Time value of money can be calculated a number of ways—using tables, formulas, spreadsheets, and financial calculators. Financial calculators are relatively inexpensive, easy to use, and versatile; performing additional functions besides calculating time value of money.

When using a financial calculator to determine time value of money, it is most efficient to follow an orderly procedure. The Time Value of Money Solution Grid can assist in achieving that orderly process.

Although there are several choices available when selecting a financial calculator, most have the same basic time value of money functions and most are laid out in the same basic fashion. So no matter the calculator, using the Time Value of Money Solution Grid can help achieve consistent positive results.

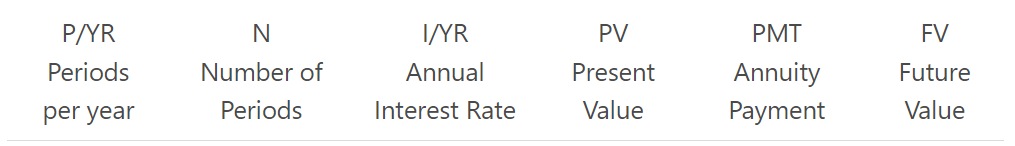

Time Value of Money Solution Grid

Financial Calculator Fundamentals

Even though the primary purpose of this overview is the discussion of the Time Value of Money Solution Grid, before getting to that, it is important to discuss some basic features of the financial calculator.

Shift Key

To begin, notice on your calculator keypad that many keys have a dual purpose, very similar to a standard computer keyboard. In the case to the HP 10bII+, the secondary key function is typically distinguished as being orange in color. Then notice that there is a key in the left column of the keypad indexed with the same color. This key in the left column is the SHIFT key . To select a key’s secondary function, first press the SHIFT key , then press the desired secondary key.

For instance, notice on the bottom row of keys, between the 0 key and the = key, there is the decimal · key. If you first press , then press ·, you will set the calculator to reflect the ,/· setting, which toggles between US (1,000.00) and EUR (1.000,00) display.

Example

Concerning Decimals

Your calculator was most likely set to 2 decimal places. However, you may want to change the number of decimal places it displays. Notice on the bottom row of keys, under =, is DISP. Press DISP, then simply enter the number of decimal places you wish to display.

- To show four decimal places, press: DISP 4

- To return to two decimal places, press: DISP 2

Clearing

It’s important to be diligent in clearing your calculator. To help understand this process, you have to remember that your calculator is not a sophisticated computer. It is a much more manual device and you have to do a lot of the “thinking” for it. So when you input information, think of it as inputting information into separate “registers.” You have to manually clear those registers one way or another.

Notice C towards the bottom left of the keypad. C clears out your last input. Now notice under C is C ALL, which stands for “Clear All.” In time value of money and certain other applications, C ALL clears out all the work in a given set.

- To clear last input, press: C

- To clear all the work in a given set, press: C ALL

The Time Value of Money Keys

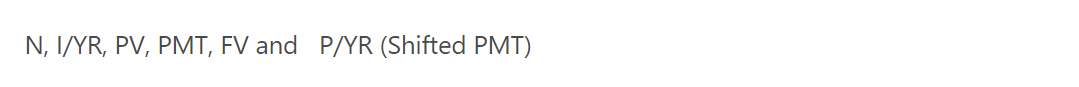

For most functions, the time value of money keys are along the top row of the keypad. Note the keys:

- N = Number of Periods

- I/YR = Annual Interest Rate

- PV = Present Value

- PMT = Annuity Payment

- FV = Future Value

- P/YR = Periods per Year

If the calculation involves annual interest, P/YR would be one;

semiannual interest, P/YR would be two;

quarterly interest, P/YR would be four;

monthly interest, P/YR would be 12; and so on.

The Solution Grid

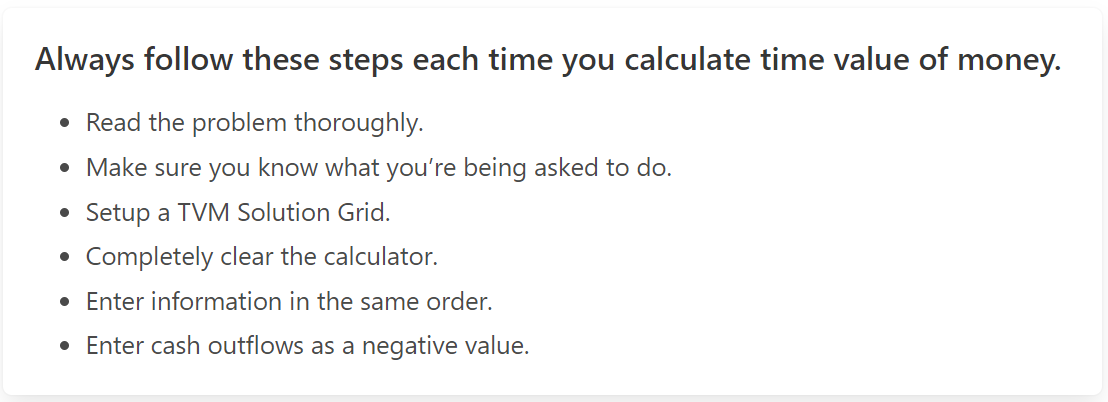

When using the Time Value of Money Solution Grid, the primary objective is to establish an orderly procedure when calculating time value of money, and to follow that procedure diligently. Read the problem, make sure you are clear about what you’re being asked to do, and then set up a solution grid.

A solution grid is simply a matrix with columns representing the time value of money components. Set up the grid the same way each time with the TVM components always in the same location, then jot down known values into the appropriate grid cells and solve for the unknown.

Time Value of Money Solution Grid

Using the Solution Grid

Problem 1

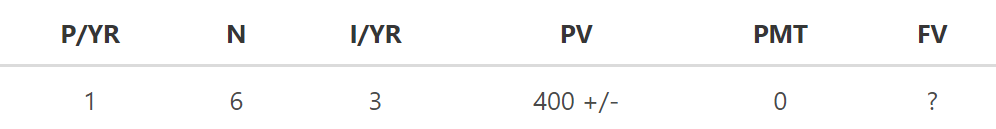

How much will you have in 6 years if you deposit $400 today at 3% interest compounded annually?

Steps

- Read the problem thoroughly. Don’t rush. This problem is pretty simple, but other problems may have more information that will have a bearing on the solution. Sometimes one word will change the solution.

- Make sure you know what you’re being asked to do. In this problem you’re being asked to find a future amount by making a cash outflow today.

- Prepare a solution grid. With a pencil and some paper, make note of the inputs you will be entering into your calculator. Literally jot down the TVM components as column headings and fill out the known data inputs that you derive from the problem. This can keep you from making mistakes. It also gets you in the habit of inputting information into your calculator in the same order every time. That way you may not make as many errors and may not skip over as many steps as you might otherwise. In this case, the solution grid is:

- There are several items you should note:

- First, note that P/YR is isolated from the other TVM components in the solution grid. This is to remind you to always set Periods per Year (P/YR) on your calculator before inputting any other TVM components. In this problem you are told interest is compounded annually. Therefore, set 1 P/YR.

- Note that you do not enter a percent sign for the interest rate (I/YR).

- Notice that your initial deposit is a cash outflow, so you will represent that by entering 400 into the calculator, then pressing +/−. This changes the sign of the $400 and means that your future amount will be a cash inflow. You should always enter cash outflows as a negative value.

- There was no annuity in this problem. However, a 0 will be entered in the PMT field to ensure that nothing will be carried forward from a previous problem, just in case you forget to clear the calculator. This is just a good habit to form.

- You are solving for the future amount. Put a ? in the FV field of your solution grid. Then when you enter your data into the calculator, you will enter all the other data in the order shown in the grid. In this problem you will press FV last, and the answer should appear.

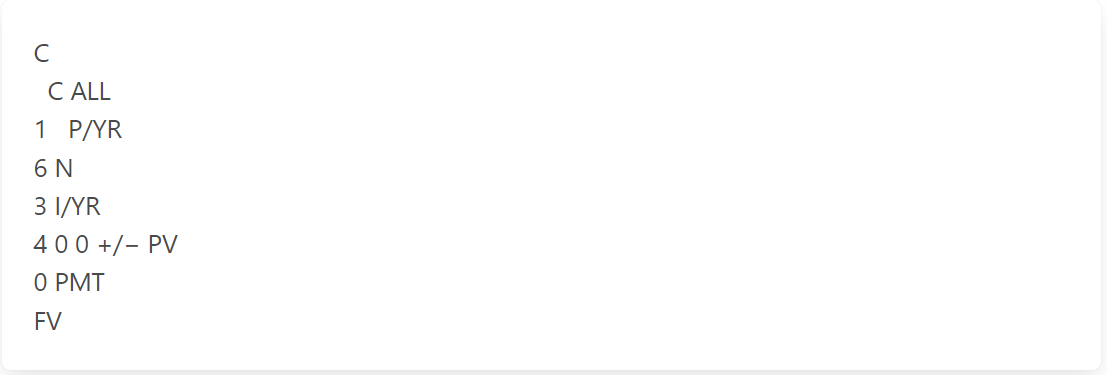

- Clear the calculator. You should do this every time you work a new problem, by pressing C ALL.

- Now that you have completed your solutions grid, enter all information in your calculator in the order laid out in the grid.

The answer is: $477.62 and the calculator keystrokes will be:

Problem 2

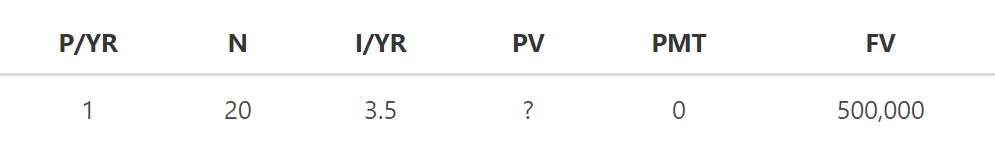

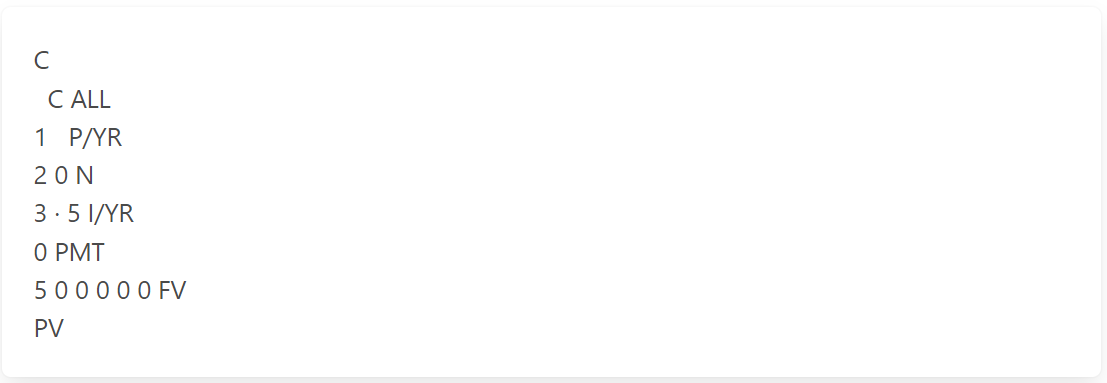

How much would you have to deposit today in order to have $500,000 in 20 years? Assume you can earn annual interest of 3.5%.

Steps

- Read the problem thoroughly.

- Make sure you know what you’re being asked to do. In this problem you’re being asked to determine how much you would need to deposit today to meet a specific amount in the future.

- Prepare a solution grid. In this problem you are told nothing about intra-year compounding, so assume annual compounding. Therefore, set 1 P/YR.

- Clear the calculator.

- Enter all information in your calculator in the order laid out in the grid.

The answer is: $251,282.94 and the calculator keystrokes will be:

The answer is displayed on your calculator as a negative value, which indicates that you would have a cash outflow in the present to receive a cash inflow in the future. Remember that cash outflows should always be a negative value.

Problem 3

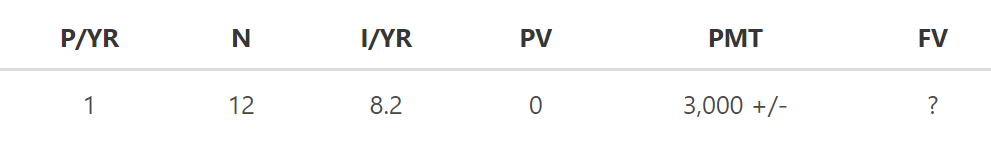

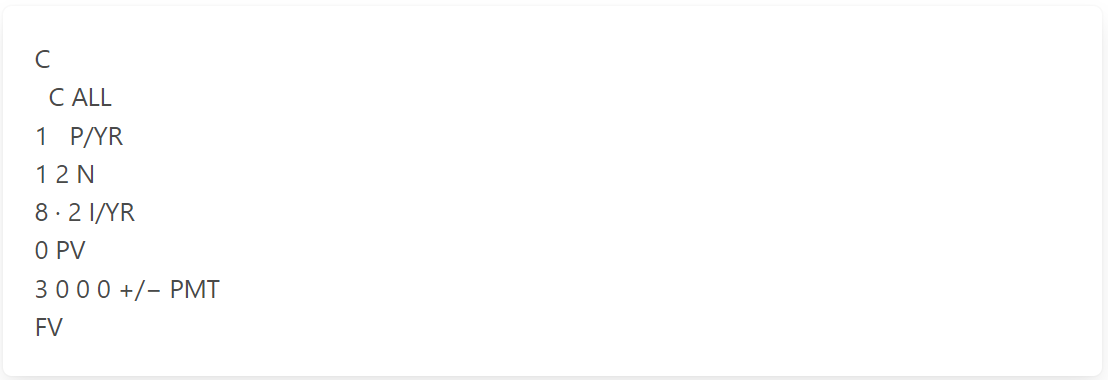

If you deposit $3,000 per year for 12 years and earn 8.2%, how much will you have saved?

The solution grid:

The answer is: $57,611.08 and the keystrokes are:

Problem 4

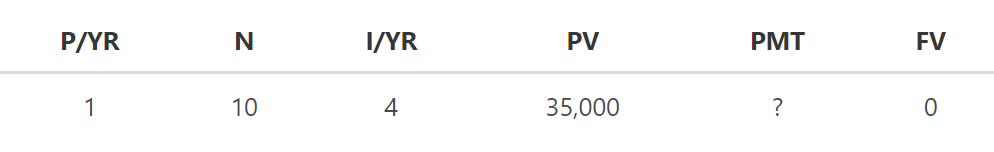

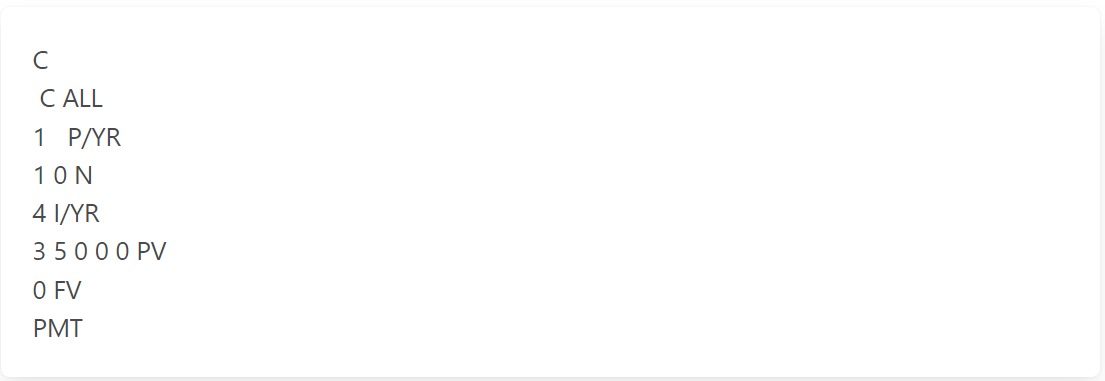

If you borrow $35,000 and make 10 annual payments at 4% interest, how much will those payments be?

The solution grid:

The answer is: $4,315.18 and the calculator keystrokes are:

Again, the answer is displayed as a negative value since the annual payments represent cash outflow.

Problem 5

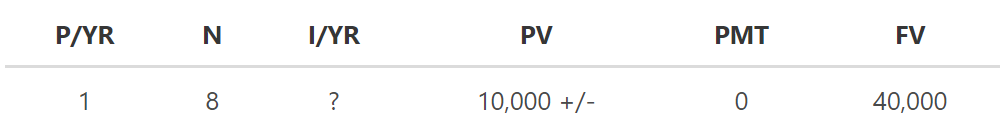

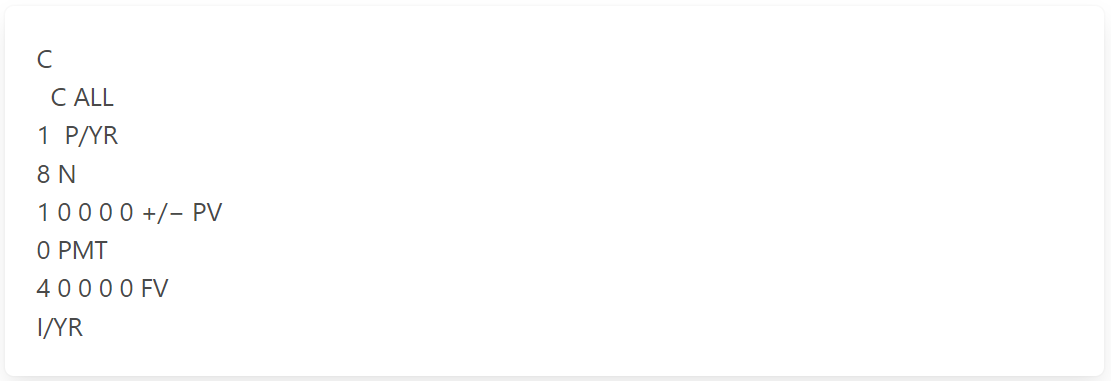

If you invest $10,000 today and want to have $40,000 in 8 years, what rate of interest will you have to earn?

The solution grid:

The answer is: 18.92% and the keystrokes are:

Remember that you have to identify your cash inflow and outflow. Should you forget, your calculator will return “no Solution” instead of the answer.

Problem 6

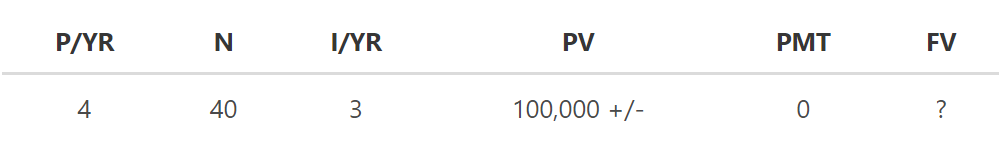

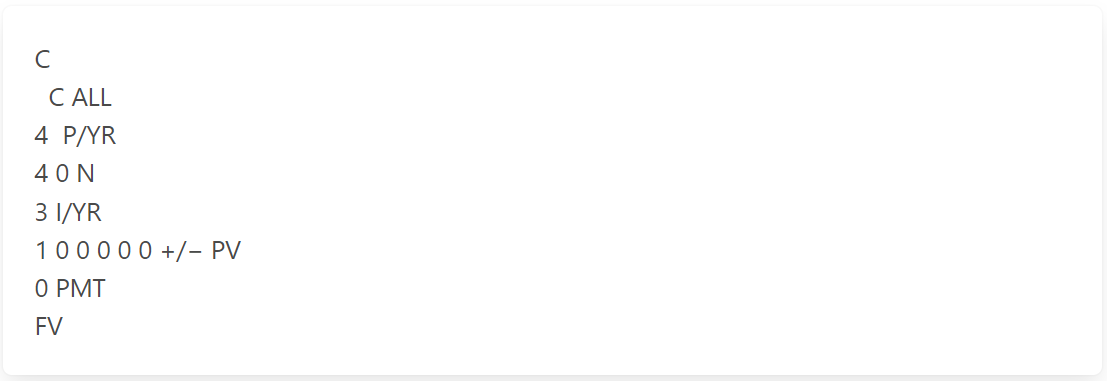

You deposit $100,000 today and can earn 3% interest, compounded quarterly. How much will you have in 10 years?

This problem is a good example of why you should read the problem thoroughly, and make sure you know what you’re being asked to do.

Notice that interest is compounded quarterly. As discussed earlier in this overview, when setting Periods per Year, if the calculation involves annual interest, P/YR is one. For semiannual interest, P/YR is two. For quarterly interest, P/YR is four, and for monthly interest, P/YR is 12. So in this case, P/YR is four.

Also, since interest is compounded quarterly, or four times annually, the number of periods has to be adjusted. This is done by multiplying the number of years (10) by the times per year interest is compounded (four). So in this case, N is 40.

The solution grid:

The answer is: $134,834.86 and the keystrokes are:

Annuity Due

Annuity due refers to annuities received or paid at the beginning of the year. These are distinguished from ordinary annuities, which are end-of-year cash flows. In most situations, annuities are assumed to be end-of-year. So unless you are told that the annuity is beginning-of-year, assume that it is an ordinary, end-of-year annuity. All of the problems in this overview thus far have involved end-of-year annuities. But now we will discuss calculating annuities due.

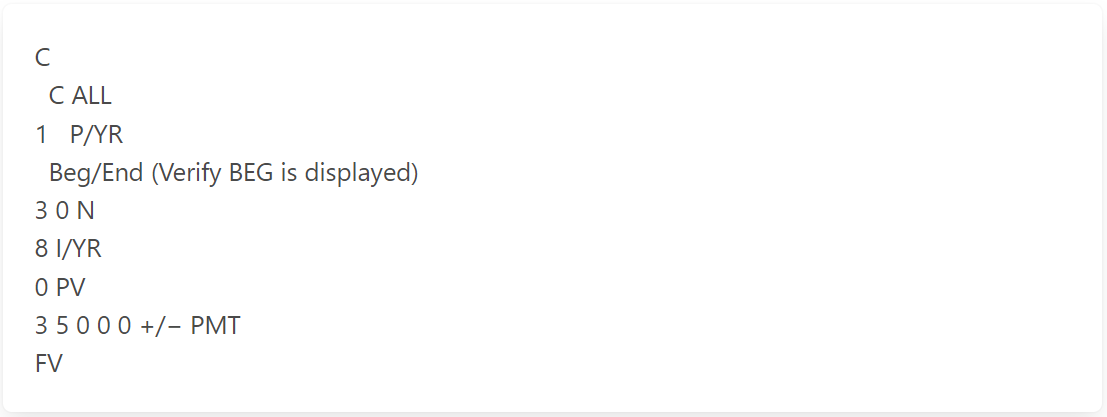

Notice at the right of the second row on the calculator keypad, the key Beg/End. This key toggles between the calculator’s Begin and End mode, and is used to set beginning-of-period and end-of-period. Press Beg/End a couple of times and notice in the calculator display that BEG appears when the calculator is set for beginning-of-period and, conversely, is clear when set for end-of-period.

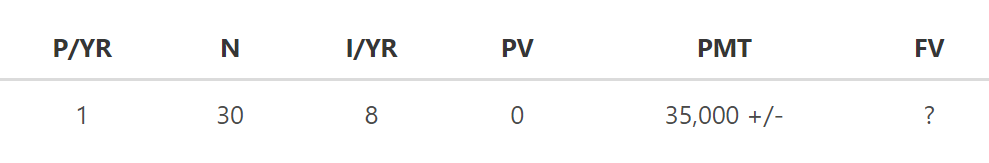

Problem

If you deposit $35,000 the beginning of each year for 30 years and earn 8%, how much will you have saved?

The solution grid:

The answer is: $4,282,105.38 and the keystrokes for the calculator are:

Now, press C ALL to clear the calculator, and notice that BEG is still displayed. Just like P/YR, Begin and End mode is a setting of the calculator and is not affected by clearing the calculator’s registers. So once Begin mode is set, anytime you work an annuity problem, you will be calculating the cash flows from the beginning of the period. To set the calculator back into End mode, simply press Beg/End until BEG clears from the calculator display.

Additional Problems

The key to mastering any technique is practice. Additional problems are available to help achieve that objective.

Working through the additional problems, keep in mind the importance of consistency. As suggested in this overview, establish an orderly procedure and follow that procedure diligently. A challenging component of calculating time value of money is understanding the problem. It is important to parse the question carefully so that you’re confident of what you are being asked to do.

Remember these steps:

- Read the problem thoroughly.

- Make sure you know what you’re being asked to do.

- Prepare the TVM Solution Grid.

- Completely clear the calculator.

- Enter all information in your calculator in the order laid out in the grid.

- Cash outflows are negative values.

This overview was developed by Dr. Sharon Garrison.

No adaptation of its content is permitted without permission.

FAQs

1. What is time value of money solution grid?

The time value of money can be calculated in several ways—using tables, formulas, spreadsheets, and financial calculators. The Time Value of Money Solution Grid can assist in achieving that orderly process.

2. What does time value of money solution grid ensure?

The time value of money solution grid helps ensure accuracy and consistency in the time value of money calculations. It also assists in problem-solving by providing a step-by-step guide to the solution.

3. Why is it important to be consistent in time value of money calculations?

Time value of money calculations is used to make important financial decisions. Inconsistent calculations can lead to inaccurate results and potential financial losses.

Let's say, for instance, you're considering taking a loan. You might use the time value of money calculations to decide what your monthly payments would be. If the calculations are done incorrectly, you may end up paying more for the loan than you need to, or you may not qualify for the loan at all.

4. What are the steps in calculating for time value of money using the solution grid?

The steps in calculating for TVM using the solution grid are:

1) Read the problem thoroughly.

2) Make sure you know what you’re being asked to do.

3) Prepare the TVM Solution Grid.

4) Completely clear the calculator.

5) Enter all information in your calculator in the order laid out in the grid.

6) Cash outflows are negative values.

5. Why are cash outflows negative values?

Cash outflows are negative values because they represent money leaving the account. Put it another way: the money is being spent and therefore the value of the account decreases.