The cash to working capital ratio measures what percentage of the company’s working capital is made up of cash and cash equivalents such as marketable securities. It lets you get a view on the liquidity of a company by ignoring any current assets that cannot easily be converted to cash.

This ratio further defines the company’s ability to finance its short-term obligations using its most liquid current assets, making it a good measure for evaluating investment potential.

Through this ratio, an analyst can understand if the company is capable of meeting its short-term financial obligations. Can it use its cash and highly liquid marketable securities, or the amount of working capital provided by cash and liquid investments, to pay them?

If the calculated ratio is less than 1.0, then it implies that the company has to rely on other short-term resources, such as receivables and inventory. These might require a longer lead time to be collected or sold, risking an inability to meet short-term obligations due to a shortage of cash. This ratio is insightful in uncovering situations where the company may be spending too much of its cash on inventories that are not being turned into sales as rapidly as they should be.

A high cash to working capital ratio means that the company is more liquid and can pay off its debts without necessarily relying on other current assets such as inventory and account receivables. In contrast, a low ratio is an indicator that the amount of cash and cash equivalents is too little, resulting in difficulty in paying short-term liabilities.

Cash to Working Capital Ratio Formula

Working capital is calculated as current assets minus current liabilities, which is represented by the summation of accounts receivable and inventories less accounts payable. So, you could also rewrite the formula to be:

The numerator of this formula should strictly include only the most liquid assets (cash and short-term marketable securities) that can be converted into cash quickly.

All this information required to calculate the cash to working capital ratio is available from the company’s balance sheet.

Usually, a ratio of less than 1.0, is an implication that the company may be suffering from low cash reserves, and may not be able to meet its financial obligations hence diverts to other short-term resources, such as receivables and inventory which might take longer to be collected to pay off its current liabilities

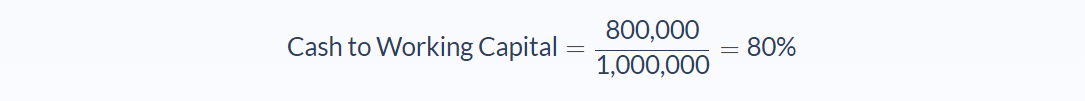

Cash to Working Capital Ratio Example

The manager of AMA Company Limited wanted to borrow some cash from the bank to help in offsetting the company’s accounts payable, but before doing so, he decided to find out the company’s ability to cover its current liabilities using its most liquid assets.

He asked the company’s Credit and Finance Officer to use the most recent company’s balance sheet to compute the cash to working capital ratio of the company. The Credit and Finance Officer determined the company’s current liabilities were $800,000 while its current assets were $1,800,000. The current assets constituted inventory worth $800,000, accounts receivable of $200,000, the cash amount of $550,000, and marketable securities worth $250,000.

Now let’s break it down and identify the values of different variables in the problem.

- Cash = $550,000

- Marketable securities (Cash equivalents) = $250,000

- Total current assets = $1,800,000

- Total current liabilities = $800,000

- Working capital: $1,000,0000 (current assets – current liabilities)

Now we can apply those variables to our equation:

The analysis revealed that 0.8 or 80% of the company’s total current liabilities could be covered using the company’s cash and cash equivalents.

Therefore, to smoothly run the operations without relying on accounts receivable and sales of existing inventories, the manager can only borrow an amount equal to 20% of its current liabilities so that the company can be able to pay its accounts payable once they fall due.

Cash to Working Capital Ratio Analysis

Cash to working capital ratio measures exactly what percentage of company working capital is made up of cash and cash equivalents. It shows the company’s ability to pay its short-term obligations using its most liquid assets such as cash and cash equivalents and marketable securities. Because of this, it’s an excellent measure to evaluate investment potential.

This ratio is insightful as it enables investors to understand the capability of the company to meet its short-term financial obligations using its cash and highly liquid marketable securities.

Also, this ratio is useful for informed decision making as it reveals situations where the company is spending too much of its cash and cash equivalents on inventory that is not being turned into sales as quickly as it should be.

Generally speaking, high cash to working capital ratio implies that the company is more liquid and can pay off its short-term obligation without struggling. In contrast, a low ratio is an indicator of difficulty in supporting short-term debts due to less cash and cash equivalents. However, time is a critical factor of consideration when you want to implement the ratio as a tool for comparing companies from various reporting periods because any large, regular cash expenditures can drastically skew the results of an organization’s cash to working capital ratio.

So, to achieve better valuation results, this metric should be used in conjunction with other liquidity assessment ratios like the sales to working capital ratio. Also, just like any metric that is using short-term assets or liabilities, the investor-analyst must try to avoid one-time and near-term events which might affect balances in these accounts.

Cash to Working Capital Ratio Conclusion

- Cash to working capital measures what percentage of the company’s working capital is constituted by cash and cash equivalents such as marketable securities

- This ratio defines the company’s ability to finance its short-term obligations using its most liquid current assets.

- This ratio gives a more refined picture of how liquid a company is as it eliminates current assets that can’t be converted to cash.

- A high ratio implies that a higher percentage of the company’s working capital is in the form of cash and other highly liquid assets.

- Low ratio implies that the company has a small amount of cash and cash equivalents

- This ratio requires only the current assets and current liabilities of a company.

- Cash to working capital gives a more realistic result when used in conjunction with other liquidity assessment ratios.

Cash to Working Capital Ratio Calculator

You can use the cash to working capital ratio calculator below to quickly calculate the percentage of the company’s most liquid assets that reside in the net working capital by entering the required numbers.

FAQs

1. What is cash to working capital ratio?

The cash to working capital ratio (CWC) is a metric that measures how much of a company’s working capital is in the form of cash and equivalents. It lets you get a view on the liquidity of a company by ignoring any current assets that cannot easily be converted to cash.

2. How is the cash to working capital ratio calculated?

The cash to working capital ratio is calculated by dividing a company’s cash and equivalents by its working capital.

The formula is as follows:

Cash to Working Capital Ratio = Cash and Equivalents / Working Capital

3. What is a good cash to working capital ratio?

Generally speaking, a high ratio would indicate that the company has more liquidity, while a low ratio would suggest that the company is experiencing financial difficulty. However, it is important to use this metric in conjunction with others to get a more accurate picture of the company’s financial state.

4. What is an example of cash to working capital ratio?

Let us say a company has $10,000 in cash and equivalents and $50,000 in working capital. Cash to Working Capital Ratio = $10,000 / $50,000 = 0.20 This company has a 20% ratio, meaning that 20% of its working capital is in the form of cash and equivalents.

5. What does the cash to working capital ratio show us?

The cash to working capital ratio tells us how much of a company’s working capital is in the form of cash and equivalents. It can be used to get a view of the liquidity of a company by ignoring any current assets that cannot easily be converted to cash.

It also shows us how much of the company’s cash is available to repay its short-term liabilities.