The capitalization ratio, also referred to as the cap ratio, is an indicator that measures the ratio between a company’s debts within its capital structure—the combination of debts and equities. Basically, the capitalization ratio gauges how dependent a company is on debt to be able to gain capital or money.

To raise capital, companies have two main ways: debt and equity (stocks and net income leftover). If a company relies too much on debt to finance its operation, it will be more prone to risks in the future. With that said, not all companies that are using a high amount of debt are necessarily in a bad shape. A company may deliberately rely on debt because of its advantages such as tax-deductible interest payments, easy access, flexibility, and debt’s convenience for not causing diluted ownership, unlike stock.

However, unsurprisingly, debts may cause a number of concerns. All debts have a due date so companies have to pay them back at some point, dissimilar to stock. Companies may also experience restrictions carried out by their creditor on their freedom of action. There is also the fear of not being able to pay liabilities during financial adverse and the inability to compete with competitors because of too many debts.

Capitalization Ratio Formula

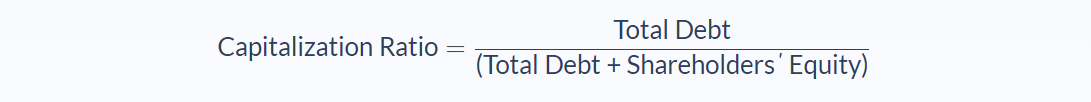

To calculate this ratio, we need to know the total debt of a company—both short-term and long-term. The shareholders’ equity includes stocks such as common stock and preferred stock. The equation can be evaluated both in decimal or percentage.

There are three main ways to calculate capitalization ratio: debt-equity ratio, long-term debt to capitalization ratio, and total debt to capitalization ratio. Each of these measurements is acceptable to calculate the capitalization ratio of a company. For simplicity, we use the total debt to capitalization ratio that includes all debts.

This version of the capitalization ratio gives a general assessment of how a company performs by how it also includes short-term debt. Another ratio (long-term debt to capitalization) only put long-term debt into the equation to give more emphasis on financial leverage.

With the total debt to capitalization formula, we measure the ratio of the total debt of a company against its total capitalization—the combination of debts and shareholders’ equity. In terms of corporations, we can simply treat “shareholder’s equity” as simply “equity”. Both phrases point out the net amount of total assets minus total liabilities.

Generally, a lower ratio is better since it means that the company is using less debt and more equity. Although, when comparing capitalization ratios of multiple companies, it’s important to only use companies within the same industry. Different types of companies handle debts and equities differently. The acceptable ratios for a company vary depending on the industry it operates.

On the contrary, a company with a very low capitalization ratio cannot always be considered better than those with a high capitalization ratio either. While the said company may have a lower risk of conducting its business, we can also assume that the company fails to leverage funds for its operation. In the long run, the company may struggle to grow its business since it lacks the capital to do so.

Capitalization Ratio Example

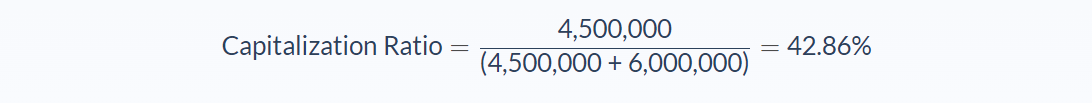

An investor wants to compare different companies to decide which one they invest in. One company the investor monitor has short-term debt of $1,500,000 and a long-term debt of $3,000,000. The shareholders’ equity is summed up to be $6,000,000. Can we calculate the company’s capitalization ratio with this data?

Let’s break it down to identify the meaning and value of the different variables in this problem:

- Short term debt = 1,500,000

- Long term debt = 3,000,000

- Total debt = 4,500,000

- Shareholders’ equity = 6,000,000

We can apply the values to our variables and calculate the capitalization ratio:

In this case, the capitalization ratio would be 42.86%.

With this result, we can conclude that the company is in good financial health with an acceptable capitalization ratio. The company isn’t afraid to use debts to grow its business while also managing risk by not using it too much. In this case, the investor can pick this company as one of the candidates to put their money into.

Capitalization Ratio Analysis

The capitalization ratio measures how well a company distributes its debts and equity. While higher debt increases the risk of bankruptcy, it also helps promote growth for the company.

There isn’t the ‘right’ amount of capitalization ratio for a company. Different industries operate differently. For instance, companies that are capital intensive—meaning they require huge amounts of capital investment— such as utilities and telecommunications companies usually have higher debts. While technology companies usually require fewer assets to operate effectively and thus has fewer debts.

To get a more accurate assessment of how well a company operates, we can track how its ratio over time to check its stability. Comparing different companies within the same industry is also a good call. Additionally, we can also determine the company’s cash flow—the net amount of cash & cash equivalents going in and out—to complement our research.

Capitalization Ratio Conclusion

- The capitalization ratio is an indicator measuring the proportion of debts within a company’s capital.

- There are three different ways to calculate the capitalization ratio. In this article, we use the total debt to capitalization ratio that includes total debts.

- The formula for capitalization ratio requires two variables: total debt (short + long term debt), and shareholders’ equity.

- Capitalization ratio can be expressed in decimal or percentage.

- There is no perfect number for the capitalization ratio. Industries that require a large amount of capital investment usually have a higher capitalization ratio.

Capitalization Ratio Calculator

You can use the capitalization ratio calculator below to quickly calculate a company’s proportion of debts within its operational capital by entering the required numbers.

FAQs

1. What are capitalization ratios?

Capitalization ratios are indicators measuring the proportion of debts within a company’s capital. Basically, it tells us how much a company has borrowed to finance its assets.

2. What is the capitalization ratio formula?

The formula for capitalization ratio is:

Capitalization Ratio = Total Debt / (Total Debt + Shareholders′ Equity)

To calculate this ratio, we need to know the total debt of a company—both short term and long term. The shareholders’ equity includes stocks such as common stock and preferred stock. The equation can be evaluated both in decimal or percentage.

3. What is a good capitalization ratio?

Generally, a cap ratio of 0.5 is seen as low, meaning a company is financing most of its assets through equity. A ratio above 1 means a company is highly leveraged and could be in for some financial trouble.

However, capitalization ratios vary from industry to industry. For instance, capital-intensive industries such as utilities and telecommunications companies usually have higher debts while technology companies usually require fewer assets to operate effectively.

4. What does the capitalization ratio show us?

The capitalization ratio can tell us a few things about a company. It can give us an idea of how risky the company is as a higher debt increases the chance of bankruptcy.

Additionally, it can also show us how well the company is managing its growth. A high cap ratio may be beneficial for companies that are expanding rapidly.

5. What is an example of a good capitalization ratio?

An example of a company with a good capitalization ratio is Walmart, which has a total debt to capitalization ratio of 0.14. This means that for every $1 of equity, the company has $14 of debts. While this is not the best in the industry, it is still manageable.