company. In the corporate world, a company that is in control of the subsidiary is usually called the parent or holding company.

Subsidiaries and the parent company are separate legal entities. Both companies have independent liabilities, tax and governance. A subsidiary can thus sue or be sued separately from the holding company.

The parent company needs to own at least 50% of the voting stock in the subsidiary to predominately own and control the subsidiary. If the parent company holds 100% of the equity the subsidiary is called a wholly-owned subsidiary.

Subsidiary Company Structure

As mentioned in the definition a subsidiary is a company that is controlled by another company, companies can gain control over another company through mergers, acquisitions, consolidation and special purpose entities. Let’s look at some quick descriptions:

- Mergers – When a larger company purchases a smaller company and absorbs it, the merging company ceases to exist.

- Consolidation – When you form a completely new company by combining two firms.

- Special purpose entities – Are created by a sponsoring firm for a special purpose or project.

- Subsidiary – has its own identity and existing organizational structure after the acquisition from the parent company.

When a company decides to purchase stock in a different company, they need to decide how much stock they want to purchase. The percentage of stock in a company will determine if the company is a subsidiary, an associate company or a minority passive investment.

- Owning 50% or more of the voting stock will make the company a subsidiary.

- Owning 20% – 50% of the voting stock will make them an associate company.

- Owning 20% or less of the voting stock will make them a minority passive investment.

We are currently looking at entities where the parent company owns majority voting stock and thus has a controlling interest in the subsidiary. After the parent company purchased the subsidiary the parent will receive synergies such as increased tax benefits, diversified risk or assets in the form of earnings, equipment or property.

A parent company has considerable influence over the subsidiaries they can for example decide to dissolve a subsidiary, claim its assets, merge the two companies or elect a company’s board of directors. There are however legal, tax and marketing reasons that could prevent the company from doing that.

If a parent owns a subsidiary in a foreign land the subsidiary must follow the laws of the country where it is incorporated and operates.

Layers of Subsidiaries

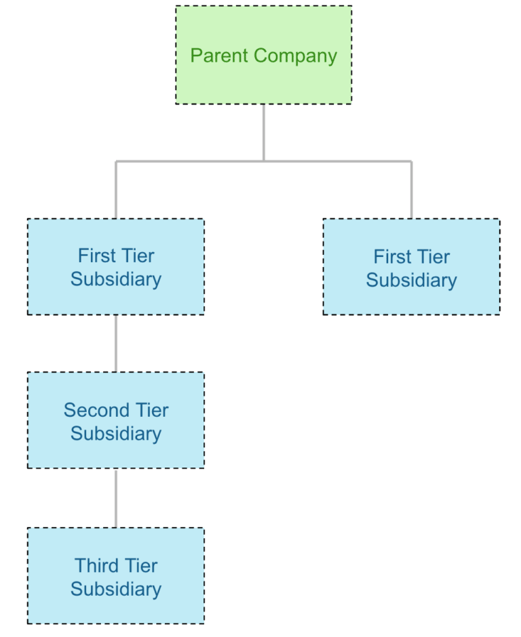

A holding company can have several layers of subsidiaries. The different layers of subsidiaries are called first-tier, second-tier, third-tier and so on. As seen in the image below the parent company owns more than 50% share in two subsidiaries. The one subsidiary, however, owns 50% of a subsidiary making this a second-tier subsidiary for the parent company the same follows for any lower-tier subsidiaries.

Diagram of the subsidiary layers

Diagram of the subsidiary layersFinancial Statements Recording

The holding company and subsidiary information need to be recorded in the financial statements at the end of every financial year. A subsidiary usually prepares its own financial statements and sends them to the parent to consolidate these subsidiaries termed consolidated subsidiaries.

The financial statements help external users to identify the relationship between the different companies. If you have multiple different companies under one parent company the one company could be struggling but the overall holding company could still be profitable due to the other companies in the group.

Wholly owned subsidiaries will be reported on a consolidated set of financial statements even if the two companies are considered separate entities. The parent company wholly owns the subsidiary it is thus an extension of the parent company and in effect the same company.

A parent company can make use of the equity method account when accounting for a majority-owned subsidiary, this method combines both companies’ financial data into a single statement. In combining the statements, it provides a more meaningful view of the company’s financial situation. There are cases like bankruptcy where it is best to not combine the majority-owned subsidiaries data into one set of statements.

Unconsolidated subsidiaries are subsidiaries whose financial data are not included in the holding company’s statements; it is normally firms that the parent company does not have a significant stake in. The investment will be denoted as an asset on the holding company’s balance sheet an associate company is an example of an unconsolidated subsidiary.

The consolidated financial statements of the holding company need to incorporate all subsidiaries of the parent. All intragroup balances, transactions, income, and expenses are eliminated during consolidation. There has to be uniformity in the accounting policies while combining the statements.

Let’s look at how the information is captured in the consolidated income and balance statement:

- The consolidated income statement needs to show all the subsidiary’s income and expenses. All the income that the parent company has no stake in will be deducted from the consolidated income. If the parent company holds more than 80% of the shares in a subsidiary the companies must submit a consolidated tax return.

- In the consolidated balance sheet, the subsidiary’s total assets and liabilities will be documented. The income that the parent company has no stake in will be recorded as a separate line under the equity section. If a parent company pays higher than the fair value, the amount is recorded as Goodwill on the balance sheet as an unidentifiable asset.

Benefits and Drawbacks to Subsidiaries

There are different benefits and drawbacks of owning subsidiaries, let’s start with the benefits of subsidiaries:

Benefits

- Potential losses to the parent company can be limited by using the subsidiary as a kind of liability shield against financial losses or lawsuits.

- The subsidiary structure can also offer tax advantages.

- Subsidiaries can be the experimental ground for different organizational structures, manufacturing techniques, and types of products.

- Subsidiaries are easier to establish and sell.

Drawbacks

- Extralegal, accounting work by aggregating and consolidating financial statements.

- Greater bureaucracy.

- Liability for subsidiary’s actions, debts – A parent company may be held liable for a subsidiary’s criminal actions, or corporate malfeasance, it could guarantee the loans for the subsidiary that could lead to financial losses.

Subsidiary Conclusion

- A subsidiary is a company that is owned by another company

- Companies can be purchased through mergers, consolidation, special purpose entities, subsidiaries

- Companies can hold different percentages of stock in another company and this influences how the company data is recorded in the parent companies’ financial statements. The different percentages are:

- 50% + is considered a subsidiary

- 20% – 50% is an associate company

- Less than 20% is a minority passive investment

- You get different tiers of subsidiaries seeing that a subsidiary can also own shares in a different company.

- Financial information for subsidiaries is recorded as follows:

- A wholly-owned subsidiary and majority-owned subsidiaries are consolidated with the parent company and reported as a single set of statements

- Associate and minority passive investments are not consolidated, the values are recorded under equity on the balance sheet.

- There are benefits and drawbacks to owning subsidiaries:

- Benefits

- Limited losses

- Tax advantages

- Experimental structure

- Easy to establish and sell

- Drawbacks

- Extralegal and accounting work

- Greater bureaucracy

- ▪ Liability for the subsidiary’s actions

- Benefits

FAQs

1. What is a subsidiary?

A subsidiary is a company that is owned by another company. In a corporate structure, a company that is in control of another company is called the parent company, and the controlled company is called the subsidiary.

2. What are the types of subsidiaries?

There are three types of subsidiaries:

-

Wholly-owned subsidiaries – these are subsidiaries in which the parent company owns all the shares.

-

Majority-owned subsidiaries – these are subsidiaries in which the parent company owns more than 50% of the shares.

-

Minority-owned subsidiaries – these are subsidiaries in which the parent company owns less than 50% of the shares.

3. Is a branch a subsidiary?

A branch is not a subsidiary. A branch is an office or agency of a company that is in a different place from the main office. Let's say you have a company with an office in New York and a branch in Chicago. The company would be considered to have two branches, one in New York and one in Chicago.

4. What is an example of a subsidiary?

An example of a subsidiary would be the company that Starbucks owns, Seattle's Best Coffee. Seattle's Best is a subsidiary of Starbucks because it is owned by Starbucks.

5. What is the purpose of a subsidiary company?

The purpose of a subsidiary company is to help the parent company achieve its goals. A subsidiary can help the parent company by performing different tasks, such as manufacturing products, distributing products, or providing services.

In addition, a subsidiary can help the parent company by acting as a test market for new products or organizational structures.