Capital lease accounting refers to the accounting treatment of assets leased by a business under a capital lease agreement.

What is a Capital Lease?

A lease is a contract in which the owner of an asset agrees to rent it to another party. In a capital lease agreement, the asset gets transferred to the books of the lessee at the beginning of the lease period.

Let’s understand this concept better with the example of Bob’s Donut Shoppe, Inc., one which we’ve used throughout to explain the concepts of accounting.

Let’s say Bob needs expensive donut equipment to expand the capacity of his donut shop. But Bob doesn’t have the money to invest upfront in this equipment. So he takes it on lease from an equipment manufacturer, say, Donut Equipments, Inc.

Under traditional accounting, this equipment will show up as an asset in the balance sheet of Donut Equipments, Inc., because they own the equipment. However, under a capital lease agreement, this equipment will show up as an asset in the balance sheet of Bob, even though he’s taken it on lease.

Capital Lease Criteria

For a lease to qualify as a capital lease, it needs to meet one of the following three criteria:

- The life of the lease must be 75% or greater than the asset’s useful life.

- The present value of total monthly lease payments should be more than 90% of the asset’s fair market value.

- The lessee should gain ownership of the asset at the end of the lease period.

Example of Capital Lease Accounting

Continuing with the example of Bob’s Donut Shoppe, Inc., let’s say Bob leases equipment worth $20,000 from Donut Equipments, Inc. on January 1, 2020.

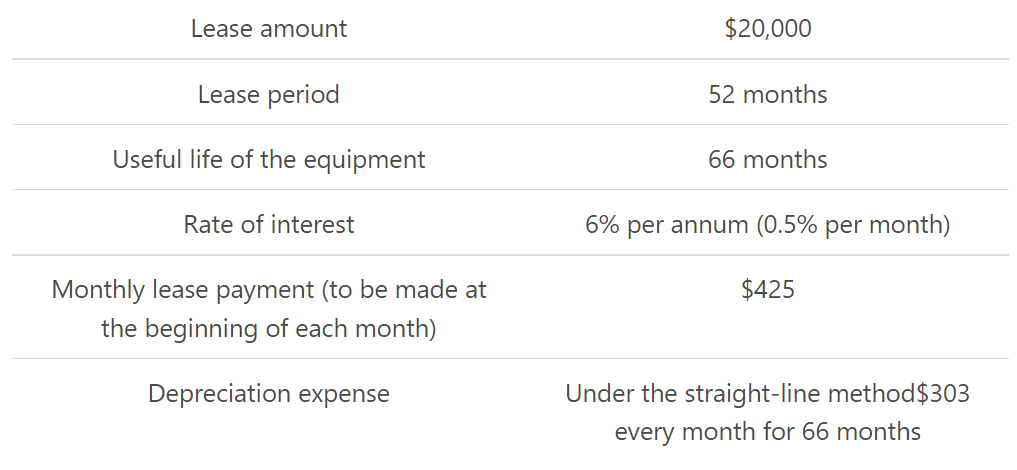

Assumptions

Testing the Capital Lease Criteria

- Criteria 1: Lease life. The lease period covers more than 75% of the asset’s useful life, and meets criteria 1.

- Criteria 2: Present value. Using our present value of an annuity calculator, we get the present value of the cash outflows as lease payments as ~ $19,418. This amount meets criteria 2.

- Criteria 3: Ownership. We assume the contract has a clause that allows the lessee (Bob) to gain ownership of the equipment at the end of the lease period.

Preparation for Journal Entries

Before moving to journal entries, let’s list all the business events taking place during the course of the lease.

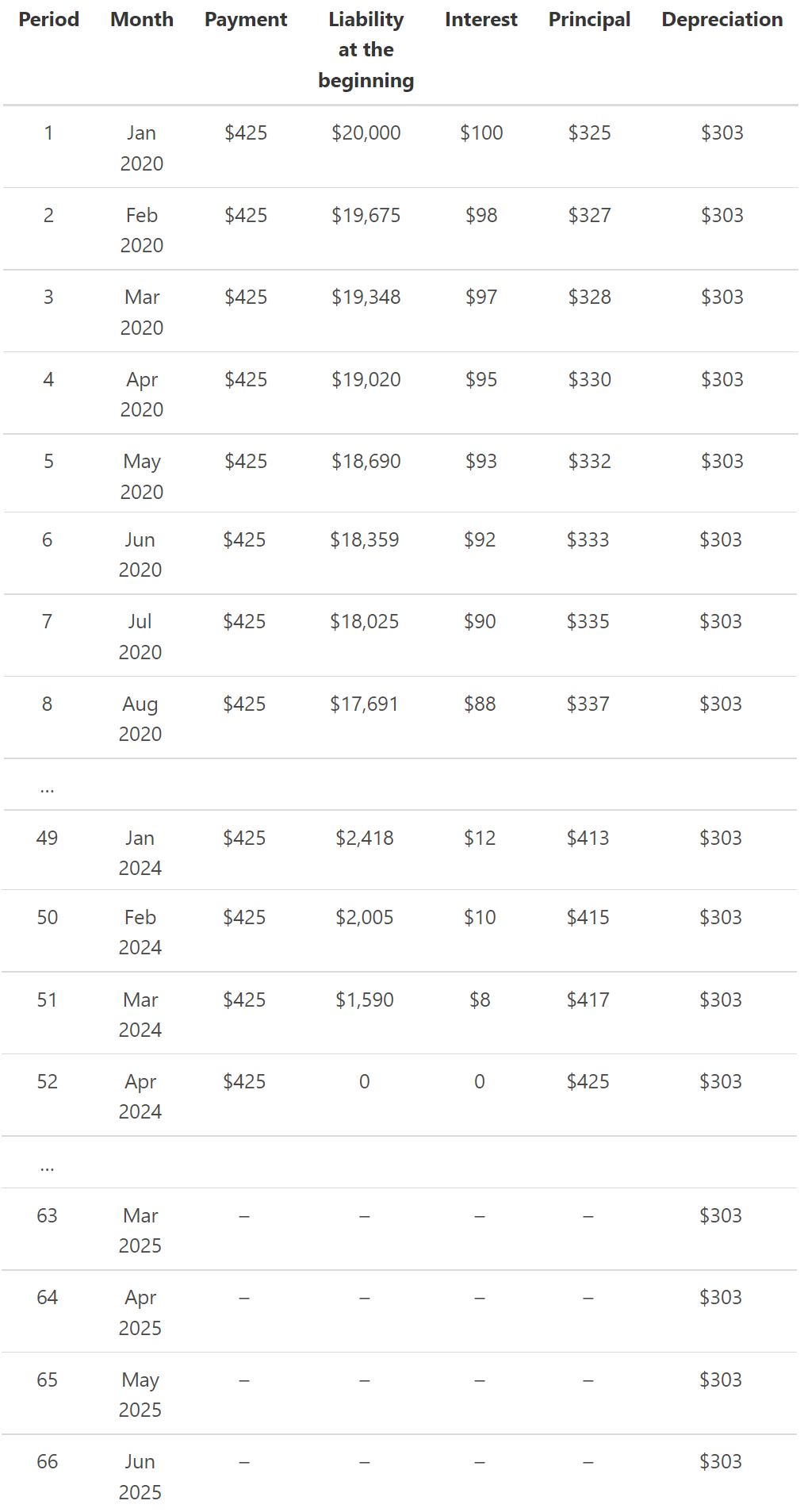

Jan 1, 2020 – Bob takes an asset worth $20,000 on lease and agrees to pay $425 every month for the next 52 months. And because he hasn’t paid any cash to acquire this asset, it’s a liability for his business.

The monthly lease payment of $425 includes an interest component as well as some repayment towards principal. So, every monthly payment reduces the original liability of Bob.

Jan 1, 2020 – Bob makes the first monthly lease payment of $425.

Jan 30, 2020 – Depreciation expense is recorded to account for the wear and tear of the asset.

April 30, 2024 – Bob makes the final monthly payment (assuming he doesn’t purchase the equipment before that.)

April 30, 2024: While the monthly lease payments are no longer due, the useful life of the asset is 66 months. Therefore, depreciation expense needs to be recorded till June 30, 2025.

June 30, 2025 – At the end of the useful life of the asset, depreciation expense is recorded for the final time.

Journal Entries for Capital Lease

Journal Entries Explained

Jan 1, 2020: Bob gets the equipment, and the asset account is debited. To account for the liability, a corresponding capital lease liability account is credited.

Jan 1, 2020: Bob’s payment of $425 is credited to his cash account. Interest expense and capital lease liability accounts are debited with their respective amounts.

Jan 31, 2020: Depreciation expense is recorded as a debit entry, and accumulated depreciation account is credited.

April 1, 2024: The final monthly lease payment of $425 doesn’t have any interest component. The principal balance as of March 1 2024 is $417, so the final payment takes care of this repayment. That’s why only the capital lease liability account is debited.

June 30,2025: The final depreciation expense is accounted for. And now that depreciation expense has been fully accounted for over the course of its useful life, the asset is written off from the books. It will no longer show as an asset in the equipment account.

FAQs

1. What is a capital lease?

A lease is a contract in which the owner of an asset agrees to rent it to another party. In a capital lease agreement, the asset gets transferred to the books of the lessee at the beginning of the lease period.

2. What are the benefits of capital leases?

Capital leases have a few benefits over other types of leases. First, they provide more certainty about the total amount of payments that will be made. Second, they allow businesses to spread out the cost of an asset over its useful life. Lastly, they can be used to acquire assets without having to pay the full price upfront.

3. How are capital leases treated in accounting?

Capital leases are treated as liabilities on the lessee's balance sheet. The asset account is credited, and a capital lease liability account is debited. The interest expense and principal payments are also tracked in their own accounts. Monthly depreciation is recorded to reflect the decline in the value of the asset over its useful life. At the end of the lease, the asset is written off and the capital lease liability is canceled.

4. What is an example of a capital lease?

One common example of a capital lease is when a company leases equipment. The lessee would record the asset as an equipment account on their balance sheet, and the liability would be recorded as a capital lease liability. The lessee would also record interest expenses and depreciation expenses over the course of the lease.

5. Is capital lease considered debt?

A capital lease is considered a type of debt. The lessee is responsible for making monthly payments, and at the end of the lease, they may have the option to purchase the asset or return it.