What Is a Trust Fund?

A trust fund refers to an arrangement in which a trust is created, and one or more designated people hold the assets of another person. The holder manages these funds for the benefit of a third party, called the beneficiary.

The trust fund arrangement offers a high degree of privacy and can manage a wide variety of assets.

A trust fund is a financial instrument that allows you to set aside money for a specific purpose.

You can use a trust fund to save for retirement, pay for your child's education, or provide income for yourself. There are many different types of trust funds, each with its own set of rules and benefits.

How Do Trust Funds Work?

A trust fund is a legal arrangement in which one person, the trustee, holds assets for the benefit of another person, the beneficiary.

The trustee can be an individual or a corporation. The trustee has a legal duty to manage the trust assets for the benefit of the beneficiary.

A trustee manages the trust fund and makes decisions about investing the money and what expenses can be paid from the fund.

The beneficiary (the person who will receive the benefits from the fund) has no control over what the trustee does with the money.

Trust funds are often used to pay for education or other expenses, such as medical care.

The trust fund is set up by a grantor (the person who sets up the fund) and can be changed at any time by the grantor or beneficiaries with written permission from all parties involved in the trust.

The trustee can invest the trust assets in numerous ways, including stocks, bonds, real estate, and mutual funds. The trustee must follow the rules in the trust agreement regarding how to invest the trust assets.

The trustee must also follow the rules in the trust agreement regarding what expenses can be paid from the fund and what distributions to make to beneficiaries.

The trustee can invest the trust assets however they want, but they cannot give themselves or anyone else a salary from the trust.

How Do I Start a Trust Fund?

If you want to start a trust fund, you will need to work with an attorney. The attorney can help you set up the trust and choose a trustee.

The grantor (the person who sets up the trust) is responsible for funding the trust. The grantor can contribute money to the trust at any time or use assets, such as stocks, bonds, and real estate, to fund the trust.

The grantor can also choose what assets will fund the trust. The trustee must follow the rules set up by the grantor regarding what assets can fund the trust and what expenses can be paid from it.

Revocable Trust Funds vs Irrevocable Trust Funds

A trust can be set up as a revocable trust or an irrevocable trust. A revocable trust can be changed at any time by the grantor. An irrevocable trust cannot be changed after its creation.

The trustee of a revocable trust is responsible for managing the assets and making decisions about what expenses can be paid from the trust.

The trustee of an irrevocable trust only manages the assets and cannot make any decisions about what expenses can be paid from the fund. They manage the assets, but they are not personally liable for them if something happens to one of the assets in the trust fund.

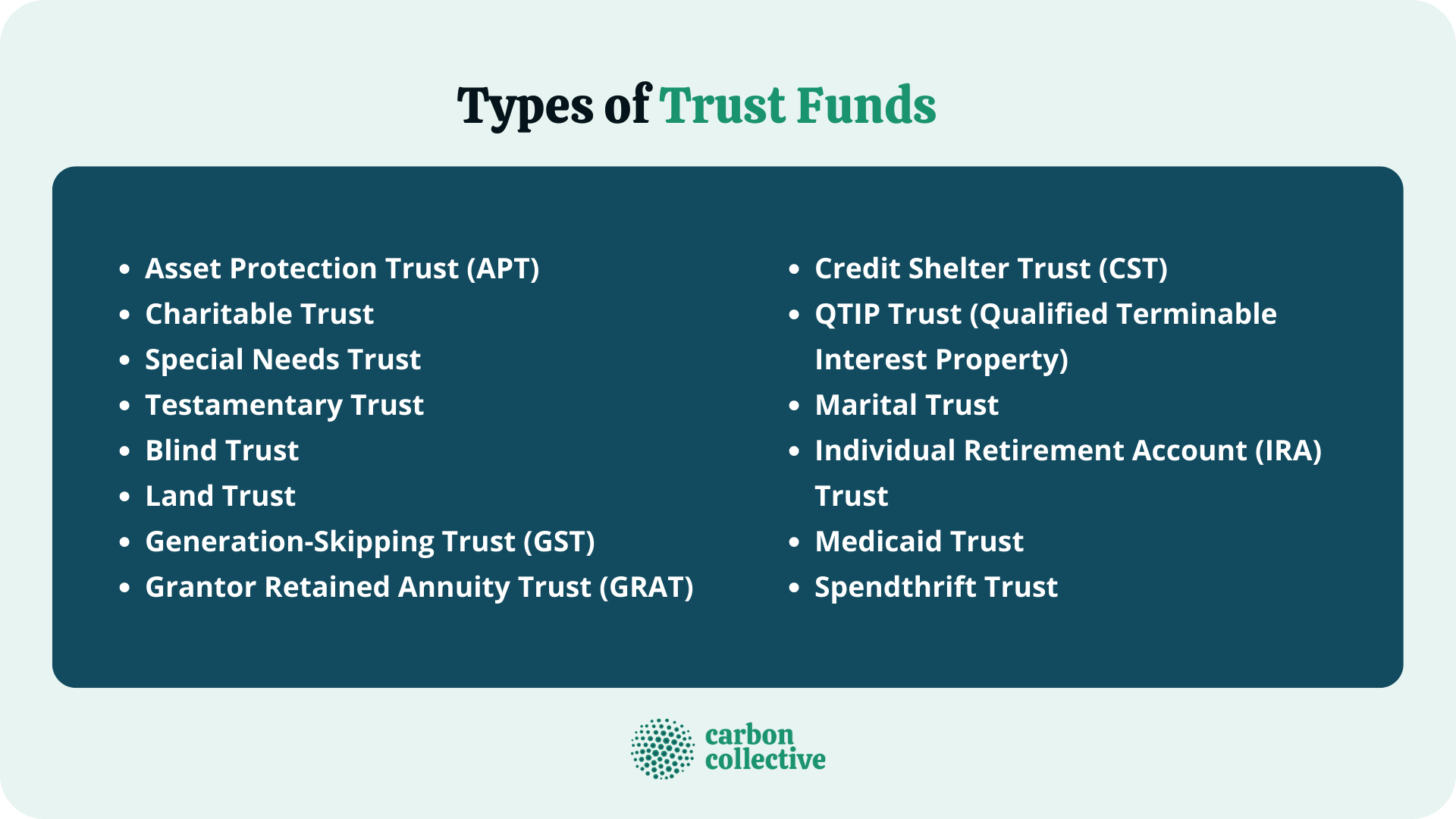

Types of Trust Funds

Aside from revocable and irrevocable trust funds, there are several other types:

- Asset Protection Trust (APT)

An APT is a trust that protects the grantor’s assets from creditors. The assets in the trust are not available to creditors if the grantor files for bankruptcy or other legal action.

- Charitable Trust

A charitable trust is a trust set up to provide financial support to a charity or organization.

The grantor cannot receive any direct benefit from the funds in this type of trust, but they may receive indirect benefits, such as tax deductions and an increase in their estate tax deduction.

- Special Needs Trust

A special needs trust provides financial support for an individual with a disability or other condition that prevents them from working full-time. The grantor of the trust can be any person aside from the beneficiary.

- Testamentary Trust

A testamentary trust is a trust set up under the terms of a will or other estate planning document to provide financial support for an individual after their death. The trustee of such trusts is usually named by the grantor in their will.

The grantor can choose to fund the trust with assets from their estate or with assets not subject to probate.

- Blind Trust

A blind trust holds assets the grantor does not want anyone else to know about.

The trustee cannot personally use any funds from this type of trust, and they cannot receive any direct benefit from it unless specified in the trust document.

- Land Trust

A land trust is a trust set up to hold real estate. The trustee can be any person but must reside in a different state than the grantor.

The trustee may be required to disclose what assets are held in the trust if asked to do so by a court of law or other legal processes.

- Generation-Skipping Trust (GST)

A generation-skipping trust holds assets that will pass down to the grantor's children or grandchildren. The trustee can be any person but must reside in a different state than the grantor.

- Grantor Retained Annuity Trust (GRAT)

A GRAT is a trust set up to hold assets that the grantor wants to give to their children or grandchildren. The grantor retains the right to receive an annual payment from the trust for a specified period.

The trustee can be any person but must reside in a different state than the grantor.

- Credit Shelter Trust (CST)

A CST is a trust set up to hold assets that the grantor wants to give to their children or grandchildren.

The trust may also have an independent executor responsible for carrying out the terms of what happens when someone dies without having a will (intestate).

- QTIP Trust (Qualified Terminable Interest Property)

A QTIP trust holds assets the grantor wants to leave to their spouse. The trustee can be any person but must reside in a different state than the grantor.

The trust document must state that the property is being left as a QTIP trust.

- Marital Trust

A marital trust holds assets the grantor wants to leave to their spouse. The trust document must state what happens when someone dies without having a will (intestate).

- Individual Retirement Account (IRA) Trust

An IRA trust holds assets the grantor wants to leave to their children or grandchildren. The trustee can be any person but must reside in a different state than the grantor.

- Qualified Personal Residence Trust (QPRT)

A QPRT is a trust set up to hold assets the grantor wants to give to their children or grandchildren.

The trust property is considered sold to the beneficiary for its current market value at the time of the grantor's death, even though the beneficiary never actually took possession of it.

- Medicaid Trust

A Medicaid trust holds assets the grantor wants using Medicaid as payment for healthcare costs and other expenses incurred while receiving care through its programs.

- Spendthrift Trust

This trust holds assets the grantor wants to protect from their beneficiary.

The trustee can be any person but must reside in a different state than the grantor.

The beneficiary cannot access the funds in the trust without the written consent of the trustee.

The Bottom Line

A trust is a legal entity that holds assets on behalf of another person. The grantor of such trusts can be any person but must reside in a different state than the grantor.

The trustee is responsible for carrying out and administering what happens when someone dies without having a will (intestate). It is crucial to understand what happens then because this type of trust does have tax implications for your heirs if they do not.

The beneficiary is the person who receives the assets from the trust.

There are many different types of trusts, each with a specific purpose.

FAQs

1. What are trust funds?

Trust funds are a legal arrangement where assets (such as cash, securities, or other property) are held by one party for the benefit of another.

2. What is a Trust Fund Baby?

Trust Fund Baby is an informal term for a child whose parents have set up to provide financial support in the event of their death.

3. What can trust money be used for?

Trust funds are typically used to pay for education or other expenses, such as medical care.

4. How much money do you need for a trust fund?

The amount of money needed varies depending on the type of trust being set up. There is no minimum amount required.

5. Does a trust need a bank account?

Yes, the trustee is responsible for depositing and withdrawing money from the trust account. So they must have their own bank account.