EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a metric used to measure a company’s financial performance and is often an alternative to simple earnings or net income.

EBITDA can be misleading at times because it excludes a variety of factors, including the cost of property and other capital investments as well as expenses associated with debt. It is still a good way to measure profitability for a company and gives an opportunity to show earnings before anything has been moved by accounting.

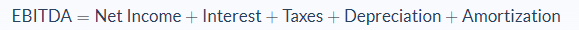

EBITDA Formula

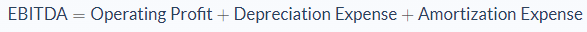

It can also be written as:

All information needed to calculate EBITDA is generally found on a company’s income statement or balance sheet and is added together in a straightforward manner.

EBITDA Example

Using the balance sheet for a fictional company, we can see that the following information is listed:

- Net Earnings: $15,000

- Taxes: $3700

- Depreciation + Amortization: $475

- Interest: $50

Adding all of these together shows that the EBITDA for this company is $19,225. Let’s say two companies with different capital structures but similar industries have comparable net income numbers. An EBITDA can be used to paint a clearer picture of which company has a higher potential for quick growth. It can highlight possible inefficiencies in the management of borrowing limits or perhaps give clues into the interest rate a company carries.

EBITDA Analysis

As mentioned above, EBITDA removes the cost of capital investments in a business, such as machinery and property. It also removes expenses associated with debt because taxes to earnings and interest expense are re-added, so the number can ultimately be a bit misleading and detractors may point to this as a reason why. Proponents of EBITDA claim that removing expenses that can hide a company’s true performance reveal a clearer picture of operations.

Though EBITDA is not considered a part of the Generally Accepted Accounting Principles (GAAP), it is often shown on a company’s income statement anyways. It is a useful metric for comparing profitability among companies and different industries.

EBITDA is also an important measurement of cash flow that is used commonly in mergers and acquisitions between small businesses. When a company has a negative EBITDA, it is generally a good indicator that a company struggles with profitability and cash flow. Conversely, a positive EBITDA does not necessarily indicate a good cash flow due to the removal of capital expenditures in its calculation.

Operating cash flow is an alternative metric that provides a clearer look into the amount of cash that a company is generating. Relying exclusively on EBITDA and excluding changes in working capital in a financial analysis can cause one to miss hints that a company is losing money due to a lack of sales.

The debt-to-EBITDA ratio can be used to measure the amount of income that is generated by a company (before interest, taxes, depreciation, and amortization) that can be used to pay off incurred debt and expenses. A company with a high debt-to-EBITDA ratio could have a debt load that is too heavy to pay off and may lead to a lowered credit rating and increased scrutiny when borrowing loans. The ratio is calculated by dividing a company’s total debt by its total EBITDA.

EBITDA Conclusion

- EBITDA is an alternate way to measure company financial performance, used next to net income or simple earnings. By eliminating the non-operating effects that are unique to the way that each company is run, it allows the analyst to focus exclusively on operating profitability.

- EBITDA is not considered a part of the GAAP, though it is still widely used. As such, companies are also not required to disclose their EBITDA.

- EBITDA is an important measure of cash flow but must be compared with other metrics such as Operating Cash Flow. When the two are not used in conjunction, essential hints regarding sales metrics can be missed.

- The info for calculating EBITDA can be easily found on balance sheets and income statements.

EBITDA can be used to great effect when comparing a company to industry averages or other specific companies.

EBITDA Calculator

You can use this calculator to calculate the EBITDA for a company by entering the information from the company balance sheet.

FAQs

1. What are earnings before interest, taxes, depreciation, and amortization (EBITDA)?

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a metric used to measure a company's financial performance. EBITDA removes the cost of capital investments in a business, such as a machinery and property, and removes expenses associated with debt because taxes to earnings and interest expenses are re-added.

2. How do you calculate earnings before interest, taxes, depreciation, and amortization (EBITDA)?

The formula for calculating EBITDA is:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

It can also be written as:

EBITDA = Operating Profit + Depreciation Expense + Amortization Expense

All information needed to calculate EBITDA is generally found on a company’s income statement or balance sheet and is added together in a straightforward manner.

3. Why is the earnings before interest, taxes, depreciation, and amortization (EBITDA) so important?

EBITDA is important because it measures a company’s financial performance before the costs associated with interest, taxes, depreciation, and amortization.

This makes it an essential metric for analysts when trying to understand how profitable a company is from its core operations.

4. What is a good earnings before interest, taxes, depreciation, and amortization (EBITDA)?

An EBITDA margin of 10% or more is generally considered good. This shows that a company is generating a healthy amount of income that can be used to pay off its debt and other associated expenses.

Conversely, a company with an EBITDA margin of 5% or less is generally seen as struggling and may be in danger of bankruptcy.

4. Why do you add back depreciation and amortization to earnings before interest, taxes, depreciation, and amortization (EBITDA)?

Depreciation and amortization are added back to EBITDA because they are not considered a part of a company’s core operating profit.

This allows analysts to measure how much income a company is generating from its operations, without the distortion of non-cash expenses.