When it comes to financial planning and investment advice, there are two main types of professionals that you can work with: wealth managers and financial advisors. Both have their own unique set of skills and advantages, so it can be difficult to decide which one you need for your specific situation. In this blog post, we will explore the differences between wealth managers and financial advisors and help you decide which one is right for you.

What is a Wealth Manager?

Wealth managers are a type of financial professional who work with high-net-worth and ultra-wealthy individuals.

They usually manage large amounts of wealth for these clients, which makes them different from other advisors in that they serve elite groups.

Wealth managers work to provide a variety of services, which are rolled into one comprehensive advisory package.

The client's needs determine which specific services they will offer. These may include investment management, financial planning, tax advice, retirement planning, legal planning, philanthropy/estate administration, among others.

Wealth managers will charge you a percentage of your assets under management (AUM). Some firms also offer additional services or products for an hourly rate.

These other fees can come in different forms, like flat-rate charges per hour that vary based on the type and complexity level at which they are needed, rather than being measured by how much work needs doing altogether.

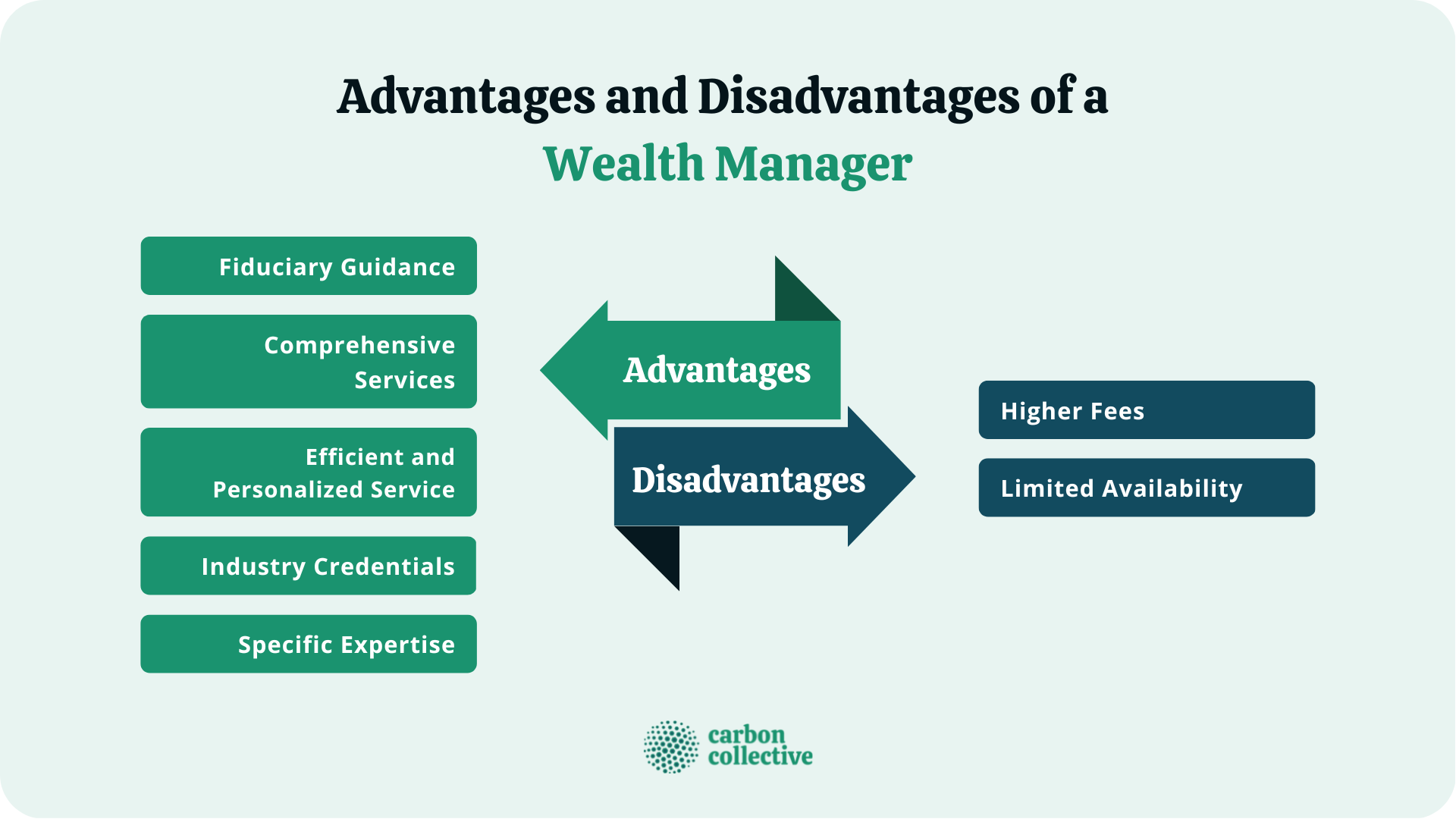

Advantages and Disadvantages of a Wealth Manager

There are several advantages to working with a wealth manager:

- Fiduciary Guidance: Wealth managers are held to a fiduciary standard, meaning they must always put their clients' best interests first. This is not the case with all financial advisors.

- Comprehensive Services: Wealth managers offer a wide range of services, which can be helpful for individuals who need help managing their finances in one place.

- Efficient and Personalized Service: Wealth managers typically offer a more personalized service than financial advisors. They have the time and resources to get to know their clients well and develop tailored investment plans.

- Industry Credentials: Wealth managers often have more industry experience and credentials than financial advisors.

- Specific Expertise: Wealth managers often have specific areas of expertise, such as investing in real estate or private equity.

There are also a few disadvantages to working with a wealth manager:

- Higher Fees: Wealth managers typically charge higher fees than other financial advisors. This is because they provide more comprehensive services.

- Limited Availability: Wealth managers are often in high demand and may not have availability to meet with new clients.

The best place to check a wealth manager's credentials is on the Financial Industry Regulatory Authority (FINRA) website. FINRA is an independent organization that regulates the securities industry.

What is a Financial Advisor?

Financial advisors have a wide range of skills and experience to help clients with their finances. They can provide you with financial planning, investment management, or just one service depending on what the client needs at that time.

There are many different types of financial advisors, but the term “financial advisor” is broad and does not refer to one specific type.

For example, a certified public accountant (CPA) is someone who has earned a certification to work with taxes or accounting, while a chartered life underwriter (CLU), is an expert in subjects such as insurance and estate planning.

There are also Certified Financial Planners™ (CFPs™) – whose job is to plan for your future goals.

These all fall into the category of “financial advisor.”

Knowing what kind of advisor you are looking for can be difficult. There are many different types, and each one may offer specialties that suit your needs.

An advisor's specialty can be determined by the certifications and licenses he or she has.

Advantages and Disadvantages of a Financial Advisor

There are several advantages to working with a financial advisor:

- Time-Saving: Financial advisors can help you save time by providing comprehensive services. This eliminates the need to work with multiple professionals.

- Expert Advice: Financial advisors have a wealth of knowledge and experience in financial planning and investing. They can provide you with advice that is tailored to your specific needs.

- Protect Against Market Risk: Financial advisors can help you protect your investments from market risk. They can also help you rebalance your portfolio to reduce the risk of losing money.

There are also a few disadvantages to working with a financial advisor:

- Cost: Financial advisors typically charge fees for their services. These fees can be expensive, especially if you require multiple services from an advisor.

- Poor-Quality Advisors: There are a few bad apples in the financial advisor world. This can be risky, as you may not receive good advice from an unprofessional advisor.

Do I Need a Wealth Manager or Financial Advisor?

So, which one should you work with: a wealth manager or financial advisor? The answer depends on your specific situation.

If you have a large portfolio and are looking for experienced advice on investments and retirement planning, then a wealth manager may be the best option.

If you are just starting out and need help creating a financial plan, then a financial advisor may be the better choice.

It is best to weigh the pros and cons of both options before making a decision, as well as to identify what specific services you need.

Questions to ask yourself include:

- Do I have a large portfolio?

- What do I need help with? With investments? Retirement planning?

- Do I need help creating a financial plan?

- How much can I afford to pay for the services?

- What are my long-term financial goals?

The Bottom Line

Wealth Managers and Financial Advisors both have their pros and cons. Each offers its own expertise that may be a better fit for your specific needs.

It is important to do your research and ask the right questions before choosing which one to work with. This will help to ensure that you find one who can provide you with the best advice and guidance possible.

FAQs

1. Do I have to be very wealthy to hire a wealth manager?

Wealth managers typically work with clients who have a net worth of $250,000 or more. However, some wealth managers may work with clients who have a lower net worth if they are looking for comprehensive financial planning services.

2. What is the difference between wealth management and financial planning?

Wealth management is a more holistic approach to financial planning that includes investment advice, tax planning, and estate planning. Financial planning is focused specifically on creating a plan for reaching your financial goals.

3. Do wealth managers have a certification or degree?

Yes, wealth managers typically have a degree in finance or economics. They may also have a certification from the CFP Board or another financial planning organization.

4. If I already have a financial advisor, can I still hire a wealth manager?

It depends. Wealth managers typically work with clients who have a large portfolio, while financial advisors work with clients of all net worth levels. If you are looking for help managing your investments, then a wealth manager may be a good option. If you are just starting out and need more general financial planning advice, then a financial advisor is the better choice. If you believe you need both services and can afford them, then you can certainly work with both a wealth manager and financial advisor. But be sure to discuss the fees each will charge so that there are no surprises down the road.

5. Where can I check wealth managers' credentials?

The best place to check a wealth manager's credentials is on the Financial Industry Regulatory Authority (FINRA) website. FINRA is an independent organization that regulates the securities industry. You can search for a wealth manager's name or firm on their website.