Journal entries are usually the first step of an accounting cycle. The process involves analyzing business transactions to determine whether a certain transaction has an economic impact on the company’s books. This step starts at the beginning of the accounting cycle and lasts throughout the period.

After identifying which transactions have an economic effect, the bookkeeper will journalize these entries in the general journal. A General journal is a daybook or a master journal in which all company transactions that occur during an accounting cycle are recorded.

The Accounting Cycle Example

Throughout this series on the accounting cycle, we will look at an example business, Bob’s Donut Shoppe, Inc to help understand the concepts of each part of the accounting cycle. Below is the complete list of accounting cycle tutorials:

- Journal Entries (you are here)

- T-Accounts

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Preparing Financial Statements

- Accounting Worksheet

- Closing Entries

- Income Summary Account

- Post-Closing Trial Balance

- Reversing Entries

We also have an accompanying spreadsheet that shows you an example of each step.

Click here to download the Accounting Cycle template

Understanding the Accounting Equation

To identify whether a transaction has an economic impact, it should be analyzed through the accounting equation.

Accounting Equation Formula

The accounting equation is the bedrock of the double-entry bookkeeping system. Each business transaction journalized via a double-entry system will affect the accounting equation. It is a simple equation that shows the relationship between multiple items in a company’s balance sheet. Assets are valuable resources that a company might possess, and these assets can be financed by either borrowing or by personal capital/raising equity by the owner.

The accounting equation is the bedrock of the double-entry bookkeeping system. Each business transaction journalized via a double-entry system will affect the accounting equation. It is a simple equation that shows the relationship between multiple items in a company’s balance sheet. Assets are valuable resources that a company might possess, and these assets can be financed by either borrowing or by personal capital/raising equity by the owner.

For maintaining accurate records, each business transaction that has been journalized will make use of the rules of debit and credit to make changes to the accounting equation in such as way that it will always be in balance.

Rules of Debit and Credit

The double-entry bookkeeping system ensures that each transaction is recorded through two different accounts. For this, a system of debit and credit has been devised.

- A debit entry will increase an asset or an expense account and decrease a liability or an equity account.

- A credit entry will increase a liability or an equity account and decrease an asset or an expense account.

Whenever a business transaction occurs, at least two accounts are impacted by a debit entry for one account and a credit entry for the other account. The total debits and credits should equal each other so that the accounting equation will always balance.

Balancing the Accounting Equation

Let us see how the debit and credit rules ensure that an accounting equation remains in balance. Assume a business starts with the following accounting equation at the start of the accounting cycle:

During the year, the following business transactions are recorded and analyzed:

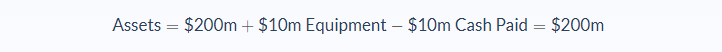

- Bought equipment worth $10 million using cash.

- Purchased Inventory costing $20 million on credit.

These business transactions would then be journalized in the general journal using the debit and credit rules in the following manner:

Journal Entry 1

As per the earlier mentioned rules of the debit and credit system, any increase in assets (equipment) is recorded as a debit entry and any decrease in an asset (cash) is recorded as a credit entry. Both entries will affect the accounting equation as the purchase of equipment would increase the assets side and the payment in cash would decrease the asset side.

The assets would remain the same at $200m:

This means that the accounting equation does not change:

This means that the accounting equation does not change:

Journal Entry 2

Journal Entry 2

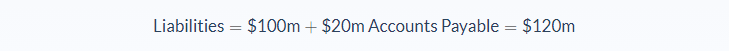

As per the rules of the debit and credit system, any increase in assets (inventory) is recorded as a debit entry and an increase in liabilities (accounts payable) is recorded as a credit entry. Both entries will affect the accounting equation as the purchase of inventory would increase the assets side and the credit facility used would increase the liability side.

After this journal entry, the assets and liabilities increase:

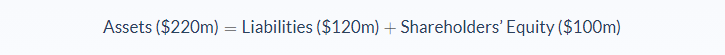

The new accounting equation is shown below:

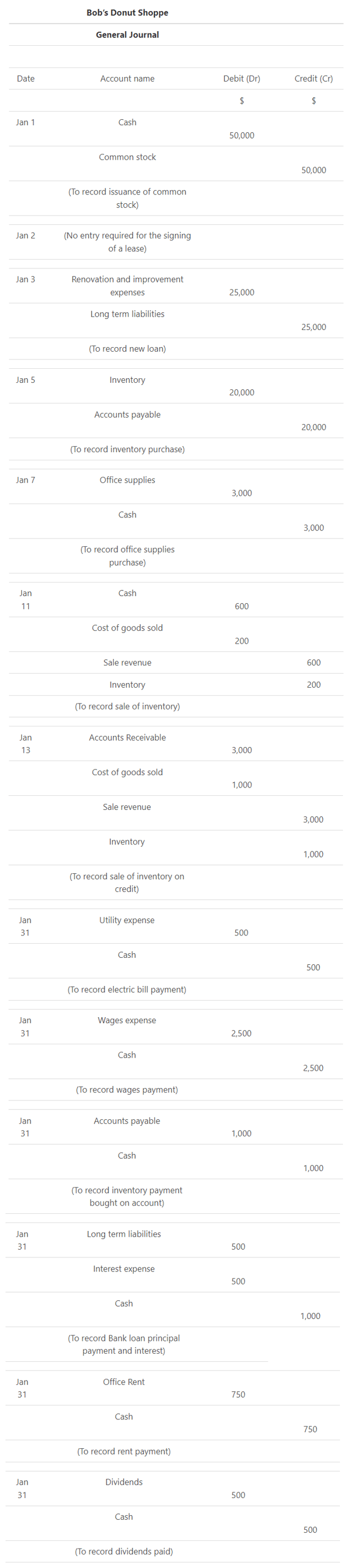

Journal Entries Example

Throughout this account cycle series, we will follow Bob and his company, Bob’s Donut Shoppe, Inc. The following business transactions take place in the first year of business:

Transactions

- Jan 1. Bob forms the Donut Shoppe, Inc by purchasing 50,000 shares at $1 per share.

- Jan 2. Bob finds a good rental place on one of the busiest streets in his location and signs a lease for $750 per month.

- Jan 3. Bob borrows $25,000 from the bank to pay for renovation and improvement expenses on the property. He agrees to pay $1000 per month for three years to repay the loan.

- Jan 5. Bob purchases $20,000 of inventory on credit from the vendors and agrees to pay $1000 per month.

- Jan 7. Bob purchases supply to use around the store costing $3000.

- Jan 11. Bob makes his first sale of 20 boxes of donuts for a neighborhood birthday party for $30 per box. They cost him $10 per box to make.

- Jan 13. Bob sells another 100 boxes of donuts for an office party on account of $ 30 per box. Costing him to make is $ 10 per box

- Jan 31. Bob pay his electric bill of $500.

- Jan 31. Bob pays his staff salaries worth $2500.

- Jan 31. Bob's first inventory payment is now due.

- Jan 31. Bob's first payment for the bank loan is also now due. In addition to the $ 1000 loan repayment, Interest on the loan is $500.

- Jan 31. Bob pays the first-month rental payment of $ 750 on the due date.

- Jan 31. Bob makes a profit at the end of the month and decides to pay himself a dividend of $ 500.

Journalizing Entries

Below we can see all of the transactions that have been added to the journal.

Next Step

Now that the business transactions have all been journalized in the general journal using the debit and credit rules, the next step is to post them to individual ledger accounts, which are commonly referred to as t-accounts.

FAQs

1. What journal entries?

Journal entries are the formal record of financial transactions made by a business. Transactions are first recorded in a journal and then posted to individual ledger accounts.

2. What is included in a journal entry?

A journal entry includes the date of the transaction, the name of the account impacted, and the amount of the transaction.

3. What are the main types of journal entries?

The main types of journal entries are Debits, Credits, Journal Entries for Cash Flow, Income Statement Journal Entries, and Balance Sheet Journal Entries

4. What is the purpose of a journal entry?

The purpose of a journal entry is to document the financial transactions of a business. This information is then used to generate financial statements.

5. How do you start a journal entry?

The first line of a journal entry starts with the date of the transaction. The second line includes the name of the account impacted by the transaction. The third line includes the amount of the transaction.